AUTHOR:AYAKA SHAIKH

DATE:23/12/2023

Introduction

Have you ever wondered how seamless transactions happen online? It’s all thanks to payment provider collection services. Let’s dive deep into this fascinating world and see how it’s shaping India’s digital economy. payment provider Collection services in india.

Why Payment Providers Matter

In today’s fast-paced world, everyone seeks convenience Payment providers act as the bridge between consumers and businesses, ensuring that transactions happen swiftly and securely. Especially in a diverse market like India, these services play a pivotal role in driving economic growth. Payment Provider Collection Services in India

The Landscape of Payment Collection in India

India, with its vast population and growing digital footprint, offers a fertile ground for payment providers. From urban metros to rural villages, the need for efficient payment solutions is evident. As technology penetrates deeper, so does the demand for reliable collection services.

The Evolution of Payment Collection Services

Remember the days when cash ruled the roost? Well, times have changed. Traditional methods, though reliable, lacked the speed and efficiency modern businesses demand. Enter modern solutions like digital wallets, UPI, and mobile banking, revolutionizing the payment landscape.

Technological Advancements

With the advent of technology Digital Payments[1] collection services have undergone a paradigm shift. AI-driven solutions, blockchain, and real-time analytics are not just buzzwords but tools that redefine user experience.

Key Players in the Indian Market

When we talk about Payment Solutions[2] providers in India, names like Paytm, PhonePe, and Razorpay come to mind. These platforms offer a plethora of features, from instant transfers to secure transactions, making them favorites among businesses and consumers alike.

Overview of Major Payment Providers

Benefits of Using Payment Collection Services

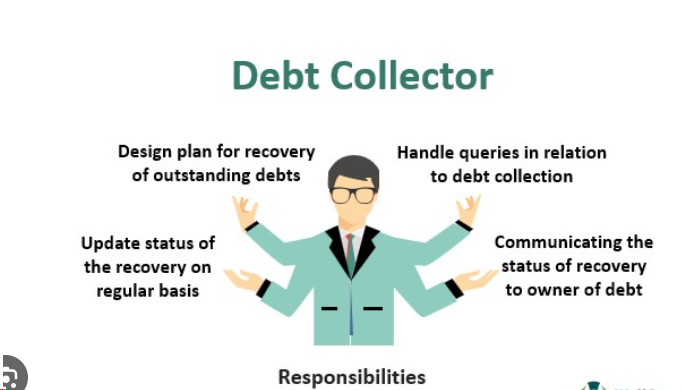

Each payment provider brings something unique to the table. While some focus on user experience, others prioritize security and scalability. Collection system[3] Understanding these nuances helps businesses make informed decisions.

Why should businesses embrace Payment Methods[4] ? For starters, they offer efficiency, ensuring that transactions happen in real-time. Moreover, the security protocols in place instill confidence among consumers, fostering trust and loyalty.

Efficiency and Convenience

Security and Transparency

Imagine waiting for days to receive .Sounds frustrating, right? Payment system[5] providers eliminate this hassle, offering instant settlements and . In an era where data breaches make headlines, security is paramount. Payment providers employ state-of-the-art encryption techniques, ensuring that sensitive information remains confidential.

Challenges Faced by Payment Providers

Regulatory Hurdles

While the road to success is paved with opportunities, challenges abound. Regulatory hurdles, stiff competition, and evolving market dynamics pose challenges that payment providers must navigate.

India’s regulatory landscape is complex. Payment providers must adhere to stringent guidelines, ensuring compliance while driving innovation.

Competition and Market Dynamics

With new entrants mushrooming every day, the competition is cut-throat. Payment providers must innovate continuously, offering value-added services that differentiate them from competitors.

Trends Shaping the Future

Rise of Digital Transactions

What does the future hold for payment providers in India? As digital transactions surge, integration with e-commerce, retail, and other sectors is inevitable. The digital wave is unstoppable. With smartphones becoming ubiquitous, digital transactions are set to soar, offering immense growth opportunities for payment providers.

Integration with E-commerce and Retail

Case Studies

E-commerce and retail sectors are undergoing a digital transformation. Payment providers play a crucial role, ensuring seamless transactions, thereby enhancing user experience. Let’s delve into some success stories that highlight the transformative power of payment providers.

Transforming Business Operations

Company A, a leading e-commerce platform, witnessed a 50% surge in sales post-integration with a payment provider. Real-time transactions, coupled with enhanced security, bolstered customer confidence, driving growth.

Pioneering Innovative Solutions

How to Choose the Right Payment Provider

Company B revolutionized the hospitality sector by offering bespoke payment solutions. From contactless payments to loyalty programs, their innovative approach set them apart, garnering industry accolades.

Selecting the right payment provider can be daunting. However, by considering factors like scalability, security, and customer support, businesses can make informed decisions.

Factors to Consider

Steps to Evaluate and Select

From transaction fees to integration capabilities, evaluating various factors ensures that businesses partner with providers that align with their goals.

Researching, comparing features, and seeking recommendations are some steps businesses can follow to choose the right payment provider

Conclusion

In conclusion, payment collection services in India are more than just a convenience; they are the backbone of the country’s burgeoning digital economy. As technology evolves and consumer expectations rise, payment providers must innovate continuously, ensuring seamless, secure, and efficient transactions.

FAQs

- Why are payment collection services essential in India?

- Payment collection services drive economic growth, offering businesses and consumers convenience, security, and efficiency.

- Which are the major payment providers in India?

- Major payment providers in India include Paytm, PhonePe, Razorpay, among others.

- How do payment providers ensure security?

- Payment providers employ state-of-the-art encryption techniques, secure servers, and stringent authentication protocols to ensure data security.

- What challenges do payment providers face in India?

- Payment providers face regulatory hurdles, stiff competition, evolving market dynamics, and the need for continuous innovation.

- How can businesses choose the right payment provider?

- Businesses can choose the right payment provider by evaluating factors like scalability, security, transaction fees, and customer support.