AUTHOR :HAANA TINE

DATE :23/12/2023

Introduction

Importance of Efficient Collections in India

Payment provider collections involve the systematic recovery of dues from customers, a process vital for sustaining the financial health of businesses and the economy at large. Given the diverse economic and cultural landscape in India, having an effective collections process is paramount. It not only ensures the stability of payment providers but also contributes to the overall financial well-being of the country.

Understanding the Collections Landscape

Key Players in the Indian Payment Industry

India boasts a thriving payment industry with various players, including traditional banks, fintech startups, and non-banking financial institutions. Understanding their roles is crucial to comprehending the dynamics of collections.

Role of Collections in the Financial Ecosystem

Challenges in Collections Process

Collections are not just about debt recovery[1] they play a pivotal role in maintaining a balance within the financial ecosystem. Timely collections contribute to the availability of funds for further lending, supporting economic growth Collection development[2].

Navigating the complex regulatory landscape in India poses a significant challenge for Payment service provider[3]. Regulations often vary across states, adding an additional layer of complexity to debt recovery processes.

Cultural and Linguistic Diversity

Economic Factors Impacting Collections

India’s cultural and linguistic diversity presents a unique challenge in communication during the collections process[4]. Tailoring communication strategies to resonate with diverse audiences is crucial for success.

Fluctuations in the economic landscape, such as job losses or economic downturns, directly impact an individual’s ability to repay debts. Payment providers need adaptive strategies to address these economic challenges.

Strategies for Effective Collections

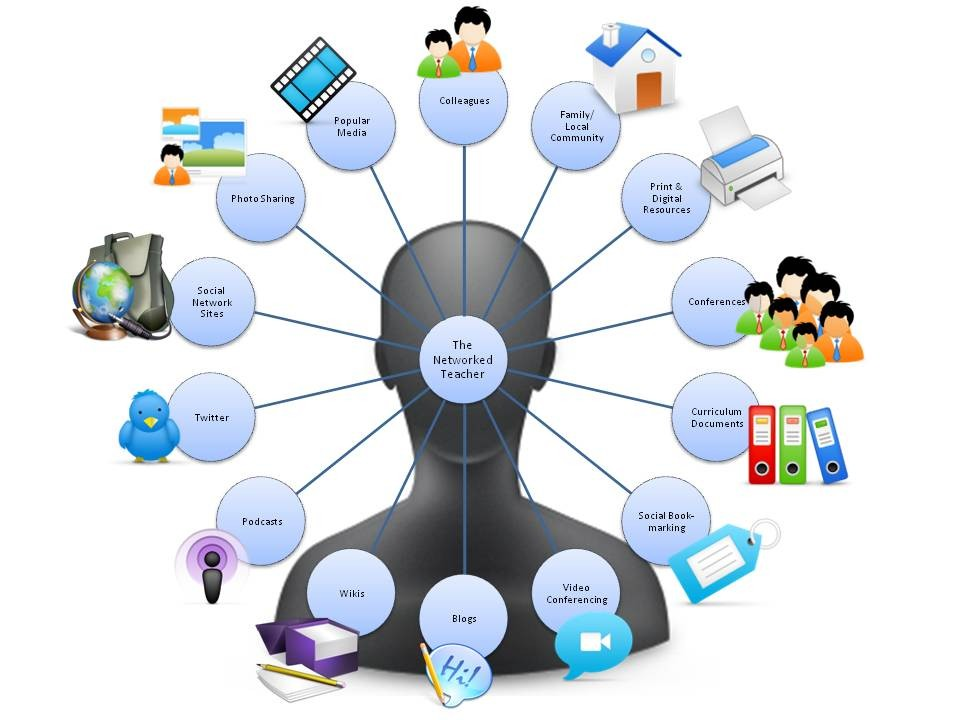

Integration of Technology

Embracing technological advancements is key to streamlining the collections process. From automated reminders to AI-driven predictive analytics, technology enhances efficiency and reduces operational costs.

Customized Approaches for Different Regions

Recognizing the diversity in India, payment providers are adopting region-specific collection strategies. online Payment Service Providers[5] Understanding local nuances helps in building trust and increasing the likelihood of successful debt recovery.

Importance of Data Analytics in Predictive Collections

Data analytics plays a pivotal role in predicting consumer behavior and tailoring collections strategies accordingly. Predictive analytics minimizes the element of surprise, enabling payment providers to proactively address potential issues.

Case Studies: Successful Collections Practices

Noteworthy Examples in the Indian Market

Several payment providers in India have successfully navigated the challenges of debt recovery. Case studies shed light on the strategies employed and the outcomes achieved. Gaining insights from both achievements and setbacks is essential for ongoing enhancement and progress. This section explores the lessons learned from real-life experiences in the collections domain.

The Human Element in Collections

Importance of Empathy in Debt Recovery

While technology is indispensable, the human connection remains unparalleled and cannot be substituted. Empathy in debt recovery fosters understanding and cooperation, increasing the likelihood of successful repayment. Trust is the cornerstone of any collections process. Establishing trust through transparent communication and fair practices contributes to long-term success in debt recovery.

Future Trends in Collections

Advancements in Technology and Automation

The future of payment provider collections lies in continued advancements in technology and automation. AI and machine learning will play a more significant role in predicting consumer behavior and optimizing collections strategies.

Regulatory Changes Shaping the Collections Landscape

Impact on Businesses and Consumers

Anticipating and adapting to regulatory changes is crucial for payment providers. This section explores potential regulatory shifts and their implications on the collections process.

A well-executed collections process positively impacts the bottom line of businesses. Timely debt recovery ensures a steady cash flow, contributing to sustained growth and profitability.

Consumer Experience and Satisfaction

Balancing Collections and Customer Relations

Balancing debt recovery with a positive consumer experience is challenging yet crucial. This section explores how payment providers can maintain high levels of customer satisfaction while recovering debts.

Building and maintaining positive customer relationships should be a priority for payment providers. This section provides actionable strategies for achieving this delicate balance.

Mitigating Negative Impacts on Brand Image

Case Studies: Challenges and Resolutions

Collections processes, if not handled properly, can negatively impact a brand’s image.Payment Provider Collections Process in India Strategies to mitigate these negative effects are crucial for long-term success. Examining specific challenges faced by payment providers in India and how they successfully overcame them. Real-world examples provide valuable insights.

Solutions Implemented for Positive Outcomes

Detailing the specific solutions implemented by payment providers to resolve challenges, emphasizing adaptability and innovative problem-solving. Fintech Innovations Transforming the Collections Process

The integration of fintech solutions is reshaping the collections landscape. This section explores how fintech innovations are enhancing efficiency and effectiveness in debt recovery.

Collaborations between Banks and Fintech Players

Examining successful collaborations between traditional banks and fintech companies in implementing advanced collections strategies.

Conclusion

Summarizing the main points discussed in the article and emphasizing the importance of adaptability for payment providers in India. Payment Provider Collections Process in India Reiterating the significance of being adaptable and innovative in navigating the evolving landscape of payment provider collections.

FAQs

Impact of technology on collections?

Discussing the transformative impact of technology on the efficiency and effectiveness of collections processes.

How do payment providers handle diverse linguistic challenges?

Exploring strategies employed by payment providers to address linguistic diversity challenges in India.

Expected regulatory changes in Indian collections?

Providing insights into potential regulatory changes that could impact payment provider collections in the near future.

Balancing collections with positive customer relations?

Offering guidance on how payment providers can maintain positive customer relations while executing effective debt recovery.

Role of empathy in successful debt recovery?

Highlighting the role of empathy in building trust and achieving successful debt recovery outcomes.