AUTHOR : KHOKHO

DATE : 21/12/2023

Introduction

Payment Provider In the dynamic landscape of corporate supply chains in India, efficient payment processing is crucial for seamless operations. Companies often face unique challenges in managing their financial transactions, requiring innovative solutions to streamline processes and enhance productivity. Provider For Corporate

Payment Challenges in Corporate Supply Chains

Corporate supply chains in India encounter various payment challenges, including complex transaction structures, currency fluctuations, and regulatory compliance issues. Supply Chains In India These challenges necessitate a robust payment infrastructure that can adapt to the specific needs of businesses operating in this environment.

The Role of Payment Providers

Enter payment for Corporate Supply providers – the unsung heroes of corporate supply chains. These entities play a pivotal role in addressing payment challenges by offering tailored solutions that simplify transactions, enhance transparency, and ensure compliance with regulations.

Identifying the crucial attributes to seek in a payment provider is paramount for businesses navigating the intricacies of financial transactions.

When choosing a payment provider for corporate supply chains in India, it’s essential to consider key features. Look for platforms that offer multi-currency support, real-time transaction tracking, and scalability to accommodate the growing needs of your business.

Top Payment Providers in India

Several payment providers stand out in the Indian market, catering specifically to corporate supply chains. From traditional banks to fintech disruptors, businesses have a range of options to choose from based on their unique requirements.

Benefits of Using Payment Providers

The advantages of using payment providers are manifold. Businesses can experience faster transaction processing, reduced operational costs, improved cash flow management and digital payment solutions[1]

and increased overall efficiency.

Case Studies

Real-world examples illustrate the transformative impact of effective payment solutions. Companies that have successfully integrated advanced payment providers into their supply chain processes[2] have witnessed improved accuracy, reduced payment errors, and enhanced vendor relationships.

Security Measures in Payment Processing

Security is a paramount concern in payment processing. Reputable payment providers implement advanced encryption technologies, ensuring the confidentiality and integrity of financial transactions within corporate supply chains.

Trends in Payment Solutions

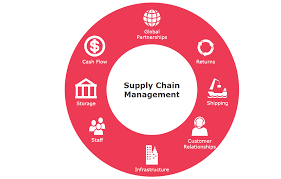

The payment solutions landscape is constantly evolving. Businesses should stay abreast of trends such as blockchain-based payments, supply chain management[3] contactless transactions, and AI-driven fraud detection to remain competitive in the market.

Regulatory Compliance

Adhering to regulatory standards is non-negotiable in the financial realm. Payment providers that prioritize compliance help businesses navigate the complex web of regulations governing corporate transactions in India Transaction Processing Services[4].

Cost Considerations

While the benefits of using payment providers are clear, businesses must also consider the associated costs. Evaluate fee structures, hidden charges, and potential savings to make informed decisions that align with your financial objectives.

Integration with ERP Systems

Seamless integration with ERP systems is a game-changer. Businesses can achieve greater efficiency by combining Business Payment Systems[5] payment processing with their broader operational workflows, creating a unified and streamlined experience.

User Experience and Interface

A user-friendly interface is essential for widespread adoption. Payment providers that prioritize user experience enhance accessibility and usability, contributing to a positive overall experience for both businesses and their suppliers.

Future Outlook

As technology continues to advance, the future of payment providers(5) in corporate supply chains looks promising. Expect further integration with emerging technologies, increased automation, and a continued focus on enhancing the overall user experience.

Conclusion

In conclusion, the choice of a payment provider can significantly impact the efficiency and success of corporate supply chains in India. By carefully evaluating features, considering security measures, and staying abreast of industry trends, businesses can position themselves for sustained growth and success.

FAQs

- How do payment providers enhance security in financial transactions?

- Payment providers employ advanced encryption technologies to ensure the confidentiality and integrity of financial transactions, enhancing overall security.

- What role do case studies play in understanding the benefits of payment providers?

- Case studies provide real-world examples of businesses that have successfully integrated payment providers, showcasing tangible benefits and outcomes.

- How can businesses navigate regulatory compliance when choosing a payment provider?

- Choosing a payment provider that prioritizes regulatory compliance and transparency helps businesses navigate the complex landscape of financial regulations.

- What trends should businesses watch for in the evolving payment solutions landscape?

- Businesses should keep an eye on trends such as blockchain-based payments, contactless transactions, and AI-driven fraud detection for future-proofing their payment processes.

- How can payment providers contribute to cost savings in corporate supply chains?

- Payment providers can contribute to cost savings through faster transaction processing, reduced errors, and improved overall operational efficiency.