AUTHOR : RUBBY PATEL

DATE : 21/12/13

Introduction

In the dynamic landscape of e-commerce, Collaborative Commerce has emerged as a game-changer, fostering partnerships and collaborations among businesses. This article delves into the crucial aspect of payment providers in the context of Collaborative Commerce in India

The Role of Payment Providers in Collaborative Commerce

Payment providers Collaborative Commerce play a pivotal role in facilitating seamless transactions between collaborators. They serve as the financial backbone, ensuring secure and efficient money transfers within collaborative ecosystems Payment For Commerce In India.

Challenges Faced by Collaborative Commerce in India

Despite the growth, Provider For Collaborative in India faces its share of challenges. From interoperability issues to trust concerns, addressing these hurdles is essential for sustained growth. encounter problems when they use multiple micropayment systems concurrently Payments modernization[1]

.

Evolution of Payment Systems in the Indian Market

To understand the current scenario, it’s vital to trace the evolution of payment systems in India. The transition from traditional methods to digital wallets and UPI has been instrumental in shaping Collaborative Both content providers and customers may encounter problems when they use multiple

micropayment systems concurrently. Examples of such problems are: they must trust the various organizations that operate these systems (payment system operators, PSOs), manage multiple accounts and e-wallets, register on PSO web sites and remember passwords, obtain and

Key Features to Look for in a Payment Provider for Collaborative Commerce

When selecting a payment provider for collaborative ventures, certain features are non-negotiable. Subscription Commerce

This section explores the essential attributes that ensure a smooth and secure transaction process[2].

Top Payment Providers in India

A comprehensive overview of the leading payment providers in India, highlighting their strengths and specializations, aids businesses[3] in making informed choices. install multiple software packages and (sometimes) hardware devices, pay for using the various payment systems, and contact multiple helpdesks in case of difficulties

Successful Collaborative Commerce Ventures

Real-world examples of successful collaborative ventures underscore the impact of effective payment solutions. Collaborative Micropayment Systems These case studies provide insights into how the right payment provider can contribute to the success of collaborative endeavors.

Security Concerns in Collaborative Commerce Transactions

Security is a paramount concern in collaborative transactions. This section addresses the common security challenges and emphasizes the need for robust measures. payment industry ecosystem[4]

How Payment Providers Address Security Challenges

Delving into the proactive measures adopted by payment providers, this section assures businesses and consumers alike about the safety of their transactions within collaborative platforms. The purpose of this paper is to discuss whether it is possible to solve these problems by proposing a micropayment system that allows both customers and providers to use their micropayment system of choice, regardless of the system used by the other party

The Impact of Government Regulations on Payment Providers

Social Commerce[5] Payments Government regulations play a crucial role in shaping the payment landscape. Examining the current regulatory framework helps businesses understand the compliance requirements and stay ahead of potential changes.

Integration of UPI in Collaborative Commerce

The integration of Unified Payments Interface (UPI) has been a transformative step in enhancing transaction efficiency. This section explores how UPI has become a cornerstone in collaborative commerce transactions.t is possible to solve these problems by proposing a micropayment system that allows both customers and providers

Future Trends in Payment Solutions for Collaborative Commerce

Predicting the future trends in payment solutions provides businesses with a strategic advantage. From blockchain to contactless payments, staying abreast of innovations ensures continued success in collaborative ventures.

Choosing the Right Payment Provider for Your Business

A step-by-step guide to help businesses choose the payment provider that aligns with their specific needs. Factors such as scalability, customer support, and integration capabilities are explored.t is possible to solve these problems by proposing a micropayment system that allows both customers and providers

Benefits of Seamless Payment Integration in Collaborative Platforms

t is possible to solve these problems by proposing a micropayment system that allows both customers and providers Seamless payment integration goes beyond transactional ease. This section elucidates the broader benefits, including increased customer trust, accelerated growth, and improved user experience.

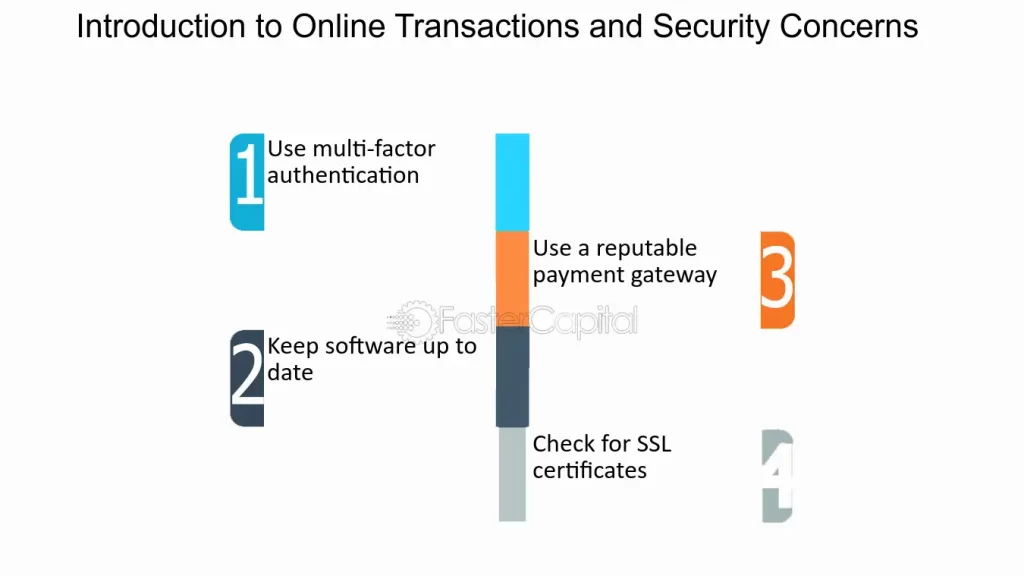

Security Concerns in Collaborative Commerce Transactions

As collaborative commerce gains momentum, security concerns become a focal point. Businesses and consumers alike worry about the confidentiality and integrity of their transactions. The prevalence of cyber threats underscores the need for robust security measures.

How Payment Providers Address Security Challenges

Payment providers understand the gravity of security challenges and employ advanced technologies to safeguard collaborative transactions. Encryption protocols, multi-factor authentication, and continuous monitoring are integral components of their security infrastructure. This proactive approach assures all stakeholders that their financial interactions within collaborative platforms are well-protected.

Conclusion

In conclusion, the symbiotic relationship between Collaborative Commerce and payment providers is integral to the success of modern businesses. Choosing the right payment solution empowers collaborations and ensures sustained growth.

FAQs

- Q: How do payment providers enhance security in collaborative transactions? A: Payment providers employ encryption, multi-factor authentication, and regular security audits to ensure the safety of collaborative transactions.

- Q: Are government regulations a hindrance to collaborative commerce in India? A: While regulations exist, they are designed to ensure a secure and transparent ecosystem, ultimately benefiting businesses and consumers.

- Q: What role does UPI play in collaborative commerce transactions? A: UPI streamlines transactions by providing a unified platform, enhancing the efficiency and speed of collaborative commerce transactions.

- Q: How can businesses choose the right payment provider for collaborative ventures? A: Businesses should consider factors like scalability, security features, and compatibility with collaborative platforms when selecting a payment provider.

- Q: What are the long-term benefits of seamless payment integration in collaborative platforms? A: Seamless payment integration leads to increased customer trust, accelerated business growth, and an overall improved user experience.