NAME : KIM FERNANDEZ

DATE : 21/12/2023

Introduction

In the dynamic landscape of business-to-business (B2B) transactions in India, the need for efficient payment systems has never been more crucial. As businesses evolve, so do their payment requirements[1], prompting the rise of specialized payment providers tailored for the intricacies of B2B exchanges.

The Current Landscape of B2B Transactions in India

The B2B ecosystem in India is vast and diverse, encompassing a myriad of industries. From manufacturing to services, businesses engage in complex transactions requiring a sophisticated payment infrastructure. However, B2B Transactions the current landscape is not without its challenges. Delays, security concerns, and inefficiencies are commonplace, necessitating a closer look at payment processes Payment Provider For B2B .

The Need for Specialized Payment Providers

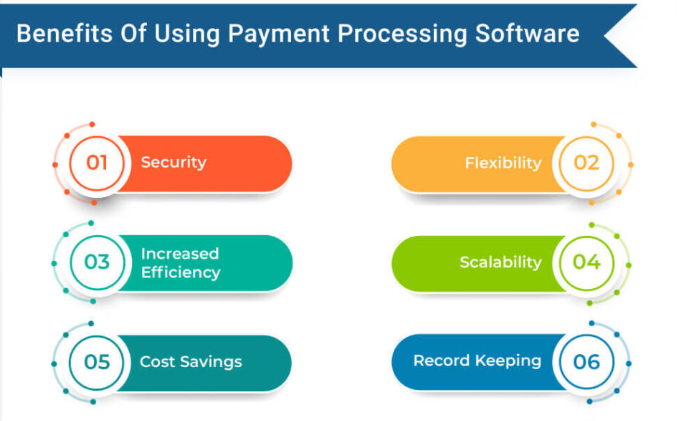

B2B Transactions In India differ significantly from consumer transactions, requiring specialized solutions that address the unique needs of businesses. Security is a paramount concern, given the large sums involved in B2B exchanges. Specialized payment providers understand these nuances and offer tailored solutions that ensure seamless and secure transactions Provider For B2B Transactions.

Key Features to Look for in a B2B Payment Provider

When considering a payment provider for B2B transactions in India, businesses must evaluate several key features. B2B integration[2] capabilities, scalability, multi-currency support, and real-time transaction tracking are among the crucial aspects that can make a significant difference in streamlining payment processes[3].

Case Studies: Successful Implementations

Real-world examples highlight the impact of choosing the right B2B payment provider. Company A experienced improved efficiency after implementing Provider X, while Company B streamlined its processes with the help of Provider Y.

Steps to Choose the Right Payment Provider

Choosing the right payment provider requires a strategic approach. Businesses should assess their needs, research provider reputations, and seek testimonials from existing clients. This thorough process ensures a seamless integration that aligns with the business’s requirements.

The Future of B2B Payment Providers in India

As technology continues to advance, the future of payment providers for B2B transactions in India looks promising. Predictions and trends suggest a shift towards more innovative solutions, further enhancing the efficiency and security of B2B transactions.

Addressing Concerns and Misconceptions

Despite the benefits, there are common myths and misconceptions surrounding payment providers for B2B transactions in India. It’s essential to debunk these misconceptions and provide clarity on the advantages these specialized solutions offer.

Advantages of Adopting Specialized B2B Payment Solutions

Businesses stand to gain significantly from adopting specialized payment providers for B2B transactions in India. Increased efficiency, B2B payment automation[4] enhanced security measures, and cost-effective solutions are among the key advantages that contribute to the overall success of a business.

Testimonials from Businesses

Real testimonials from businesses that have adopted specialized B2B payment solutions provide valuable insights. Positive experiences and challenges overcome offer a firsthand account of the impact these providers can have on businesses.

How to Get Started: A Step-by-Step Guide

For businesses ready to embrace specialized payment provider solutions for B2B transactions in India, a step-by-step guide can simplify the process. From the initial assessment to contacting providers and implementing the system, this guide ensures a smooth transition.

B2B Payment Provider Comparison Chart

To aid businesses in making informed decisions, a comparison chart highlighting features, pricing, and user reviews of various payment providers for B2B transactions in India can be instrumental.

Success Stories: Businesses Thriving with B2B Payment Providers

The article concludes with success stories of businesses that have thrived after implementing specialized B2B payment solutions[5]. These stories underscore the positive impact on revenue and streamlined operations.

Conclusion

In conclusion, the landscape of B2B transactions in India is evolving, and businesses need payment solutions that can keep pace. Specialized B2B payment providers offer the tailored approach necessary for seamless, secure, and efficient transactions.

FAQs

- Q: Are B2B payment providers only for large enterprises? A: No, B2B payment providers cater to businesses of all sizes, offering scalable solutions.

- Q: How long does it take to implement a B2B payment solution? Implementation timelines vary but can be expedited with proper planning and cooperation.

- Q: What security measures do B2B payment providers employ? B2B payment providers employ advanced encryption and authentication protocols to ensure security.

- Q: Can B2B payment solutions integrate with existing business systems? A: Yes, many providers offer seamless integration with existing business systems.

- Q: Are there ongoing costs associated with B2B payment solutions? A: While there may be fees, the long-term benefits often outweigh the costs.