AUTHOR : SELENA GIL

DATE : 27/12/2023

Introduction

In recent years, the landscape of financial transactions has undergone a paradigm shift with the emergence of virtual assets. These digital currencies and tokens have gained traction, presenting new avenues for investment and transactions. However, within India, the use of virtual assets[1] has necessitated the development of efficient payment processors

The need for Payment Processors in India

Growing Virtual Asset Market

India has witnessed a surge in the adoption of virtual assets, enticing both investors and consumers. This burgeoning market demands robust payment processing systems tailored to the unique needs of digital asset[2] transactions.

Regulatory Landscape

Navigating the regulatory landscape is crucial. India’s regulatory frameworks continuously evolve, impacting the operations and viability of payment processors[3] catering to virtual assets.

Role of Payment Processors

Facilitating Transactions

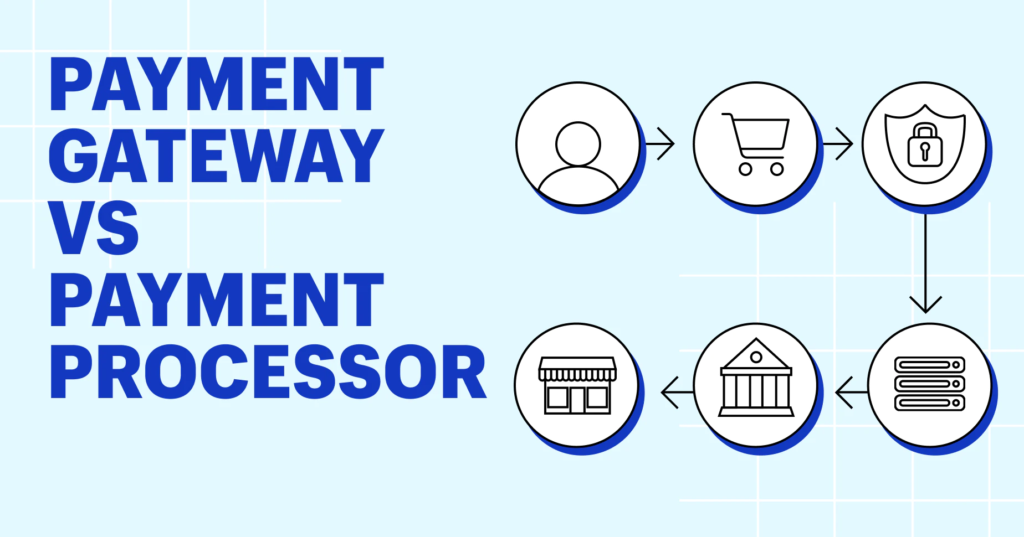

Payment processors play a pivotal role in enabling seamless transactions[4] within the virtual asset realm. Their integration ensures swift and reliable fund transfers.

Ensuring Security

Security remains paramount in the virtual asset domain. Payment processors employ sophisticated encryption and authentication protocols to safeguard transactions.

Key Features of Payment Processors for Virtual Assets

Compliance with Regulations

Effective processors adhere to stringent regulatory norms, ensuring legality and compliance with Indian financial regulations.

Integration Options

Offering diverse integration options enhances accessibility, accommodating various platforms and devices for transaction facilitation.

Transaction Speed and Efficiency

Efficiency in processing transactions, coupled with swift execution, defines the success of payment processors in the virtual asset ecosystem.

Popular Payment Processors in India

This leading processor offers a comprehensive suite of services tailored to the evolving virtual asset market in India.

Known for its user-friendly interface and robust security measures, Processor B stands as a prominent choice for many virtual asset users.

Challenges and Solutions

Regulatory Challenges

Adapting to evolving regulations presents a hurdle, but proactive measures in compliance frameworks ensure sustained operations.

Security Concerns

Addressing security concerns through innovative technologies and constant vigilance fortifies the trust users place in these processors.

Addressing the user experience

Streamlining user interfaces and optimizing transaction experiences contribute significantly to widespread adoption.

The Evolving Landscape of Payment Processors

As the realm of virtual assets expands, the necessity for efficient payment processors becomes increasingly evident. These processors act as the bridge between traditional financial systems and the burgeoning world of digital currencies and tokens. India, in particular, showcases a dynamic market where the demand for reliable payment processing services for virtual assets is on the rise.

Understanding the Shift in Transactions

Traditional modes of financial transactions[5] are being reshaped by the advent of virtual assets. Cryptocurrencies, digital tokens, and other virtual forms of value have gained significant attention from investors, businesses, and consumers. With this surge comes the need for seamless, secure, and efficient payment processing mechanisms specifically tailored to these digital assets.

Navigating Regulatory Changes

One of the primary challenges faced by payment processors in India revolves around the ever-evolving regulatory landscape. The government and regulatory bodies continually reassess and modify guidelines and policies governing virtual assets and their transactions. This necessitates that payment processors maintain agility and compliance while catering to market demands.

The Crucial Role of Security

In the realm of virtual assets, security remains paramount. Payment processors dedicated to handling these assets deploy state-of-the-art encryption, multi-factor authentication, and stringent security measures to protect users’ funds and data. Ensuring the integrity of transactions and safeguarding against cyber threats is imperative.

Tailoring Services to User Needs

Successful payment processors understand the significance of the user experience. Simplifying interfaces, optimizing transaction speeds, and providing responsive customer support are pivotal in fostering trust and increasing adoption among users engaging in virtual asset transactions.

Addressing Challenges and Paving the Way Forward

While the potential for growth in the virtual asset market in India is immense, challenges persist. Adapting to regulatory shifts, enhancing security protocols, and continually refining user experiences are ongoing endeavors for payment processors . However, these challenges also present opportunities for innovation and improvement within the industry.

Conclusion

In India’s dynamic landscape for virtual assets, payment processors stand as crucial facilitators. Their adherence to regulations, emphasis on security, and commitment to enhancing user experiences are pivotal in shaping the future of digital transactions in the country.

FAQs

- What makes a payment processor suitable for virtual assets in India?

- Are there risks associated with using payment processors for virtual assets in India?

- How do regulatory changes impact payment processors dealing with virtual assets?

- Can payment processors guarantee absolute security for virtual asset transactions?

- What factors should one consider while choosing a payment processor for virtual assets in India?