AUTHOR :HAANA TINE

DATE :26/12/2023

Online debt consolidation[1] has emerged as a beacon of financial hope for individuals navigating the complexities of debt in India. As the digital landscape[2] evolves, finding the right payment processor[3] becomes paramount in ensuring a seamless and secure debt consolidation[4] experience. In this article, we’ll explore the intricacies of payment processors[5] tailored for online debt consolidation in India, empowering you to make informed choices for your financial well-being.

Introduction

Definition of Online Debt Consolidation

Online debt consolidation is a financial strategy that involves combining multiple debts into a single, manageable payment. This approach simplifies financial obligations and provides individuals with a structured plan to regain control over their finances.

Importance of Efficient Payment Processors

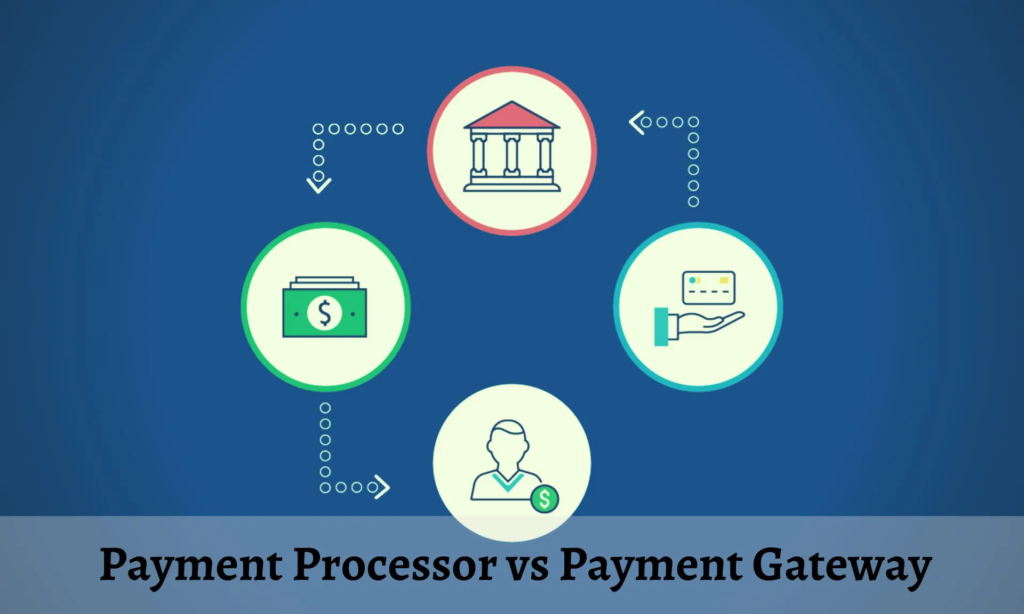

Selecting an efficient payment processor is a critical aspect of the online debt consolidation process. It ensures secure transactions, timely payments, and a user-friendly experience, contributing significantly to the success of debt consolidation efforts.

The Need for Online Debt Consolidation in India

Rising Debt Concerns

India has witnessed a surge in personal debts, ranging from credit cards to loans. Exploring online debt consolidation becomes imperative for those seeking a holistic solution to their financial challenges.

Benefits of Consolidating Debts Online

The online approach to debt consolidation offers unparalleled advantages, including convenience, accessibility, and often, lower interest rates. This section will delve into the tangible benefits of opting for online debt consolidation in the Indian context.

Choosing the Right Payment Processor

Factors to Consider

Navigating the diverse landscape of payment processors requires careful consideration of factors such as reliability, reputation, and integration capabilities. This section will guide you through the essential elements to keep in mind during the selection process.

Security Measures

Security is a paramount concern in online transactions, particularly when dealing with financial information. We’ll explore the security measures implemented by top payment processors, ensuring your data remains confidential and protected.

Integration Options

Flexible integration options are crucial for seamless transactions. This section will underscore the significance of choosing a payment processor that aligns with various platforms and financial tools.

Top Payment Processors for Online Debt Consolidation in India

Features and Benefits

A comprehensive examination of the features and benefits offered by the first top-rated payment processor. From advanced tools to customer-centric features, Processor A sets the benchmark.

User-Friendly Interface

The importance of a user-friendly interface cannot be overstated. Processor B takes the spotlight for its intuitive design, ensuring a hassle-free experience for users.

Competitive Rates

Affordability is a key factor in the debt consolidation journey. We’ll explore how Processor C stands out with competitive rates, providing financial relief to individuals seeking debt consolidation.

Step-by-Step Guide to Using a Payment Processor for Debt Consolidation

Setting Up an Account

A step-by-step guide on creating an account with your chosen payment processor, streamlining the initial setup process.

Adding Debts to the Platform

The process of inputting and organizing your debts within the platform, ensuring accurate and comprehensive Combining.

Initiating Payments

A detailed walkthrough on initiating payments using the chosen payment processor, emphasizing the simplicity and efficiency of the transaction process.

Tips for Managing Debt Effectively Through Payment Processors

Budgeting Assistance

Explore how payment processors can assist in creating and adhering to a budget, fostering responsible[1] financial habits.

Automatic Payment Scheduling

The benefits of automated payment[2] scheduling for timely repayments, reducing the risk of missed payments and associated penalties.

Tracking and Monitoring Tools

Utilizing the tracking and monitoring tools[3]provided by payment processors for better financial management and informed decision-making.

Real-Life Success Stories

Testimonials from Users

Real-life testimonials from individuals who have successfully navigated their debt consolidation[4] journey using online payment processors.

How Payment Processors Made a Difference

Anecdotes highlighting the transformative impact of choosing the right payment processor[5], providing inspiration and motivation.

Conclusion

In conclusion, the search for the right payment processor in India for online debt Combining is crucial for a successful and secure financial journey. With streamlined transactions, enhanced security measures, and the convenience of user-friendly interfaces, these processors pave the way for effective debt management. Choose wisely, and empower yourself to take control of your finances, ensuring a path towards a debt-free future in the evolving landscape of online debt Combining in India.

FAQs

A. How secure are online debt Combining payment processors?

Addressing concerns about the security of personal and financial information during online debt Combining, reassuring users about robust security measures.

B. Can I use multiple payment processors for debt Combining?

Exploring the feasibility and implications of using multiple payment processors, providing insights into customization options.

C. What happens if there is a payment processing error?

Guidance on resolving payment processing errors and potential solutions, ensuring a smooth and error-free experience.

D. Are there any fees associated with using these payment processors?

A transparent discussion on potential fees associated with using online debt Combining payment processors, empowering users with financial clarity.

E. How quickly can I expect to see results with online debt Combining?

Setting realistic expectations for the timeline of results when opting for online debt Combining, helping users plan their financial journey effectively.