AUTHOR :HAANA TINE

DATE :29/02/2024

Introduction

Digital payments[1] have witnessed a significant surge in India, driven by factors such as demonetization[2], technological advancements, and government initiatives like Digital India[3]. Simultaneously, the education sector has embraced digital learning[4] tools to enhance accessibility and effectiveness. This intersection presents a unique opportunity for payment providers[5] to collaborate with edtech companies and facilitate seamless transactions for educational content and services.

Overview of Digital Learning Tools

Digital learning tools[1] encompass a wide range of technologies and platforms designed to facilitate online education[2]. From learning management systems (LMS) and then virtual classrooms to educational apps and interactive content, these tools cater to diverse learning needs and preferences. In India, the adoption of digital learning tools has been accelerated by factors like smartphone penetration[3], internet connectivity, and the growing demand for flexible learning solutions.

Integration of Payment Providers with Digital Learning Tools

The integration of payment providers[4] with digital learning tools is essential to ensure smooth and secure transactions between users and educational platforms. Seamless payment options enable learners to purchase courses, access premium content, and make subscription payments conveniently. Moreover, integration enhances user experience by reducing transactional friction[5] and offering multiple payment modes to cater to diverse user preferences.

Popular Payment Providers in India

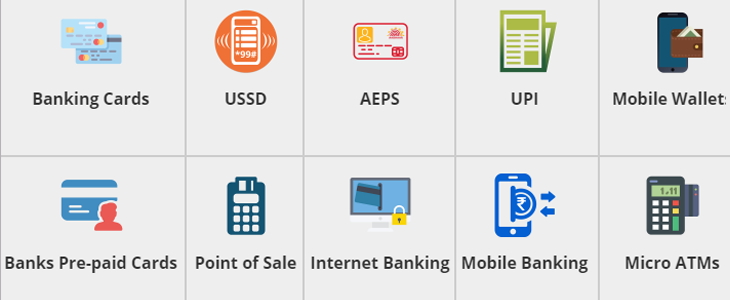

In India’s dynamic payment landscape, several providers offer specialized solutions tailored to the needs of edtech platforms and users. Leading payment gateways such as Paytm, Razorpay, and Instamojo provide comprehensive payment solutions, including payment links, recurring billing, and digital wallets. These providers leverage advanced security measures and robust infrastructure to safeguard transactions and build trust among users.

Challenges and Solutions

Despite the benefits of integrating payment providers with digital learning tools, certain challenges persist, including security concerns, payment failures, and regulatory compliance.Payment Provider Digital Learning Tools in India To address these challenges, stakeholders must prioritize data security, implement fraud detection mechanisms, and adhere to regulatory guidelines. Additionally, enhancing user awareness and providing seamless customer support can mitigate concerns and enhance trust in digital transactions.

Future Outlook

Looking ahead, the synergy between payment providers and digital learning tools is poised for continued growth and innovation. With advancements in technology such as Distributed ledger, artificial intelligence, and biometrics, the payment ecosystem will evolve to offer more secure, efficient, and personalized solutions. Moreover, collaborations between fintech and edtech companies will drive the development of integrated platforms that revolutionize online education delivery.

As the digital education ecosystem in India continues to expand, driven by advancements in technology and changing learning preferences, the role of payment providers becomes increasingly crucial. These providers act as facilitators, enabling seamless transactions between learners and educational content providers, thereby supporting the growth and then sustainability of the digital learning landscape.

One significant aspect of integrating payment providers with digital learning tools is the diversification of revenue streams for educational content providers. By offering various payment options such as one-time purchases, subscriptions, and installment plans, content creators can cater to the diverse financial needs and preferences of their audience. This flexibility not only enhances user experience but also allows content providers to maximize their earning potential.

Conclusion

The integration of payment providers with digital learning tools represents a transformative trend in India’s education landscape.Payment Provider Digital Learning Tools in India By enabling seamless transactions and enhancing user experience, this convergence fosters greater accessibility, affordability, and quality in online education. As stakeholders navigate challenges and embrace opportunities, the future holds immense potential for driving inclusive and also sustainable growth in the digital learning ecosystem.

FAQs

- How do payment providers ensure the security of transactions?

- Payment providers employ encryption technologies, tokenization, and robust authentication measures to secure transactions and then protect user data from unauthorized access.

- Can users choose their preferred payment mode while using digital learning platforms?

- Yes, most digital learning platforms integrate multiple payment options, including credit/debit cards, net banking, UPI, and also digital wallets, to accommodate diverse user preferences.

- What are some regulatory considerations for payment providers operating in India?

- Payment providers must comply with regulations issued by the Reserve Bank of India (RBI) and other regulatory authorities governing digital transactions, data protection, and then anti-money laundering measures.

- How can edtech companies enhance user trust in digital payments?

- Edtech companies can enhance user trust by Openly conveying security measures, providing secure payment gateways, and then offering responsive customer support to address any concerns or issues.

- What role do emerging technologies play in the future of payment integration with digital learning tools?

- Emerging technologies such as Distributed ledger, artificial intelligence, and machine learning hold the potential to revolutionize payment integration by offering enhanced security, automation, and personalized experiences for users.