AUTHOR:AYAKA SHAIKH

DATE:25/12/2023

Introduction

Credit management is a vital aspect of financial stability and also growth, especially in a rapidly developing economy like India. With the surge in digital transactions and also online businesses, the need for effective credit management systems has become paramount. But what exactly does credit management entail, and also how do payment providers fit into this payment provider Credit management in india.

Importance of Payment Providers

Imagine a bustling marketplace where buyers and also sellers interact seamlessly. Payment providers act as the bridge, Enabling smooth transactions and also checking that both parties benefit. In India, the role of payment providers in credit management, without a doubt, cannot be overstated and continues to grow in significance as digital payments evolve. They offer innovative solutions, mitigate risks, and also drive financial inclusion. payment provider Credit management in india.

Historical Context of Credit in India

Historically, India has seen a transformation in its credit landscape. From traditional money lending systems to modern banking solutions, the evolution has been remarkable. Payment providers have played a pivotal role in this transition, offering convenience, security, and efficiency. The Role of Payment Providers in Credit Management

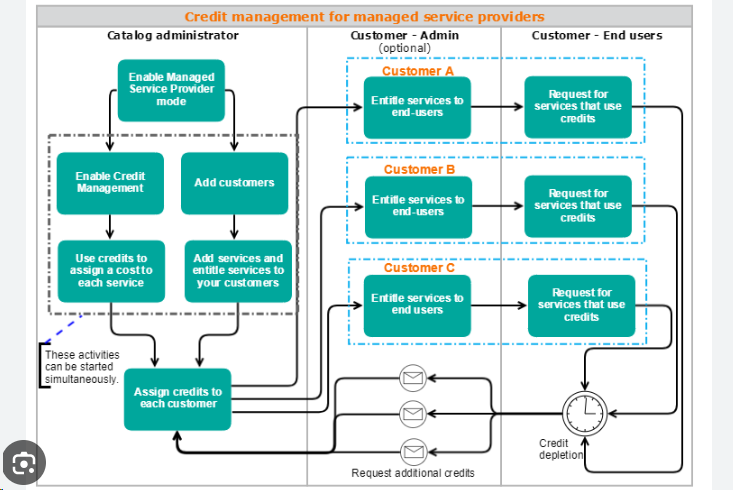

How Payment Providers Operate

Advantages of Using Payment Providers

Digital Payment solutions[1] leverage to offer a wide range of services, including online payments, peer-to-peer transfers, and also credit solutions. By integrating advanced algorithms and also secure platforms, they ensure that transactions are swift and also secure. But how do they manage credit effectively?

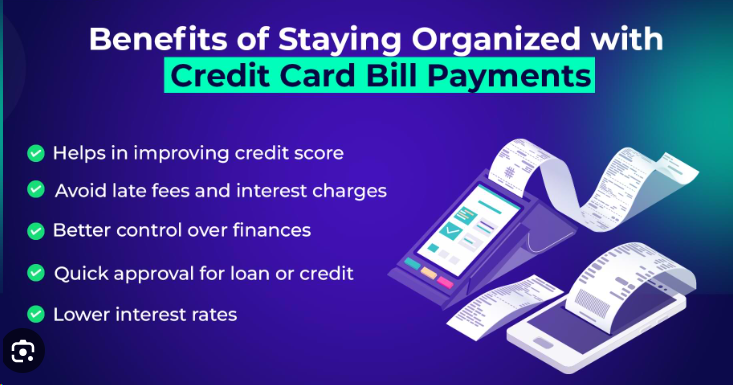

- Efficiency: With real-time processing capabilities[2], payment providers streamline operations, reducing manual errors.

- Security: Advanced encryption techniques protect sensitive data, check customer trust.

- Innovation: Constantly evolving platforms offer new features, enhancing user experience.

Challenges Faced by Payment Providers

While payment providers offer numerous benefits, they also face challenges like regulatory compliance, cybersecurity threats, and market competition. Navigating these hurdles requires strategic planning, adaptability, and innovation. Key Features of Effective Debt Collection[3] Management Systems

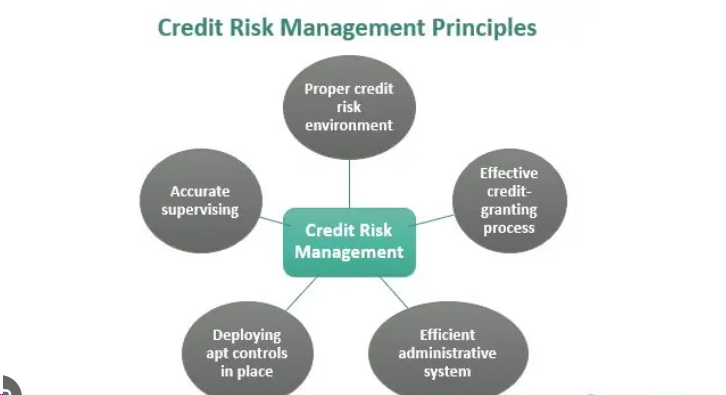

Risk Assessment and Mitigation

Transparency and Compliance

Effective credit management Payment Processing Systems[4] employ robust risk assessment tools to evaluate borrower profiles, monitor creditworthiness, and also mitigate potential defaults. By leveraging data analytics and predictive modeling, they ensure prudent lending practices.

