AUTHO :HAANA TINE

DATE :23/12/2023

Introduction

In the dynamic landscape of India’s financial sector, the use of credit cards has witnessed a remarkable upswing. However, this surge brings along the persistent challenge of credit card debt. This article aims to explore the intricate relationship between payment providers and the prevailing issue of credit card debt in India.

Understanding Credit Card Debt

Common Causes of Credit Card Debt

Credit card debt refers to the amount of money individuals owe to credit card companies for purchases made using their cards. It accumulates when users don’t pay their outstanding balances in full, leading to the imposition of interest charges. Examining the root causes of credit card debt is essential for understanding and addressing the issue. Factors such as impulsive spending, unforeseen expenses, and poor financial management contribute significantly to the mounting debt.

The Role of Payment Providers

How Payment Providers Impact Credit Card Debt

Payment service providers[1] a pivotal role in shaping credit card [2]usage patterns. Their influence is felt through facilitating seamless transactions and providing user-friendly interfaces, which can either exacerbate or alleviate credit card debt.

Advantages of Using Payment Providers

We delve into the benefits that payment providers bring to the table. Payment Processing Debt Consolidation [3]Industry in India These include enhanced security measures, enticing reward programs, and simplified expense tracking. Such advantages can contribute to fostering responsible credit card usage.

Challenges Faced by Credit Card Users in India

High-Interest Rates

One significant challenge faced by credit card users in India is the high-interest rates imposed on outstanding balances. Understanding these rates is crucial for individuals to make informed decisions regarding credit card usage. A prevalent challenge contributing to credit card debt is the lack of financial literacy among users. Payment system[4] Credit Card Debt in India This section discusses the importance of financial education in mitigating this issue.

Economic Factors

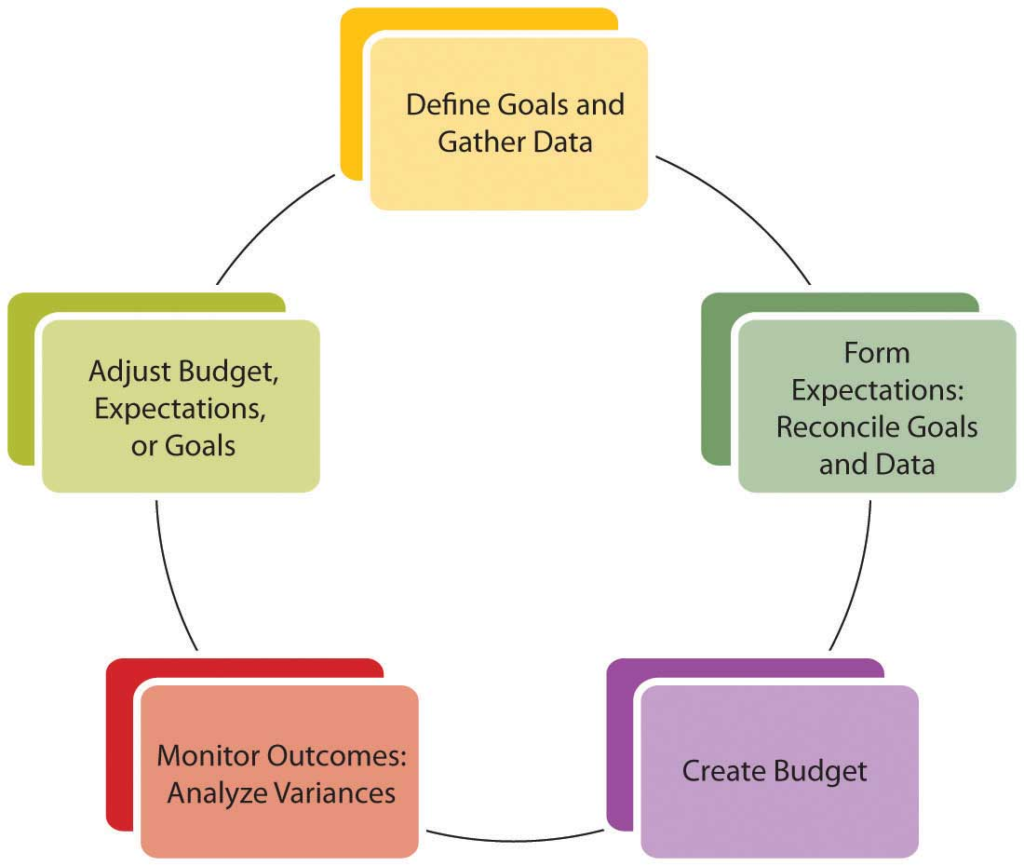

Solutions to Manage Credit Card Debt

Exploring the economic factors affecting Consumer debt[5], including inflation and job instability, provides a comprehensive view of the challenges faced by users. Effective budgeting and financial planning are paramount in managing credit card debt. This section provides practical tips on creating a budget and sticking to it.

Debt Consolidation

Debt consolidation is a strategy that can help individuals manage multiple credit card debts. Understanding the process and its potential benefits is crucial for those seeking to regain financial control.

The Evolution of Payment Systems in India

Traditional Methods vs. Digital Payment Solutions

This section explores the evolution of payment systems in India, contrasting traditional methods with the rise of digital payment solutions, and their impact on credit card usage.

Understanding how the evolution of payment systems influences credit card usage provides insights into the changing financial landscape and its implications for users.

The Rise of Fintech Companies

Fintech’s Role in Shaping Credit Card Debt Trends

Fintech companies are playing an increasingly significant role in shaping credit card debt trends. This section examines the innovative solutions they offer to address the challenges faced by users.

Regulatory Measures in India

Government Regulations on Credit Card Debt

Exploring specific solutions provided by fintech companies, such as budgeting apps and financial management tools, sheds light on how these technologies contribute to debt management.

Government regulations play a crucial role in protecting consumers from predatory practices. This section discusses the existing regulations and their impact on credit card debt.

Credit Card Debt and Financial Well-being

Psychological Impact of Debt

Understanding the consumer protection laws in place provides users with the knowledge needed to assert their rights and navigate credit card usage safely.

Credit card debt extends beyond financial implications; it also affects mental well-being. This section explores the psychological impact of debt and how individuals can address these challenges.

Steps to Achieve Financial Well-being

Future Trends in Credit Card Usage

Practical steps towards achieving financial well-being are outlined, emphasizing the importance of a holistic approach to money management.

Technological Advancements

As technology continues to advance, its impact on credit card usage is inevitable. This section explores anticipated technological trends and their implications for users.

Understanding how consumer behavior is evolving in response to technological advancements provides insights into future trends in credit card usage.

Conclusion

Effectively navigating the landscape of credit card debt in India demands a strategic approach. Payment providers, when coupled with informed financial decisions, can empower individuals to manage their credit effectively. As India undergoes a digital transformation, the future promises innovative solutions prioritizing financial well-being.

FAQs

How can I avoid falling into credit card debt?

Avoiding credit card debt involves prudent financial planning. Establish a budget, track expenses meticulously, and prioritize needs over wants.

Are payment providers safe to use?

Yes, reputable payment providers employ advanced security measures to safeguard user information and transactions.

What role do fintech companies play in reducing credit card debt?

Fintech companies often provide innovative solutions for debt management, offering users tools to track spending and manage their finances effectively.

How do government regulations protect consumers from credit card pitfalls?

Government regulations set guidelines for fair lending practices, ensuring transparency and shielding consumers from predatory practices.

Can credit card debt affect my credit score?

Certainly, unpaid credit card debt can have adverse effects on your credit score. Therefore, managing your credit responsibly is paramount.