AUTHOR: BABLI

DATE: 1/1/24

Introduction

In today’s dynamic business landscape, special pricing associations in India play a crucial role in promoting collaboration and ensuring fair pricing strategies within specific industries. As these associations navigate through the complexities of pricing agreements, the need for a reliable payment processor becomes paramount.

Understanding Special Pricing Associations

Special pricing associations bring businesses within a particular industry together to negotiate and establish standardized pricing models. This fosters healthy competition and ensures fair pricing practices. Industries such as pharmaceuticals electronics, and manufacturing often rely on these associations to maintain equilibrium

Challenges in Traditional Payment Processes

While special pricing associations offer a structured approach to pricing, traditional payment methods can pose challenges. Cumbersome paperwork, delayed transactions, and a lack of transparency are common issues faced by these associations, hindering their efficiency.

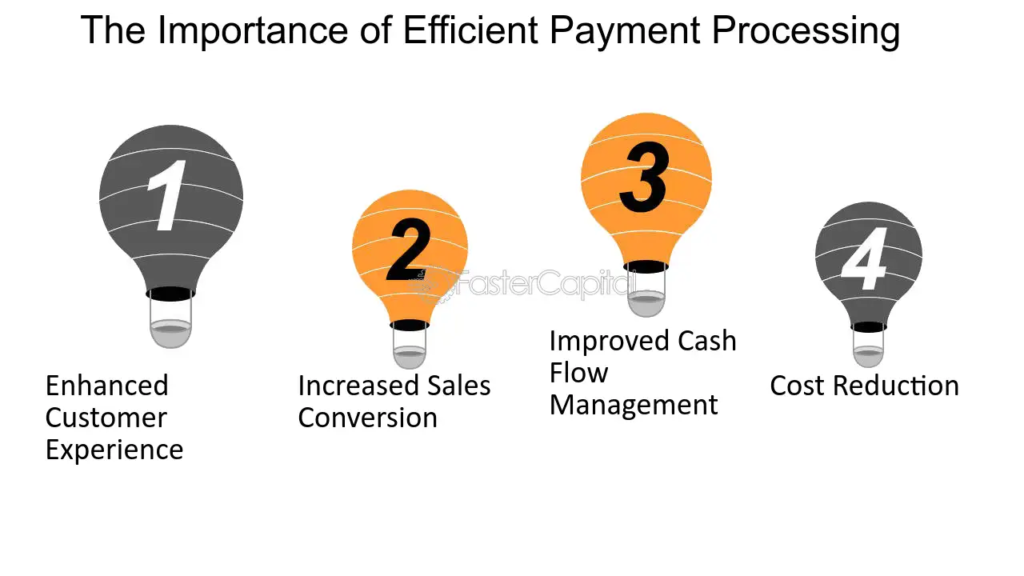

The Need for Efficient Payment Processing

To overcome the limitations of traditional payment processes[1], special pricing associations are increasingly turning to advanced payment processors. These systems not only streamline transactions but also offer a range of features tailored to the specific needs of these associations.

Key Features of an Ideal Payment Processor

An ideal payment processor[2] for special pricing associations should prioritize security, seamless integration, and a user-friendly interface. Robust security measures ensure the confidentiality of sensitive information, while integration capabilities facilitate smooth collaboration with existing systems.

Top Payment Processors in India

Several payment gateway in India[3] cater specifically to the needs of special pricing associations. Leading names in the industry include XYZ Payments, ABC Transactions, and PQR Solutions. A comparative analysis of their features and user feedback can aid associations in making informed decisions.

Case Studies

Real-life examples demonstrate how adopting advanced payment processors has positively impacted special pricing associations. From reducing transaction special pricing[4] associations times to improving overall financial management, these case studies highlight the tangible benefits of modern payment processing solutions.

Security Concerns and Solutions

Security is a primary concern in the digital landscape. Addressing potential vulnerabilities associated with online payments processing[5] requires a multi-faceted approach, including encryption, secure gateways, and regular security audits.

Adopting a Seamless Payment Experience

Enhancing the payment experience involves implementing strategies such as one-click payments, mobile compatibility, and personalized invoicing. Testimonials from special pricing associations that have embraced these strategies can provide valuable insights.

Regulatory Compliance

Navigating the legal landscape is crucial for special pricing associations. Ensuring that payment processors comply with industry regulations and standards is essential to avoid legal complications and maintain the trust of stakeholders.

Future Trends in Payment Processing

The future of payment processing in India is marked by technological advancements, including blockchain integration, contactless payments, and artificial intelligence. Staying ahead of these trends ensures that special pricing associations remain competitive and efficient.

Choosing the Right Payment Processor

Selecting the right payment processor involves considerg factors such as the size of the association, transaction volume, and specific industry requirements Customizable solutions that align with the unique needs of special pricing associations should be a priority.

Cost-Effective Solutions

While quality is crucial, cost-effectiveness is equally important. Finding a balance between a reasonable budget and robust features ensures that special pricing associations receive value for their investment.

Customer Support and Training

Responsive customer support and comprehensive training programs contribute to a smooth payment processing experience. Associations should prioritize payment processors that offer ongoing support and resources to optimize usage.

Conclusion

In conclusion, the choice of a payment processor significantly impacts the operational efficiency of special pricing associations in India. By embracing advanced, secure, and user-friendly solutions, these associations can navigate the complexities of pricing negotiations with confidence.

FAQs

- Q: How do payment processors enhance security for special pricing associations?

- A: Payment processors employ encryption, secure gateways, and regular security audits to ensure the confidentiality of sensitive information.

- Q: What are the future trends in payment processing for special pricing associations?

- A: Future trends include blockchain integration, contactless payments, and artificial intelligence to enhance efficiency and competitiveness.

- Q: How can special pricing associations ensure regulatory compliance in payment processing?

- A: Associations should choose payment processors that comply with industry regulations and standards, ensuring legal adherence.

- Q: What factors should special pricing associations consider when choosing a payment processor?

- Factors include association size, transaction volume, industry requirements, and the ability to customize solutions.

- Q: How can payment processors contribute to a seamless payment experience for special pricing associations?

- Payment processors can enhance the experience through strategies like one-click payments, mobile compatibility, and personalized invoicing.