AUTHOR : JAYOKI

DATE : 23/12/2023

Introduction

In recent years, India has witnessed a remarkable surge in digital payments, thanks to the widespread adoption of smartphones and the government’s push for a cashless economy. As payment providers continue to evolve, so does the need for robust credit risk management to ensure financial stability and maintain user trust.

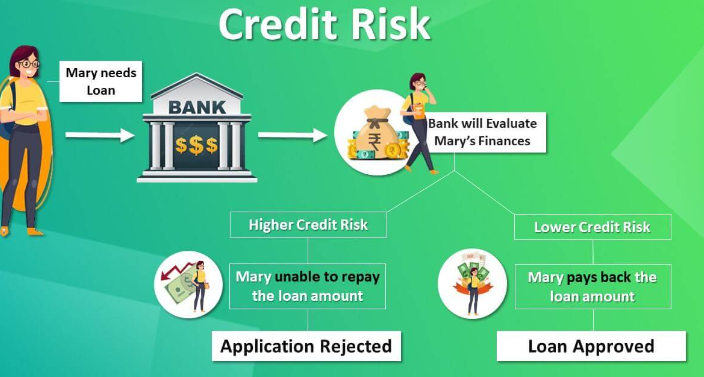

Overview of Credit Risk

Credit risk, a fundamental aspect of financial services, refers to the potential loss a lender may face if a borrower fails to repay a loan or meet contractual obligations. In the context of payment providers, credit risk extends to the possibility of users defaulting on digital transactions or engaging in fraudulent activities.

Payment Providers in India

India boasts a diverse array of payment providers, traditional banks to innovative fintech startups. The landscape is characterized by a mix of established players and emerging platforms, all contributing to the nation’s growing digital ecosystem. The rapid growth of digital payments necessitates a closer look at the credit risks associated with these transactions.

Importance of Credit Risk Management for Payment Providers

Efficient credit risk management is not merely a regulatory requirement; it is a strategic imperative for payment providers. It ensures financial stability, safeguards against potential losses, and, Payment Provider Credit Risk[1] In India most importantly, fosters trust among users. A transparent and well-defined credit risk management framework is essential for sustainable business operations.

Challenges Faced by Payment Providers in India

Despite the growth opportunities, Payment Solution[2] providers in India face several challenges in managing credit risks effectively. Intense market competition, coupled with frequent regulatory changes, adds complexity to the risk landscape. Navigating these challenges requires a proactive and adaptive approach to risk management.

Credit Risk Assessment Tools

In the era of advanced technologies, Payment service provider[3] leverage sophisticated tools for credit risk assessment. Machine learning algorithms play a crucial role in analyzing vast datasets, identifying patterns, and predicting potential risks. These tools enable timely and accurate risk assessments, contributing to the overall resilience of payment systems.

Examining real-world examples of Consumer credit risk[4] management in leading payment providers provides valuable insights. Case studies showcase how organizations navigate challenges, implement effective risk mitigation strategies, and adapt to the evolving financial landscape.

Best Practices for Credit Risk Mitigation

Diversification of risk and continuous monitoring are paramount in mitigating credit risks. Payment providers should adopt best practices, including stringent due diligence processes, to minimize exposure and protect both the organization and its users.

Role of Regulatory Authorities

Regulatory authorities play a pivotal role in shaping the credit risk landscape for payment providers. Striking a balance between fostering innovation and safeguarding consumers, regulators establish guidelines and compliance standards that influence risk mitigation strategies. Credit risk[5]

Future Trends in Credit Risk Management

As technology continues to evolve, so do the challenges and opportunities in credit risk management. The future promises advancements in risk assessment tools, adaptive strategies to address emerging risks, and collaborative efforts between stakeholders to enhance the resilience of payment systems.

User Education on Credit Risks

Empowering users with knowledge about credit risks is a shared responsibility. Payment providers should prioritize user education, offering clear guidelines on secure transactions, recognizing potential risks, and reporting suspicious activities. Educated users contribute to a safer and more resilient digital payment ecosystem.

The Human Factor in Credit Risk

Beyond technological tools, the human factor is critical in credit risk management. Employee training programs that focus on risk awareness and ethical conduct contribute to a culture where every team member understands their role in safeguarding the organization and its users.

Benefits of Effective Credit Risk Management

A well-executed credit risk management strategy brings multifaceted benefits. It not only safeguards the financial health of payment providers but also instills confidence among users, encouraging increased adoption of digital payment methods. Effective risk management is a catalyst for sustained business growth.

Conclusion

In conclusion, the landscape of payment provider credit risk in India is dynamic and multifaceted. Navigating the challenges requires a comprehensive approach that blends technological innovation, regulatory compliance, and user education. Payment providers must remain agile, continuously adapting their strategies to stay ahead in this ever-evolving digital ecosystem.

FAQs

- What is credit risk in payment providers?

- Credit risk in payment providers refers to the potential loss they may face if users default on transactions or engage in fraudulent activities.

- How do payment providers assess credit risk?

- Payment providers use advanced technologies, including machine learning algorithms, to analyze data and predict potential risks.

- Are there government regulations for credit risk in India?

- Yes, regulatory authorities in India establish guidelines and compliance standards for credit risk management by payment providers.

- Can users play a role in mitigating credit risk?

- Yes, educated users who follow secure transaction guidelines contribute to a safer digital payment ecosystem.

- How often should payment providers update their risk management strategies?

- Payment providers should continuously update their risk management strategies to adapt to evolving technological, market, and regulatory changes.