AUTHOR : SELENA GIL

DATE : 27/12/23

The landscape[1] of online commerce[2] in India has experienced a significant upsurge in recent years, with a multitude of businesses offering various products and services. However, the backbone of any successful online business[3] lies in its ability to seamlessly process payments[4]. This article will delve into the realm of payment processors in India, examining their significance, challenges, selection criteria, popular options, benefits, integration steps, and their profound impact on the e-commerce[5] sector.

Introduction

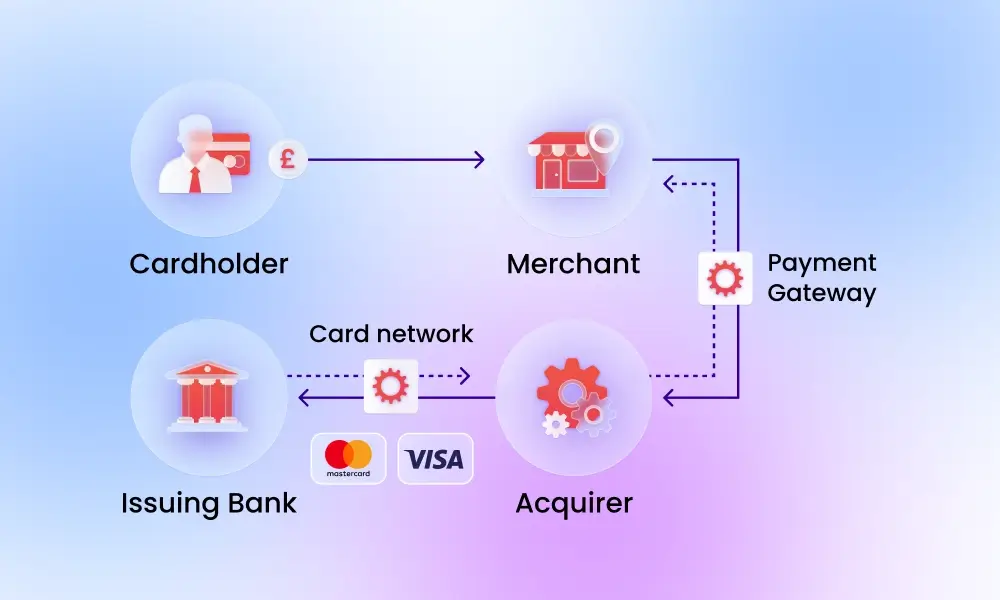

In today’s digital era, payment processors serve as the crucial intermediaries between merchants and customers, facilitating secure transactions over the internet. For online businesses in India, having a reliable payment processor is not just a convenience but a necessity for ensuring smooth transactions and building trust among consumers.

Challenges of Online Payments in India

The Indian online market presents its own set of challenges, from regulatory complexities to diverse consumer behaviors. Regulatory frameworks and compliance issues often pose hurdles for businesses operating in the online space. Additionally, understanding and adapting to the preferences of Indian consumers regarding payment methods is vital for success.

Criteria for Choosing a Payment Processor

When selecting a payment processor in India, several factors need consideration. Security features, encryption methods, integration options with popular platforms, transparent transaction fees, and responsive customer support are among the critical aspects that businesses should evaluate.

Popular Payment Processors in India

In India’s burgeoning market, numerous payment processors compete, each offering unique features and services. From established players to newer entrants, the landscape includes names like Paytm, Razorpay, PayPal, and others, each catering to specific needs of businesses.

Benefits of Using Payment Processors for Online Products

Employing a robust payment processor offers a myriad of advantages. Enhanced security measures safeguard sensitive financial information, expanding the customer base by providing multiple payment options, and ensuring smoother transactions contribute significantly to an online business’s success.

Steps to Integrate a Payment Processor

Integrating a payment processor involves setting up an account, integrating APIs, conducting rigorous testing, and finally, launching the Payment Processor for Online Products in India payment gateway. Each step demands meticulous attention to ensure flawless execution.

Impact of Payment Processors on E-commerce in India

The influence of payment processors on India’s e-commerce[1] landscape cannot be overstated. Witnessing exponential growth, these processors have not only facilitated transactions but have also contributed to the evolution of consumer behavior, paving the way for a more seamless online shopping experience.

Enhanced Security Measures

One of the most crucial aspects of payment processors is their stringent security protocols. Given the rising concerns about online fraud and data breaches, these processors incorporate robust encryption methods to protect sensitive financial information[2]. This increased security instills confidence in consumers, encouraging them to engage in more online transactions.

Diversified Payment Options

Payment processors in India offer a wide array of payment methods, catering to the diverse preferences of consumers. From credit and debit cards[3] to mobile wallets and UPI (Unified Payments Interface), these processors ensure that businesses can accommodate various payment modes, thereby attracting a broader customer base.

Key Aspects to Evaluate While Selecting a Payment Processor“

Selecting the right payment[4] processor involves a meticulous evaluation of various aspects. Security measures, transaction fees, compatibility with different platforms, Payment Processor for Online Products in India and scalability options are crucial factors that businesses need to weigh before making a choice.

Role of Payment Processors in Online Business Growth

Payment processors are not merely facilitators of transactions; they play a significant role in shaping the success of online businesses. Beyond ensuring secure payments, they build customer[5] trust, drive sales, and offer scalability, laying the foundation for sustainable growth

Conclusion

In essence, the right choice of payment processor significantly influences the success of online businesses in India. Understanding the challenges, selecting based on tailored criteria, and leveraging the benefits offered by these processors can pave the way for sustainable growth and trust-building among consumers.

FAQs

- Q: What makes a payment processor essential for online businesses in India? A: Payment processors ensure secure and smooth transactions, fostering trust among consumers.

- Q: How do I select the best payment processor for my online business? A: Consider factors like security features, integration options, fees, and customer support.

- Q: Are there specific payment processors more suitable for certain types of businesses? A: Yes, some processors offer tailored services for different industries or business sizes.

- Q: Can a payment processor help expand my customer base? A: Certainly, by providing various payment options, you can attract a broader audience.

- Q: What role do payment processors play in the evolution of e-commerce in India? A: They contribute significantly by facilitating transactions, influencing consumer behavior, and fostering growth.