AUTHOR : ISTELLA ISSO

DATE : 21/12/2023

Introduction

In the dynamic landscape of Indian business-to-business[1] (B2B) connections, the role of payment providers has become increasingly crucial. As companies engage in complex transactions[2], the need for efficient and secure payment systems[3] has never been more evident. This article delves into the world of payment providers catering to B2B connections in India, exploring the challenges, trends, and key considerations for businesses[4] seeking optimal financial solutions[5].

The Landscape of B2B Transactions in India

Overview of the Indian B2B market

India’s B2B market is vast and diverse, encompassing various industries and sectors. From manufacturing to services, businesses engage in transactions that drive the nation’s economic engine. Understanding the unique characteristics of this market is essential for payment providers looking to offer tailored solutions.

Growth and challenges

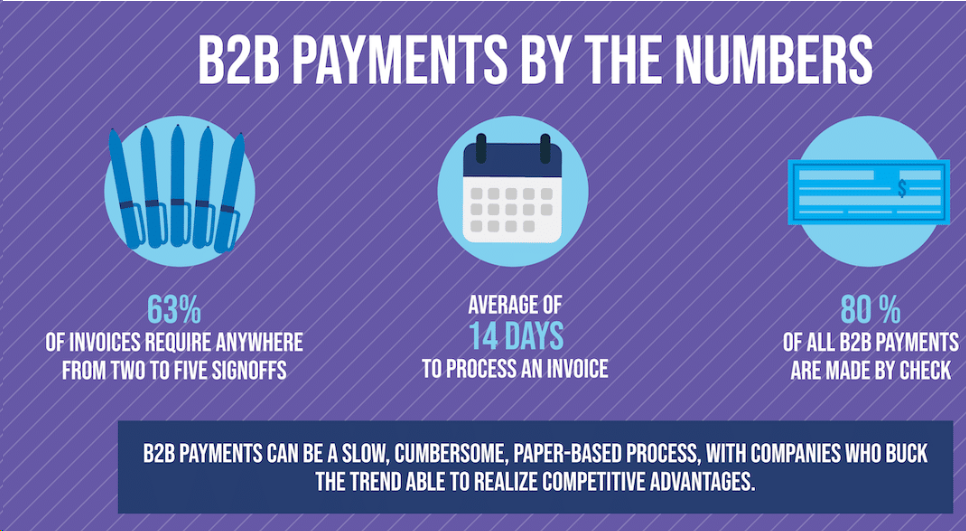

While the B2B market in India is experiencing significant growth, it is not without its challenges. Late payments, complex reconciliation processes, and evolving regulatory landscapes create hurdles for businesses seeking seamless financial operations.Payment Provider For Business-To-Business Connections In India

Importance of Efficient Payment Systems

Streamlining financial processes

Efficiency is the cornerstone of any successful business. Payment providers play a pivotal role in streamlining financial processes, allowing businesses to focus on their core operations. From invoicing to fund transfers, a reliable payment system is indispensable.

Reducing payment delays and errors

One of the primary pain points in B2B transactions is the delay in payments and the occurrence of errors in financial transactions. A robust payment provider addresses these issues, ensuring timely and error-free transactions that contribute to the overall operational efficiency of businesses.

Key Features to Look for in a B2B Payment Provider

Security measures

Security is paramount in B2B transactions[1], considering the sensitive nature of financial data. A reliable payment provider incorporates robust security measures to protect against fraud and unauthorized access.Payment Provider For Business-To-Business Connections In India

Integration capabilities

Seamless integration with existing systems is a key feature businesses look for in payment providers. Compatibility with various software and platforms ensures a smooth transition and minimal disruption to operations.

Cost-effectiveness

While advanced features are essential, businesses also need cost-effective solutions[2]. The right payment provider offers a balance between features and affordability, catering to the financial needs of businesses of all sizes.

Prominent B2B Payment Providers in India

Analysis of leading companies

Several payment providers have established themselves as leaders in the Indian market. A detailed analysis of their services, reputation, and customer feedback is crucial for businesses looking to make informed decisions.

Comparative study of their offerings

Comparing the offerings of different payment providers helps businesses identify the one that aligns best with their requirements. Factors such as transaction fees, processing times, and customer support contribute to the decision-making[3] process.

Case Studies: Successful Implementation of B2B Payment Solutions

Real-world examples of businesses benefiting from efficient payment providers

Examining case studies provides valuable insights into how businesses have successfully implemented B2B payment solutions. These examples serve as benchmarks for other enterprises seeking similar outcomes.

Addressing Security Concerns

Ensuring data protection

Data protection is a top priority for businesses and consumers alike. A reliable B2B payment provider employs robust encryption and security protocols to safeguard sensitive information[4].

Compliance with regulatory standardsX

Adherence to regulatory standards is non-negotiable. Payment providers must stay abreast of the ever-evolving regulatory landscape to ensure compliance and build trust among their clients.Payment Provider For Business-To-Business Connections In India

Trends in B2B Payments

Technological advancements

The B2B payment sector is witnessing rapid technological advancements. From blockchain to artificial intelligence, these technologies are reshaping how businesses transact, offering new possibilities[5] for efficiency and transparency.

Shifting preferences in payment methods

As technology evolves, so do the preferences of businesses regarding payment methods. Understanding these shifts is crucial for payment providers to stay ahead of the curve and continue offering relevant solutions.

Tips for Choosing the Right Payment Provider

Understanding business requirements

No two businesses are identical. Therefore, understanding the unique requirements of a business is the first step in selecting the right payment provider. Whether it’s the volume of transactions or specific industry needs, customization is key.

Scalability and flexibility

A payment provider should not only meet current needs but also scale alongside the growth of the business. Flexibility in adapting to changing requirements ensures a long-term partnership.

Challenges Faced by Businesses in B2B Transactions

Late payments

Late payments are a common challenge in B2B transactions, impacting cash flow and relationships. Identifying the root causes and implementing strategies to mitigate late payments is essential for sustained success.

Complexity in reconciliations

Reconciling transactions can be complex, especially for businesses engaging in numerous transactions daily. Payment providers offering streamlined reconciliation processes alleviate this burden, allowing businesses to focus on strategic goals.

Future Outlook for B2B Payment Providers in India

Anticipated developments and innovations

The future of B2B payment providers in India holds exciting possibilities. Anticipated developments include enhanced automation, innovative payment methods, and further integration with emerging technologies.

Conclusion

In conclusion, the landscape of payment providers for business-to-business connections in India is evolving rapidly. The right choice can significantly impact the efficiency and success of B2B transactions. As businesses navigate the complexities of the market, partnering with a reliable and forward-thinking payment provider becomes a strategic imperative.

FAQs

- How do B2B payment providers ensure the security of financial transactions?

- Payment providers implement robust encryption and security protocols to safeguard sensitive information, ensuring the utmost security for financial transactions.

- What are the key factors to consider when choosing a B2B payment provider?

- Businesses should consider security measures, integration capabilities, and cost-effectiveness when selecting a B2B payment provider.

- How can businesses address the challenge of late payments in B2B transactions?

- Implementing strategies to identify and mitigate the root causes of late payments is essential for businesses facing this challenge.

- What trends are shaping the future of B2B payments in India?

- Technological advancements, such as blockchain and artificial intelligence, are reshaping the B2B payment sector, offering new possibilities for efficiency and transparency.

- How can payment providers help businesses streamline reconciliation processes?

- Payment providers offering streamlined reconciliation processes alleviate the complexity of reconciling transactions, allowing businesses to focus on strategic goals