AUTHOR: KHOKHO

DATE: 28/12/2023

Introduction

The digital era has revolutionized the way content is created, consumed, and monetized. In India, a diverse and dynamic landscape of online content has emerged, ranging from blogs and videos to e-books and podcasts. As content creators flourish, the need for efficient payment processors becomes paramount to ensuring seamless financial transactions

Evolution of Online Content

In the early days of the internet, content creation was a hobby rather than a profession. However, with the rise of platforms like YouTube, Instagram, and independent blogs, individuals have found opportunities to turn their passion into a livelihood. This evolution brought forth the need for reliable payment processors that could handle the financial aspects of online content creation.

Challenges Faced by Content Creators in India

Despite the growth in the online content industry, Indian creators face several challenges when it comes to receiving payments. Issues such as delays in transactions, currency conversion hurdles, and the lack of secure payment channels have hindered the monetization potential of content.

Role of Payment Processors

Payment processors act as intermediaries between content creators and their audiences. They facilitate secure and swift financial transactions, ensuring that creators receive their earnings promptly. This pivotal role highlights the significance of choosing the right payment processor for online content in India.

Key Features to Look for in a Payment Processor

Selecting an ideal payment processor involves considering various factors. Security measures, user-friendly interfaces, and compatibility with different content platforms are essential features that content creators should prioritize when making their choices.

Popular Payment Processors in India

In the Indian market, several payment processors have gained prominence. From traditional banking solutions to fintech companies, a comparative analysis of these processors can help content creators make informed decisions based on their specific needs and preferences.

Integration with Online Platforms

One of the key advantages of using payment processors is their seamless integration with online platforms. Whether it’s a website, a mobile app, or a digital storefront, the integration ensures a smooth and hassle-free payment process [1], enhancing the overall user experience.

Currency Considerations

For content creators with a global audience, handling diverse currencies is a common challenge. A reliable payment processor should offer solutions for currency conversion, allowing creators to cater to an international audience without complications [2].

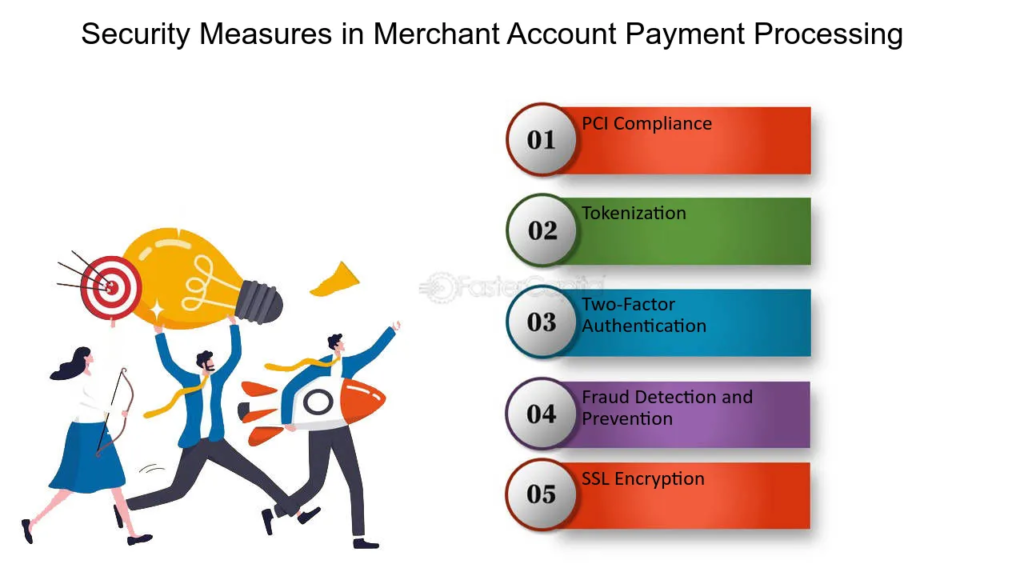

Security Measures in Payment Processing

Security is paramount in online transactions [3]. Payment processors employ encryption techniques and secure payment gateways to protect the financial data of both content creators and consumers. This instills confidence and trust in the online content ecosystem.

User Experiences and Testimonials

Real-life success stories of content creators who have benefited from using payment processors provide valuable insights. These testimonials highlight the positive impact on revenue streams, audience engagement [4], and the overall growth of their online presence.

Future Trends in Payment Processing

The payment processing landscape is continually evolving. Emerging technologies such as blockchain and decentralized finance (DeFi) are expected to play a significant role in shaping the future of online content transactions in India.

The regulatory landscape in India

Understanding the regulatory environment is crucial for content creators [5]. Compliance with financial regulations ensures a legal and sustainable online content business. An overview of the regulatory landscape helps creators navigate legal requirements seamlessly.

Comparison with International Standards

Comparing India’s payment processing standards with international benchmarks provides valuable insights into areas for improvement. Learning from global best practices can contribute to the advancement of the Indian online content industry.

Tips for Content Creators

Selecting the right payment processor is a critical decision for content creators. Tips on evaluating the features, understanding the contractual terms, and managing finances effectively can guide creators toward making informed choices that align with their business goals.

Conclusion

In conclusion, a reliable payment processor is the backbone of a successful online content business in India. By addressing the unique challenges faced by content creators and considering the key features discussed, creators can enhance their monetization strategies and focus on producing high-quality content.

FAQs

- What payment processors are popular among Indian content creators?

- Explore the popular choices and their features.

- How do payment processors handle currency conversion?

- Understand the mechanisms behind currency conversion.

- Are there any regulatory challenges for content creators in India?

- Learn about the regulatory landscape and compliance requirements.

- What security measures should content creators prioritize when selecting a payment processor?

- Gain insights into essential security features.

- How can emerging technologies impact the future of payment processing for online content in India?

- Explore the potential influence of technologies like blockchain and DeFi.