AUTHOR : RIVA BLACKLEY

DATE : 21/12/2023

Introduction

In the dynamic landscape of Indian Digital Transformation in Commercial Payments[1], the role of payment providers has become increasingly pivotal. These entities facilitate the smooth flow of funds, ensuring secure and efficient transactions between businesses and customers. Payment Provider For Commercial Transactions In India.

The Landscape of Payment Providers in India

As commerce in India has evolved, so too have the payment solutions available. The market boasts a diverse range of providers, from traditional banks to innovative fintech companies. Understanding this landscape is crucial for businesses navigating the complexities of commercial transaction[2].

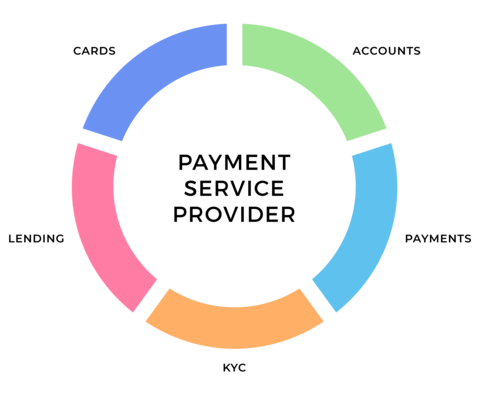

Uncovering Essential Attributes in a Payment Service Provider

Selecting the right payment provider requires a careful consideration of key features. Security measures, transaction speed, integration options, and cost factors are among the critical aspects that businesses should evaluate. Payment Provider For Commercial Transactions In India.

Regulatory Environment

The Reserve Bank of India (RBI) plays a significant role in shaping the regulatory environment for payment provider For Commercial. Compliance with guidelines is not just a legal requirement but also impacts the trust customers place in these providers.

Popular Payment Methods in India

Invoice Payment[3] methods dominate the Indian market, each with its unique advantages. From the widely used Unified Payments Interface (UPI) to digital wallets and traditional credit/debit cards, businesses need to understand and leverage these options.

Challenges Faced by Payment Providers

The journey of payment providers is not without hurdles. Cybersecurity concerns, technical glitches, and establishing user trust pose challenges that require constant vigilance and innovation to overcome. In those countries in which specific legal consequences attach to E-commerce payment system[4], it is necessary to develop a precise definition of what constitutes a commercial transaction.

Advancements and Innovations

The landscape of payment Provider For Commercial solutions is ever-evolving. Contactless payments, biometric authentication, and blockchain technology are emerging trends that promise to revolutionize the way transactions are conducted.

Importance of Choosing the Right Payment Provider

The choice of a payment provider is not merely a logistical decision; it significantly influences the overall customer experience and business growth. Building trust with customers through seamless Commercial transactions is a competitive advantage.

Case Studies

Examining success stories and failures in the utilization of payment providers provides valuable insights for businesses. Mobile Payments[5] Smartphones and tablets enable us to manage our day-to-day tasks and business operations easily on the go. Whether you sell online, in-store, Learning from both triumphs and setbacks contributes to informed decision-making.

Future Trends in Payment Providers

As technology continues to advance, the future of payment providers holds exciting possibilities. Artificial intelligence in transactions, cryptocurrency integration, and the globalization of payment solutions are trends businesses should keep a close eye on.

How Businesses Can Choose the Right Payment Provider

Navigating the myriad options requires a strategic approach. Assessing business needs, conducting thorough research, and seeking expert advice are steps that can guide businesses toward the right payment provider.

Expert Opinions

Industry leaders offer valuable perspectives on the evolving landscape of payment providers. Their insights and tips can serve as a compass for businesses seeking to optimize their financial transactions. Only a few traces of rules on commercial transactions in antiquity have survived. The most notable is a rule developed by the seafaring Phoenicians and named after the island of Rhodes in the eastern Mediterranean

Additional Information and Considerations

Before delving into the selection process of a payment provider, businesses should assess additional factors. Integration with existing systems, customer support quality, and scalability are crucial aspects that can influence the overall effectiveness of a chosen provider.

Integration with Existing Systems

Compatibility with a business’s existing infrastructure is paramount. A seamless integration ensures minimal disruptions to operations and a smoother transition for both the business and its customers. Payment providers offering versatile integration options often stand out in the market.

Customer Support Quality

In the realm of financial transactions, responsive and effective customer support is non-negotiable. Businesses must prioritize payment providers with a reputation for excellent customer service. Timely assistance in case of issues can prevent potential financial hiccups and maintain customer satisfaction.

Conclusion

In summary, the role of payment providers in Indian commercial transactions is indispensable. Choosing the right provider involves careful consideration of various factors, and businesses must stay attuned to industry trends to stay competitive.

FAQS

- What is the significance of payment providers in commercial transactions? Payment providers play a crucial role in facilitating secure and efficient financial transactions between businesses and customers.

- How do regulatory guidelines impact payment providers in India? The Reserve Bank of India (RBI) sets guidelines that payment providers must adhere to, impacting both legal compliance and customer trust.

- What are the key features businesses should consider when selecting a payment provider? Security measures, transaction speed, integration options, and cost factors are critical features to evaluate when choosing a payment provider.

- How do advancements like blockchain and biometric authentication impact payment solutions? Innovations such as blockchain and biometric authentication are reshaping payment solutions, enhancing security and efficiency.

- What role does the choice of payment provider play in building customer trust? The right payment provider contributes to a seamless customer experience, building trust and loyalty among users.