AUTHOR :HAANA TINE

DATE :25/12/2023

Introduction

In the vast landscape of financial services in India, payment providers play a pivotal role in facilitating transactions and enhancing economic activities. However, the accessibility of these services becomes a complex issue when individuals are grappling with bad credit In this article, we will delve into the challenges faced by those with poor credit scores and explore the evolving landscape of inclusive financial services.

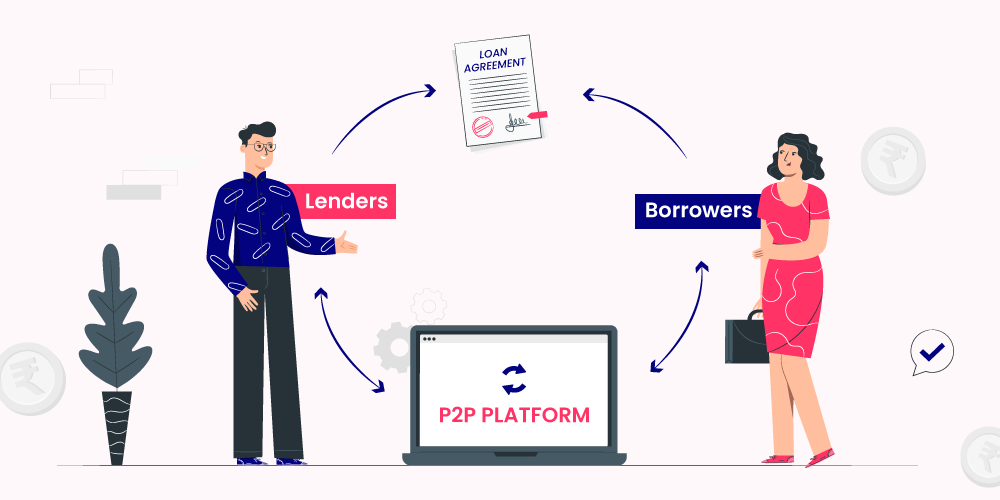

Definition of Payment Providers

Payment providers, commonly known as financial institutions, enable individuals to send and receive money, make transactions, and access various financial services. These entities range from traditional banks to modern fintech companies, each offering a spectrum of services to cater to diverse needs.

Significance of Credit Scores

Credit scores serve as a crucial factor when individuals seek financial services. A good credit score opens doors to a plethora of options, while a bad credit score can pose significant obstacles. Understanding the impact of credit scores is vital for navigating the financial landscape effectively. Payment Provider Bad Credit in India

Challenges Faced by Individuals with Bad Credit in India

For those with a less-than-stellar credit history[1], the journey to finding suitable payment providers can be arduous. The challenges include limited options, higher interest rates, and stringent collateral requirements. This article aims to shed light on the intricacies of this predicament and offer guidance for those navigating these challenges.

The Impact of Bad Credit on Payment Provider Options

Limited Choices for Individuals with Bad Credit

Individuals with bad credit often find themselves excluded from mainstream financial services. Traditional banks may be hesitant to extend credit, leaving many with fewer choices for Payment service provider[2].

One of the consequences of bad credit is the imposition of higher interest rates and additional fees. This adds financial strain to individuals who are already facing challenges, making it crucial to explore alternative options.

Security Deposits and Collateral Requirements

Emerging Trends in Inclusive Financial Services

Some payment systems explained[3] may require security deposits or collateral from individuals with bad credit to mitigate the perceived risk. This can further limit the accessibility of financial services, especially for those without substantial assets.

In recent years, fintech companies have emerged as game-changers, introducing innovative solutions for individuals with bad credit. Payment Provider Bad Credit in India These solutions leverage technology to assess risk differently and Financial services[4] to a wider audience.

Micro-Lending Platforms

Micro-lending platforms have gained prominence, offering smaller loan amounts with more flexible terms. These platforms cater specifically to individuals with bad credit, providing a lifeline for those in need of financial assistance.

Government Initiatives for Financial Inclusion

Governments are recognizing the importance of financial inclusion and are implementing initiatives to support individuals with bad credit. These measures aim to create a more inclusive financial system that addresses the diverse needs of the population.

Choosing the Right Payment Provider with Bad Credit

Researching Available Options

When facing bad credit, thorough research becomes paramount. Payment processor[5] in India Exploring the available payment providers, both traditional and alternative, allows individuals to make informed decisions about the services that best align with their needs.

Understanding the terms and conditions of payment providers is crucial. Individuals should pay attention to interest rates, fees, and any additional requirements to ensure transparency and avoid unforeseen challenges.

Seeking Professional Advice

For those navigating the complexities of bad credit, seeking advice from financial professionals can be immensely beneficial. Financial advisors can provide personalized guidance based on individual circumstances, helping to make informed decisions.

Tips for Improving Credit Scores

Understanding Credit Reports

Improving credit scores starts with understanding the factors that contribute to them. Regularly checking credit reports allows individuals to identify areas for improvement and take proactive steps.

The Future of Payment Providers and Bad Credit in India

Technological Advancements

As technology continues to advance, payment providers are likely to adopt more sophisticated risk assessment tools, providing a fair chance to individuals with bad credit.

Policy Changes and Regulatory Developments

Changes in policies and regulations can shape the landscape of financial services .Payment Provider Bad Credit in India Advocacy for inclusive practices and regulatory developments may pave the way for a more accessible financial system.

Projected Growth and Opportunities

The projected growth of inclusive financial services indicates a positive trajectory. As more options become available, individuals with bad credit can anticipate increased opportunities for accessing essential financial services.

Conclusion

In conclusion, the challenges posed by bad credit in India can be daunting, but the evolving landscape of payment providers offers hope. By staying informed, exploring alternative options, and taking proactive steps to improve credit scores, individuals can navigate these challenges successfully. The future holds promising opportunities for inclusive financial services, ensuring that no one is left behind in the journey toward financial well-being.

FAQs

Is it possible for individuals with a poor credit history to secure a loan in India?- While traditional banks may be hesitant, there are alternative options, such as microlending platforms, that cater specifically to individuals with bad credit.

- How can I improve my credit score quickly?

- Timely repayment of existing debts, understanding credit reports, and seeking professional financial counseling are effective strategies for improving credit scores.

- Are government initiatives effective in promoting financial inclusion for individuals with bad credit?

- Government initiatives play a crucial role in creating a more inclusive financial system, offering support and opportunities for those with bad credit.

- What should I consider when choosing a payment provider with bad credit?

- Researching available options, reading terms and conditions thoroughly, and seeking professional advice are key considerations when choosing a payment provider with bad credit.

- What is the role of technology in the future of payment providers for individuals with bad credit?

- Technological advancements are likely to result in more sophisticated risk assessment tools, providing increased opportunities for individuals with bad credit to access essential financial services.