AUTHOR : SELENA GIL

DATE : 25/12/2023

Introduction

Credit card debt individuals is a common financial challenge faced by individuals worldwide. It’s the result of unpaid credit card balances often accompanied by high-interest rates, leading to financial strain for many. In India, this issue has been on the rise, impacting individuals’ financial stability and the broader economy.

Importance of Payment Processors

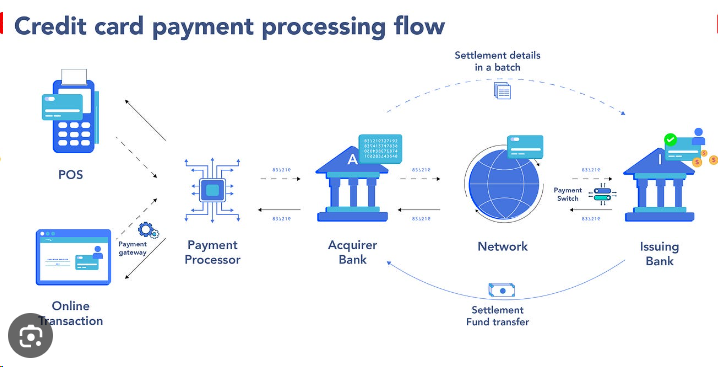

Payment processors play a crucial role in facilitating transactions made through credit cards. Their significance extends beyond simple transactions, especially concerning debt management. These processors enable smoother repayment processes, aiding individuals in managing their credit card debt efficiently.

Challenges of Credit Card Debt in India

The Indian scenario poses unique challenges regarding credit card debt. With increasing accessibility to credit cards, debt accumulation has become more prevalent. The statistics highlight a concerning trend, indicating the need for effective debt management solutions.

Role of Payment Processors in Debt Management

Payment processors come to the rescue by offering strategies and mechanisms that assist in debt repayment. Through various tools and platforms, they provide users with options to structure and pay off their credit card dues systematically.

Popular Payment Processors in India

Factors to Consider When Choosing a Payment Processor for Debt

Several payment processors[1] operate in India, each offering distinctive features and benefits that aid in debt resolution. Understanding these options and their suitability for individual needs is crucial when addressing credit card debt.

Selecting the right payment processor involves considering specific criteria, including fees, usability, customer support, Credit card debt[2] and security. A comparative analysis helps in making an informed decision about the best-suited processor.

Regulations and Compliance in Credit Card Debt Management

Case Studies and Success Stories

In India, there are regulations and compliance measures set forth to manage credit card Payment processors[3] must adhere to these guidelines, Payment Processors for Credit Card Debt in India ensuring a secure and legal framework for debt resolution.

Real-life examples demonstrate how payment processors have helped individuals successfully manage and overcome their credit card debt. These stories provide insight into the impact of effective Debt Reduction Strategies[4].

Future Trends in Payment Processing and Debt Management

Emerging technologies and trends in payment processing offer a glimpse into the future of debt management. With advancements in financial technology, the landscape of debt resolution is expected to evolve significantly.

Real-life Impact of Payment Processors

The impact of payment processors[5] on individuals grappling with credit card debt cannot be understated. Take, for instance, the case of Ananya, a young professional in Mumbai burdened with accumulating credit card bills. With the assistance of a reputable payment processor, Ananya gained access to a structured repayment plan tailored to her financial capabilities. This not only eased her stress but also empowered her to take control of her financial situation.

Similarly, Rahul, a small business owner in Delhi, faced challenges managing his credit card debt due to irregular income. However, with the help of a payment processor offering flexible repayment options, he successfully navigated his way out of debt without compromising his business operations.

Technological Advancements Shaping Debt Resolution

Looking ahead, the future of payment processing in debt management seems promising, thanks to technological advancements. Artificial intelligence, machine learning algorithms, and blockchain technology are revolutionizing the financial sector. These innovations are expected to provide even more sophisticated tools for debt resolution, enabling personalized solutions tailored to individual financial circumstances.

Additionally, the integration of biometrics for enhanced security and user authentication is on the horizon. This not only ensures safer transactions but also simplifies the user experience, making debt management more accessible and user-friendly.

Navigating Regulatory Compliance

The landscape of credit card debt management through payment processors also involves navigating through regulatory frameworks. In India, the Reserve Bank of India (RBI) sets guidelines and standards to ensure the security and legality of financial transactions. Payment processors operating in India must adhere to these regulations, emphasizing the importance of choosing a processor that complies with these norms for a secure and lawful debt management process.

Customer-Centric Approach of Payment Processors

One notable aspect of payment processors is their customer-centric approach. Reputable processors prioritize user experience, offering accessible interfaces and round-the-clock customer support. This plays a crucial role in guiding individuals through their debt repayment journey, providing assistance and guidance whenever needed.

Conclusion

Payment processors play a pivotal role in addressing credit card debt in India. Understanding their significance and functionalities empowers individuals to make informed decisions, leading to better debt management and financial stability.

FAQs

- Are payment processors the same as banks?

- Payment processors facilitate transactions but are not banks. They work in tandem with banks to enable smooth transactions.

- Do all payment processors offer debt management services?

- Not all payment processors specialize in debt management. Some may provide tools or options specifically designed for debt resolution.

- How do payment processors ensure security during transactions?

- Security measures such as encryption and stringent protocols are implemented by payment processors to safeguard transactions.

- Can payment processors negotiate with credit card companies on behalf of users?

- Some payment processors may offer negotiation services to help users settle debts, but this varies based on the processor.

- Are payment processors regulated by authorities in India?

- Yes, payment processors in India are subject to regulations imposed by authorities to ensure compliance and security.