AUTHOR : PUMPKIN KORE

DATE : 22/12/2023

INTRODUCTION

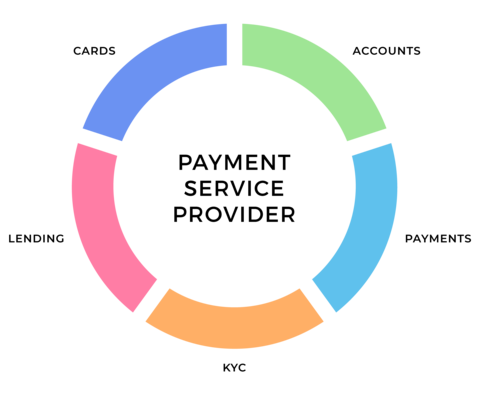

The FinTech ecosystem in India has evolved significantly, driven by advancements in technology and changing consumer preferences. Payment providers innovative solutions, have become the backbone of digital transactions. payment provider business coaching in india

Understanding the market dynamics is crucial for anyone venturing into the payment provider business. From the competitive landscape to the regulatory environment, staying informed is the first step towards sustainable success. payment provider business coaching in india

Importance of Business Coaching

In a highly regulated industry, navigating through compliance requirements can be overwhelming. Specialized coaching programs guide entrepreneurs in understanding and adhering to regulatory standards, ensuring a smooth operational journey.

As a payment provider business grows, scaling operations becomes a priority. Coaching programs offer insights into scalable strategies, helping businesses expand without compromising efficiency.

Tailored Coaching Programs for Payment Providers

Effective financial management is crucial for the longevity of any business. Tailored coaching programs[1] focus on instilling financial acumen, enabling payment providers to make informed decisions.

In a digital era, customer experience sets businesses[2] apart. Coaching programs emphasize the importance of user-centric approaches, enhancing customer satisfaction and loyalty.

Key Players in Indian Payment Provider Coaching

Exploring success stories within the industry provides valuable insights. Learning from the experiences of established players can inspire and guide emerging Payment service provider[3] .

Identifying challenges and implementing effective solutions is a key aspect of business growth. Understanding how industry leaders tackle obstacles offers a roadmap for success.

The integration of artificial intelligence and machine learning is reshaping the FinTech landscape. Business coaching[4] programs delve into the possibilities these technologies offer, guiding businesses towards innovation.

Transaction Volume and Value

Tracking transaction volume and value is essential for assessing business performance. Coaching programs provide insights into key performance indicators, aiding in data-driven decision-making.

Happy customers are the foundation of a successful business. Coaching programs emphasize the significance of customer satisfaction, leading to increased brand loyalty.

Transformative Leadership

Examining transformative leadership within the FinTech sector reveals the impact of visionary leaders. Coaching programs delve into leadership styles that drive positive change.

Innovations in technology often distinguish successful payment service providers[5]. Case studies highlight how embracing technological advancements can lead to breakthroughs.

In an interconnected world, exploring global integration opportunities can open new avenues. Coaching programs guide businesses in expanding their reach beyond domestic boundaries.

Challenges and Solutions

Staying compliant with ever-changing regulations is a constant challenge. Coaching programs offer strategies for staying ahead of regulatory changes, minimizing risks.

Technological barriers can hinder growth. Coaching programs equip businesses with the knowledge and tools to overcome technological challenges, fostering innovation.

Building a Successful Payment Provider Coaching Business

Collaborations and partnerships are instrumental in the FinTech sector. Coaching programs emphasize the value of strategic alliances, fostering growth through synergies.

The FinTech landscape is dynamic, requiring continuous learning and adaptation. Coaching programs instill a culture of learning, ensuring businesses stay ahead in the rapidly evolving industry.

Acknowledging and learning from failures is equally important. Testimonials share valuable lessons learned, offering a holistic perspective on the entrepreneurial journey.

The Role of Leadership in FinTech Coaching

Effective leadership is a cornerstone of success. Coaching programs delve into leadership styles that align with the fast-paced and innovative nature of the FinTech sector.

Fostering a culture of innovation requires empowered teams. Coaching programs guide leaders in creating environments that encourage creativity and continuous improvement.

Conclusion

In conclusion, payment provider business coaching in India is not just a necessity but a catalyst for success. As the FinTech sector continues to evolve, businesses that invest in quality coaching programs position themselves for sustainable growth and innovation.

FAQs

How can payment provider coaching benefit my business?

Payment provider coaching offers tailored guidance on regulatory compliance, strategic financial management, and scaling operations, enhancing the overall success and longevity of your business.

What are the common challenges faced by payment providers in India?

Payment providers often grapple with regulatory complexities, cybersecurity concerns, and the need for seamless scalability. Coaching programs address these challenges proactively.

How do coaching programs address regulatory changes in the FinTech sector?

Coaching programs keep businesses informed about regulatory changes, providing strategies to adapt and thrive within the evolving legal landscape of the FinTech sector.

Are there specific coaching programs for startups in the payment industry?

Yes, many coaching programs cater specifically to startups in the payment industry, offering foundational knowledge, mentorship, and strategies for sustainable growth.

How does technology play a role in the success of payment provider businesses?

Technology is a cornerstone of success in the FinTech sector. Coaching programs explore the integration of AI, machine learning, and innovative technologies, fostering a competitive edge.