AUTHOR :HAANA TINE

DATE :16/12/2023

Introduction

India boasts a thriving collectible coin market, attracting mathematicians and investors alike. The allure of rare and historical coins fuels a robust economy surrounding these artifacts. However, as transactions surge, the reliance on secure payment methods becomes crucial.

Importance of Payment Processors for Collectible Coin Transactions

The traditional modes of payment, such as cash transactions and bank transfers, often pose challenges. To ensure seamless transactions and foster trust in the market, the integration of efficient payment processors is indispensable.

Popular Collectible Coins in India

From ancient artifacts to modern commemorative pieces, the Indian collectible coin market offers a diverse array of options. Understanding the demand for these coins is essential for selecting appropriate payment processors.

Growing Demand and Market Trends

The surge in interest for collectible coins necessitates a payment infrastructure that accommodates the growing demands of buyers and sellers. Payment processors act as facilitators, ensuring a smooth exchange of these prized possessions.

Challenges in Traditional Payment Methods

Limitations of Cash Transactions

Dealing with large sums of cash is not only inconvenient but also poses security risks. The need for a safer and more traceable method becomes apparent as transactions reach significant values.

Risks and Inconveniences of Bank Transfers

While bank transfers are a common mode of payment, they come with their own set of challenges. Lengthy processing times and potential errors can disrupt the flow of transactions in the fast-paced collectible coin market.

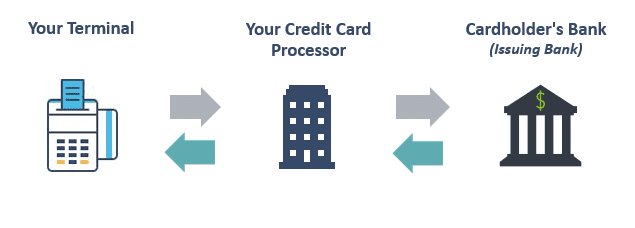

The Role of Payment Processors

Payment processors act as intermediaries, facilitating transactions between buyers and sellers. Their role in ensuring the security and efficiency of payments is paramount in the world of collectible coins.

How Payment Processors Streamline Transactions for Collectible Coins

By offering secure online platforms, payment processors simplify the buying and selling process for collectible coins. They provide a bridge between the buyer’s preferred payment method and the seller’s need for a reliable and traceable transaction.

Top Payment Processors for Collectible Coins in India

PayPal

As a globally recognized payment processor, PayPal offers a secure and user-friendly platform for collectible coin transactions. Its buyer and seller protection policies make it a popular choice among enthusiasts.

Paytm

With the widespread adoption of digital wallets, Paytm has emerged as a prominent player in the Indian market. Its seamless integration with various e-commerce platforms makes it a convenient option for collectors.

Razorpay

Focused on providing a smooth payment experience, Razorpay caters to the evolving needs of the collectible coin market. Its customizable solutions and transparent fee structures appeal to both buyers and sellers.

UPI (Unified Payments Interface)

The UPI system has revolutionized digital transactions in India. Its direct bank-to-bank transfers offer a secure and instant method for buying and selling collectible coins, making it a preferred choice for many.

Advantages of Using Payment Processors

Security and Fraud Protection

Payment processors employ robust security measures, including encryption and authentication, to safeguard transactions. This is crucial in the collectible coin market, where the value of items can be substantial.

Convenience for Buyers and Sellers

The convenience of online transactions[1] through payment processors enhances the overall experience for both buyers and sellers. Quick and hassle-free payments contribute to a positive market environment.

Faster Transactions

In the fast-paced world of collectible coins, swift transactions are essential. Payment processors[2] ensure that funds are transferred promptly, minimizing the time between agreement and completion of the transaction.

Considerations for Choosing a Payment Processor

Fees and Charges

Before selecting a payment processor, it’s essential to understand the fee structure. Different processors may have varying transaction fees[3], and sellers must consider these costs in their pricing strategy.

Case Studies: Successful Transactions with Payment Processors

Real-Life Examples of Secure Collectible Coin Transactions

Numerous success stories demonstrate the effectiveness of payment processors in facilitating secure collectible coin transactions[4]. These case studies highlight the positive impact on both buyers and sellers in the market.

Positive Impact on the Market

The widespread adoption of payment[5] processors has contributed to a positive shift in the collectible coin market. Increased security and efficiency have fostered trust among participants, leading to a thriving ecosystem.

Conclusion

In conclusion, payment processors serve as the backbone of secure and efficient transactions in the collectible coin market in India. Their role in overcoming the limitations of traditional payment methods is crucial for the continued growth of the market. Payment Processors for Collectible Coins in India To ensure a positive experience for both sellers and buyers, it is imperative to embrace secure transactions facilitated by payment processors. This collective effort contributes to a vibrant and trustworthy collectible coins market.

FAQs

- Are payment processors safe for collectible coin transactions? Yes, payment processors use advanced security measures, including encryption and authentication, to ensure the safety of transactions.

- How do I choose the right payment processor for my collectible coin transactions? Consider factors such as fees, integration with e-commerce platforms, and user-friendly interfaces when selecting a payment processor.

- Can I use multiple payment processors for my transactions? Yes, some sellers opt to offer multiple payment options to cater to a broader range of buyers.

- What should I do if I encounter issues with a payment processor? Contact the customer support of the payment processor immediately to address and resolve any issues.

- Is it necessary to have a bank account for using payment processors? While not always mandatory, having a linked bank account enhances the functionality and convenience of using payment processors for collectible coin transactions.