AUTHOR : ISTELLA ISSO

DATE : 12/12/2023

Introduction

In the bustling streets of India, where time is of the essence and convenience is a priority, the evolution of mobile payments[1] has become a game-changer. As the digital[2] landscape transforms[3], payment processors[4] play a pivotal role in facilitating seamless transactions. Let’s delve into the realm of payment processor mobile payments in India[5], exploring the journey, challenges, and promising future that lie ahead.

Evolution of Payment Processors

In the not-so-distant past, traditional payment methods dominated the Indian market. However, with rapid technological advancements, the landscape witnessed a paradigm shift. The emergence of payment processors revolutionized the way transactions occur, making them faster, secure, and more accessible.

Key Players in the Indian Mobile Payment Scene

In the vast Indian mobile payment[1] ecosystem, several key players compete for supremacy. From established giants to innovative startups, the competition fuels a constant drive for improvement and customer satisfaction. Understanding the market dynamics and the share each player commands is crucial for both consumers and businesses.

Benefits of Using Mobile Payment Processors

The allure of mobile payment processors[2] lies in their ability to provide unparalleled convenience. Users can make transactions with a simple tap on their smartphones, eliminating the need for physical cash. The efficiency, coupled with robust security features, makes mobile payments an attractive option for the tech-savvy Indian population.

Challenges in Mobile Payments

While the benefits are evident, challenges persist. Cybersecurity concerns loom large as the digital landscape becomes a breeding ground for malicious activities. Additionally, resistance to digital[3] adoption, especially in rural areas, and connectivity issues pose hurdles in the widespread acceptance of mobile payments.

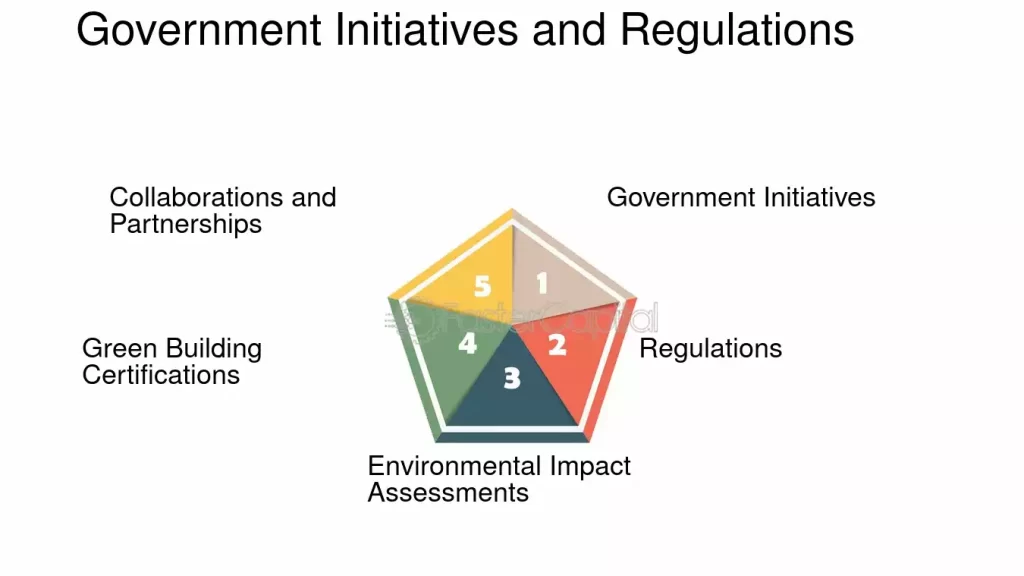

Government Initiatives and Regulations

Recognizing the transformative potential of digital transaction[4], the Indian government has taken significant steps to promote and regulate the mobile payment sector. Understanding the role of the government and the regulatory framework is essential for a comprehensive grasp of the industry.

Impact of Mobile Payments on Businesses

Businesses, big and small, have experienced a positive impact from the surge in mobile payments. Increased sales, a broader customer base, and streamlined financial operations are just a few of the advantages that businesses enjoy in this cashless era.

Trends in Mobile Payment Technology

The landscape of mobile payment technology is ever-evolving. From contactless payments to biometric authentication, payment processors continually introduce innovative features. Keeping an eye on these trends is crucial for businesses aiming to stay ahead in the competitive market.

Consumer Adoption and Behavior

Understanding consumer behavior is key to the success of mobile payments. The shift in preferences towards digital transactions is influenced by factors such as convenience, security, and incentives offered by payment processors. Analyzing these aspects provides insights for businesses[5] and payment processors alike.

Future Prospects and Growth Opportunities

The future of mobile payments in India holds exciting possibilities. Projections indicate exponential growth, with emerging trends like blockchain integration and decentralized finance shaping the landscape. Businesses and investors keen on growth opportunities should keep a watchful eye on these developments.

Comparison with Global Mobile Payment Trends

In the global arena, India stands out for its rapid adoption of mobile payments. Comparing trends and practices with other countries provides valuable insights and lessons. As India navigates its unique challenges, there’s much to learn from global success stories.

Case Studies of Successful Mobile Payment Implementations

Examining real-world examples of successful mobile payment implementations offers practical insights. From urban hubs to remote villages, these case studies showcase how effective strategies and partnerships can lead to widespread acceptance and usage.

Educational Initiatives for Digital Literacy

As mobile payments become ubiquitous, there’s a need for widespread digital literacy. Payment processors are taking the lead in educating users about the benefits, security measures, and responsible usage. These educational initiatives are crucial for building trust and confidence in digital transactions.

Environmental Impact of Mobile Payments

Beyond the convenience and efficiency, mobile payments contribute to environmental sustainability. Reducing the reliance on physical currency and embracing digital transactions can significantly lower the carbon footprint associated with traditional banking practices.

Conclusion

In conclusion, the landscape of payment processor mobile payments in India is dynamic and promising. From the evolution of technology to the impact on businesses and consumers, the journey reflects a shift towards a cashless future. As India embraces digital transactions, payment processors will continue to play a pivotal role in shaping the financial landscape.

FAQs

- Are mobile payments secure in India?

- Payment processors in India employ advanced security measures to ensure the safety of transactions, making mobile payments highly secure.

- How can businesses benefit from mobile payments?

- Businesses can experience increased sales, a broader customer base, and streamlined financial operations by adopting mobile payment solutions.

- What role does the government play in promoting digital transactions?

- The government plays a significant role in promoting digital transactions through initiatives and regulatory frameworks that support the growth of the mobile payment industry.

- What are the emerging trends in mobile payment technology?

- Emerging trends include blockchain integration, contactless payments, and biometric authentication, enhancing the overall user experience.

- How can users in rural areas overcome challenges in mobile payments?

- Education and awareness programs initiated by payment processors and the government can help users in rural areas overcome challenges and embrace mobile payments.