Transparency is crucial in credit management. Payment service providers[5] adhere to regulatory guidelines, disclose terms and conditions clearly, and maintain ethical business practices. Compliance with RBI regulations is non-negotiable, ensuring a level playing field for all stakeholders.

Customer Experience and Satisfaction

Ultimately, prioritizing customer contentment stands as the cornerstone of success.

Payment providers focus on enhancing user experience, offering seamless integration, responsive customer support, and personalized solutions. By prioritizing customer needs, they build long-lasting relationships.

Regulatory Landscape for Payment Providers in India

RBI Guidelines and Regulations

The Reserve Bank of India (RBI) plays a pivotal role in regulating payment providers. Through stringent guidelines, licensing requirements, and periodic audits, the RBI ensures that payment ecosystems are secure, transparent, and efficient.

Compliance and Reporting Requirements

Payment providers must adhere to a myriad of compliance requirements, including KYC norms, transaction limits, and data protection regulations. Regular reporting, audit trails, and transparency are essential to maintaining regulatory compliance.

Future Outlook and Trends

As technology evolves and consumer behavior shifts, the payment landscape in India is poised for further growth. Innovations like blockchain, AI-driven analytics, and decentralized finance (DeFi) are reshaping the industry, offering new opportunities and challenges.

Case Studies: Successful Credit Management through Payment Providers

XYZ Company

XYZ Company leveraged payment providers to streamline its credit management processes, reduce operational costs, and enhance customer satisfaction. By integrating advanced payment solutions, they achieved significant growth and market penetration.

ABC Organization

ABC Organization faced numerous challenges in managing its credit portfolio. Through strategic partnerships with payment providers, they implemented robust risk mitigation strategies, improved cash flow, and expanded their customer base.

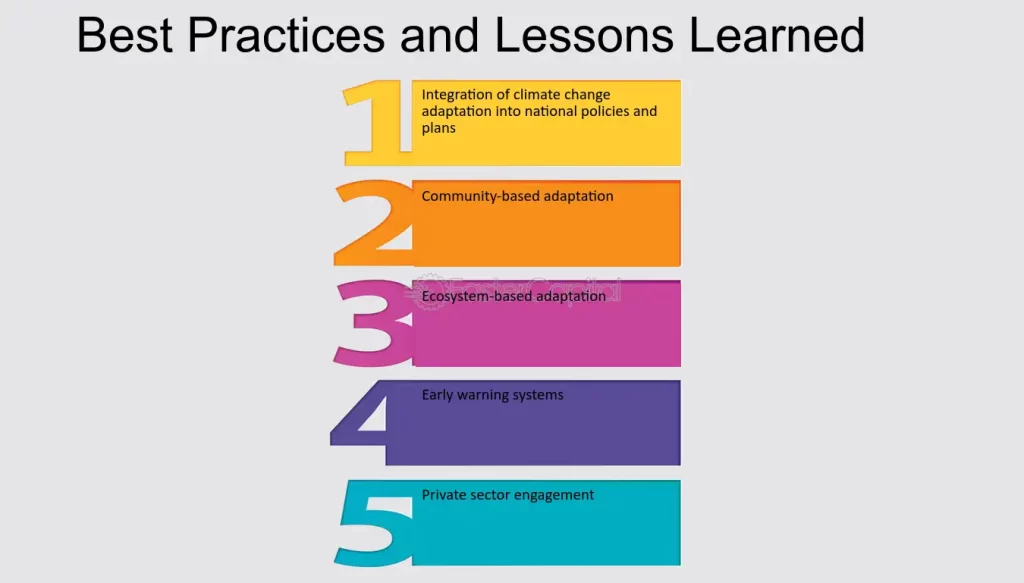

Lessons Learned and Best Practices

Both case studies highlight the importance of collaboration, innovation, and adaptability. By leveraging payment providers’ expertise, organizations can navigate complex credit landscapes, drive growth, and mitigate risks effectively.

Conclusion

In summary, credit management in India is undergoing a transformative phase, driven by technological advancements, regulatory reforms, and changing consumer behavior. Payment providers play a crucial role in this ecosystem, offering innovative solutions, mitigating risks, and boosting customer experience. As the industry evolves, collaboration, transparency, and compliance will remain key pillars of success.

FAQs

- Understanding credit management is crucial because it dictates financial stability and shapes your borrowing potential.

- ? Credit management involves managing credit risks, evaluating borrower profiles, and checking timely repayments. It’s crucial for financial stability, growth, and mitigating default risks.

- How do payment providers contribute to credit management in India? Payment providers offer innovative solutions, facilitate transactions, mitigate risks, ensure regulatory compliance, and boost credit management effectiveness.

- What challenges do payment providers face in India? Payment providers face challenges like regulatory compliance, cybersecurity threats, market competition, and consumer behavior.

- How does the RBI regulate payment providers in India? The RBI regulates payment providers through stringent guidelines, licensing requirements, periodic audits, and compliance checks to ensure a secure and transparent ecosystem.

- What are the future trends in credit management and payment solutions in India? Future trends include blockchain technology, AI-driven analytics, decentralized finance (DeFi), boost security measures, and personalized customer experiences.