AUHTOR : SOFI PARK

DATE : 28/12/2023

Introduction

In the bustling landscape of India’s digital transformation, one sector that has witnessed a remarkable evolution is digital payment services. From the days of traditional cash transactions to the current era of seamless digital transactions, the payment provider digital services in India have played a pivotal role in shaping the financial ecosystem

Evolution of Digital Payments

The journey of digital payments in India has been nothing short of fascinating. Starting with the advent of online banking, the landscape has expanded to include a variety of services such as digital wallets, Unified Payments Interface (UPI), and sophisticated Point of Sale (POS) systems. This evolution has not only simplified transactions but has also contributed significantly to financial inclusion.

Key Players in the Indian Market

In a highly competitive market, several payment providers[1] have emerged as key players. Companies like Paytm, PhonePe, and Google Pay have not only captured significant market share but have also set benchmarks for innovation and user experience.

Services Offered by Payment Providers

Digital payment[2] providers offer a range of services to cater to diverse consumer needs. From secure digital wallets to the convenience of online banking, these platforms provide users with multiple options for conducting transactions seamlessly. The rise of UPI has further revolutionized the way individuals and businesses transfer money.

Impact on Small Businesses

One of the most noteworthy aspects of payment provider digital services is their impact on

small businesses. By facilitating swift and secure transactions, these services have empowered small enterprises, enabling them to participate more actively in the digital economy[3].

Challenges and Solutions

However, with great innovation comes great responsibility. Security concerns and the evolving regulatory landscape pose challenges to the industry. Yet, payment providers are continually investing in cutting-edge technologies to address these issues and ensure the safety of digital transactions[4].

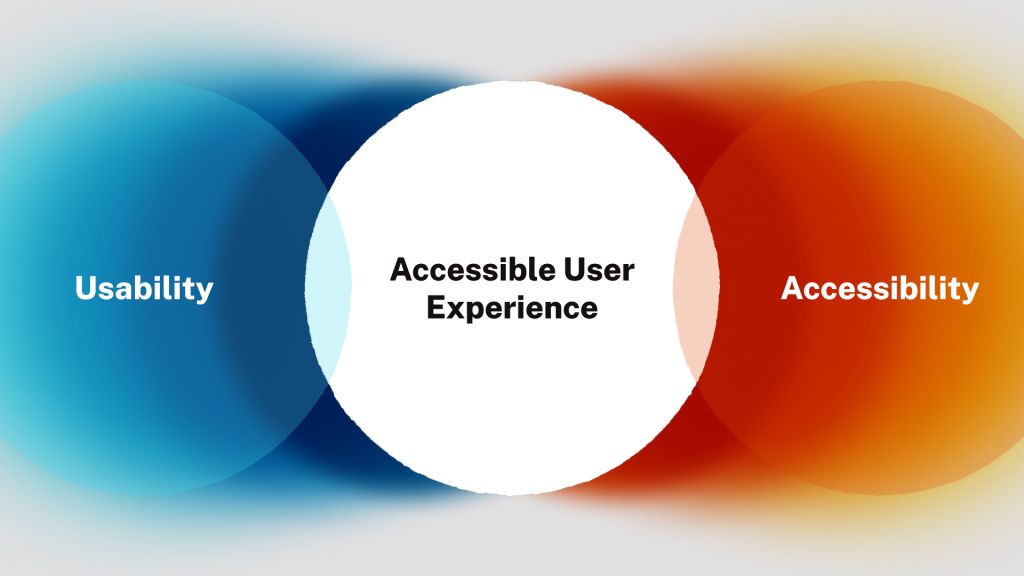

User Experience and Accessibility

The success of digital payment services is not solely dependent on functionality; user experience plays a crucial role. Mobile applications with user-friendly interfaces have become the norm, contributing to the widespread adoption of digital payment methods.

Future Trends

Looking ahead, emerging technologies such as blockchain and artificial intelligence are expected to shape the future of digital payments in India. Anticipated developments include increased integration with other services and enhanced security features.

Consumer Perspectives

The voice of the consumer is a critical aspect. Feedback and reviews from users provide valuable insights into the strengths and weaknesses of digital payment services, influencing further advancements.

The Role of Government Initiatives

Government initiatives, such as demonetization, have played a significant role in promoting digital payments. Policies supporting the growth of digital transactions have further contributed to the widespread adoption of these services.

Global Comparisons

Contrasting India’s digital payment services with global counterparts offers a broader perspective. Learning from international experiences can help in refining strategies and overcoming challenges.

Financial Inclusion and Digital Literacy

Efforts to ensure financial inclusion and promote digital literacy[5] are vital. Initiatives aimed at educating users, especially in remote areas, are crucial for the continued growth of digital payment services.

The Future Landscape

Predicting the future of payment provider digital services in India involves considering upcoming technologies, regulatory changes, and the evolving preferences of consumers. The industry is poised for continued growth, presenting both opportunities and challenges.

Conclusion

In conclusion, payment provider digital services have transformed the way financial transactions occur in India. The impact on small businesses, the challenges faced, and the continual evolution of these services make the sector dynamic and exciting. As we look to the future, the role of technology, government initiatives, and user perspectives will shape the next phase of India’s digital payment journey.

FAQs

- Are digital payment services safe to use?

- Yes, digital payment services invest heavily in security measures to ensure the safety of transactions.

- What is the future of digital wallets in India?

- The future of digital wallets in India looks promising, with ongoing innovations and increasing user acceptance.

- How do government initiatives impact digital payments?

- Government initiatives, such as demonetization, have positively influenced the growth of digital payments in India.

- Can small businesses benefit from digital payment services?

- Absolutely, digital payment services empower small businesses by providing them with efficient and secure transaction solutions.

- What role do consumer perspectives play in shaping digital payment services?

- Consumer feedback and perspectives play a crucial role in refining and improving digital payment services based on user needs.