AUTHOR : JENNY

DATE : 22-12-2023

Self-employment in India has witnessed a significant surge in recent years, reflecting the dynamic landscape of the country’s workforce. With this evolution, the need for efficient and secure payment processors for self-employment options in India tailored to the unique demands of self-employed individuals has become paramount.

Introduction to Payment Processors

In the realm of financial transactions, payment processors play a pivotal role. They facilitate the smooth transfer of funds between buyers and sellers, ensuring seamless transactions in various industries. For self-employed individuals, choosing the right payment processor for self-employment options in India is crucial to manage their earnings efficiently.

Self-Employment in India

India’s self-employment sector has flourished, spurred by technological advancements and the growing trend of freelancing, consulting, and gig-based work. Despite the opportunities, self-employed individuals encounter challenges, one of which is the absence of dedicated financial infrastructure.

Understanding Payment Processors

What Are Payment Processors?

Payment processors[1] act as intermediaries, handling transactions between buyers and sellers. They enable secure and efficient payment processing through various channels, including credit/debit cards, digital wallets, and online banking.

Traditional vs. Online Payment Processors

Key Features and Differences

Traditional processors involve physical terminals for transactions, while online processors operate in the digital space, Self-employment[2] catering to e-commerce and online businesses.

Different processors vary in terms of transaction[3] fees, currency support, and user interface. Selecting the right one depends on the specific needs and preferences of the self-employed individual.

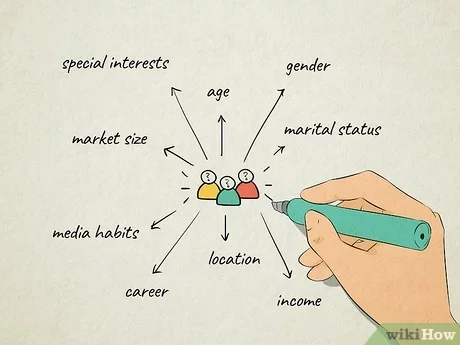

Criteria for Selecting a Payment Processor

Choosing an ideal payment[4] processor involves considering several factors:

Security Measures

Transaction Fees and Charges

Security remains a paramount concern. Self-Employment Ensuring robust encryption and fraud prevention measures is essential to safeguard financial data.

Understanding the fee structure is crucial to manage costs effectively. Transaction charges, currency conversion fees, and withdrawal costs impact earnings.

Integration and Accessibility

User-Friendly Interface

A user-friendly interface and seamless integration with self-employment platforms enhance convenience and accessibility for users.

Ease of use and intuitive navigation are essential for a smooth transaction experience, especially for individuals new to digital payments.

Top Payment Processors for Self-Employment in India

Several payment processors cater specifically to the needs of self-employed individuals in India. Some of the prominent ones include:

PayPal

Payoneer

As a global leader, PayPal offers secure and versatile payment solutions[5], facilitating transactions in multiple currencies.

Payoneer specializes in cross-border transactions, enabling freelancers to receive payments from international clients easily.

Razorpay

Instamojo

Razorpay is known for its simple integration and robust security measures, making it a preferred choice for many startups and freelancers.

Instamojo provides a user-friendly interface and comprehensive payment solutions, supporting businesses of all sizes.

How to Choose the Right Processor

Evaluating Business Needs

To select the most suitable payment processor, self-employed individuals should: Understanding specific requirements, such as transaction volume, international transactions, and preferred payment methods, aids in selecting the right processor.

Comparison of Offerings

Case Studies or Success Stories

Comparing features, transaction fees, and user reviews assists in making an informed decision regarding the most suitable payment processor.

Analyzing success stories or case studies of similar self-employed individuals using specific payment processors provides valuable insights.

Setting Up a Payment Processor

Integration with Self-Employment Platforms

Setting up a payment processor involves: Following the platform’s guidelines for registration, verification, and integration into the business workflow.

Ensuring seamless integration with platforms where the self-employed individual operates, such as e-commerce websites or freelancing portals.

Troubleshooting Common Issues

Security and Privacy Concerns

Addressing common concerns like transaction failures or account verification problems helps in a smooth operation.

Amid the digital landscape, prioritizing data protection and implementing fraud prevention strategies is imperative to safeguard sensitive financial information.

Future Trends in Payment Processing

The future of payment processing in self-employment is marked by continual innovation. Advancements in technology, such as blockchain and AI, are expected to revolutionize transactional experiences.

Conclusion

In essence, a reliable payment processor is the cornerstone for successful financial transactions in the realm of self-employment. With the diverse options available, understanding individual needs and meticulously assessing the offerings of different processors are key in making an informed choice.

FAQs

- Do payment processors charge fees for every transaction? Payment processors typically levy a transaction fee, but the structure varies among providers. Some charge a percentage of the transaction value, while others might have a flat fee.

- Can I use multiple payment processors for my self-employment business? Yes, using multiple processors is possible, but it’s crucial to consider integration complexities and manage fees effectively.

- Are payment processors secure for online transactions? Reputable payment processors prioritize security measures like encryption and fraud prevention to ensure safe online transactions.

- How long does it take to set up a payment processor account? The setup duration varies among processors but usually involves a few simple steps, including account verification.