AUTHOR : ROSE KELLY

DATE : 27/12/23

Introduction

Definition of Payment Processors

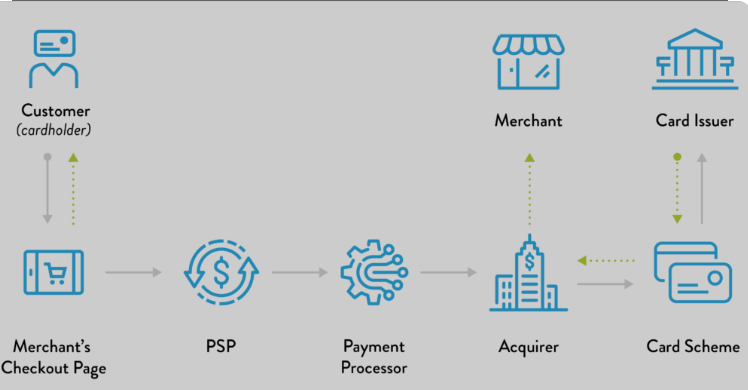

Payment processors are financial entities that facilitate online transactions by acting as intermediaries between buyers and sellers. They play a crucial role in ensuring secure and efficient electronic payments.

Importance of Payment Processors for Internet Products

In the realm of internet products a reliable payment processor is essential for seamless transactions, trust-building, and overall business success.

Popular Payment Processors in India

Paytm

As one of the pioneers in the Indian digital payment space, Paytm offers a user-friendly platform with diverse payment options, making it a popular choice among internet product sellers.

Razorpay

Known for its robust technology and easy integration, Razorpay caters to businesses of all sizes, providing a comprehensive solution for payment processing.[

Instamojo

Focused on empowering small businesses, Instamojo simplifies the payment process with features like instant settlement and customizable payment links.

CCAvenue

With a wide range of payment options and advanced security features, CCAvenue has established itself as a trusted payment gateway for internet-based businesses.

Factors to Consider When Choosing a Payment Processor

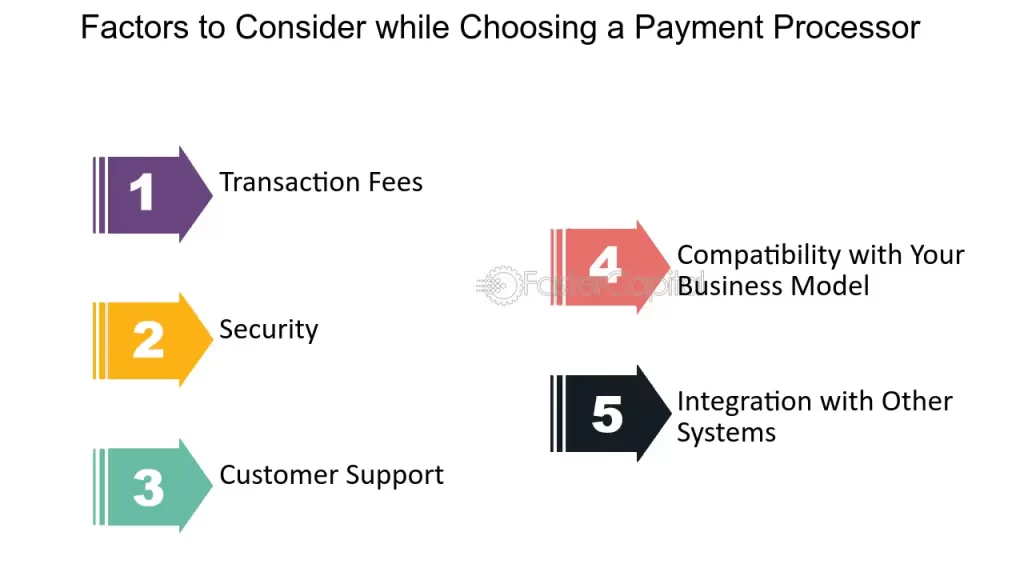

Transaction Fees

Understanding the transaction fees associated with different payment processors is crucial for businesses to optimize costs and maximize profits.

Security Features

In the digital age, security is paramount. Choosing a payment processor with robust security measures ensures protection against online threats.

Integration Options

The ease of integration with existing platforms and systems can significantly impact the efficiency of online transactions[1].

User Experience

A seamless and user-friendly payment process enhances customer satisfaction and encourages repeat business.

Challenges Faced by Internet Product Sellers

Fraud Prevention

Internet product[2] sellers often grapple with the challenge of preventing fraudulent transactions. Payment processors play a vital role in implementing effective fraud prevention measures.

Currency Conversion

For businesses operating globally, dealing with multiple currencies can be complex. Payment processors [3] offering reliable currency conversion services are invaluable.

Regulatory Compliance

Adhering to the ever-evolving regulatory landscape is crucial for internet product sellers. Payment processors that assist in compliance can save businesses [4] from legal hassles.

How Payment Processors Enhance User Experience

Seamless Checkout

A quick and hassle-free checkout process contributes to a positive user experience, reducing cart abandonment rates.

Multiple Payment Options

Catering to diverse preferences [5], payment processors that offer various payment options, including cards, digital wallets, and UPIs, enhance user convenience.

Mobile Responsiveness

Given the surge in mobile transactions, a payment processor’s mobile responsiveness is vital for tapping into this market segment.

Case Studies

Success Stories of Businesses Using Payment Processors

Exploring real-world success stories illustrates how businesses have thrived by leveraging the capabilities of payment processors.

Challenges Overcome with Payment Processors

Case studies also shed light on the challenges businesses faced and successfully overcame with the right payment processor.

Future Trends in Payment Processing for Internet Products

Emerging Technologies

Advancements such as blockchain and AI are expected to reshape the payment processing landscape, providing new opportunities for internet product sellers.

Improvements in Security Measures

As cyber threats evolve, payment processors will continue to enhance their security measures to safeguard online transactions.

Global Expansion

The globalization of businesses calls for payment processors that can seamlessly handle international transactions and diverse currencies.

Tips for Optimal Use of Payment Processors

Regularly Update Security Protocols

Staying ahead of potential threats requires businesses to regularly update and reinforce their security protocols in collaboration with their payment processor.

Monitor Transactions Closely

Active monitoring of transactions helps detect and address issues promptly, ensuring a smooth payment process for customers.

Stay Informed About Regulatory Changes

Given the dynamic nature of regulations, businesses should stay informed and work with payment processors that assist in compliance.

Comparison of Payment Processors

Feature-Based Comparison

An in-depth comparison of features helps businesses choose a payment processor that aligns with their specific needs and goals.

User Reviews and Ratings

Real-world user experiences provide valuable insights into the reliability and performance of different payment processors.

Conclusion

Recap of Key Points

In conclusion, the choice of a payment processor is a critical decision for internet product sellers. Consideration of transaction fees, security features, user experience, and staying ahead of challenges is essential for long-term success.

The importance of Choosing the Right Payment Processor

The right payment processor not only facilitates transactions but also contributes to building trust, enhancing the user experience, and positioning businesses for growth.

FAQs

What is the role of a payment processor?

A payment processor acts as an intermediary, facilitating secure electronic transactions between buyers and sellers.

How do payment processors handle fraud prevention?

Payment processors implement various security measures, including encryption and fraud detection algorithms, to prevent fraudulent transactions.

Can businesses use multiple payment processors simultaneously?

Yes, businesses can integrate multiple payment processors to offer customers a variety of payment options.

Are there any hidden fees associated with payment processors?

It’s crucial to review the terms and conditions carefully to identify any potential hidden fees associated with specific payment processors.