AUTHOR : NORA

DATE : 19-12-23

Introduction

In the dynamic landscape of door-to-door auto transport in India, the role of payment providers has become increasingly vital. This article delves into the significance of these providers, the challenges they address, and the top players in the industry.

The Current Landscape of Auto Transport in India

Overview of the Door-to-Door Auto Transport Industry

The auto transport sector in India is experiencing unprecedented growth, with more individuals opting for the convenience of door-to-door services. However, this surge brings along its own set of challenges, especially in the realm of payments.

Existing Payment Challenges in the Sector

As the industry expands, traditional payment methods prove to be inadequate, leading to delays and inefficiencies. This section explores the current hurdles users face when it comes to paying for auto transport services.

The Role of Payment Providers

Advantages of Using Payment Providers for Auto Transport

Payment providers play a crucial role in ensuring that transactions are not only secure but also swift. In an era where digital transactions dominate, the need for reliable payment solutions becomes paramount. This subsection highlights the numerous benefits users can reap by leveraging payment providers, from enhanced security to streamlined processes.

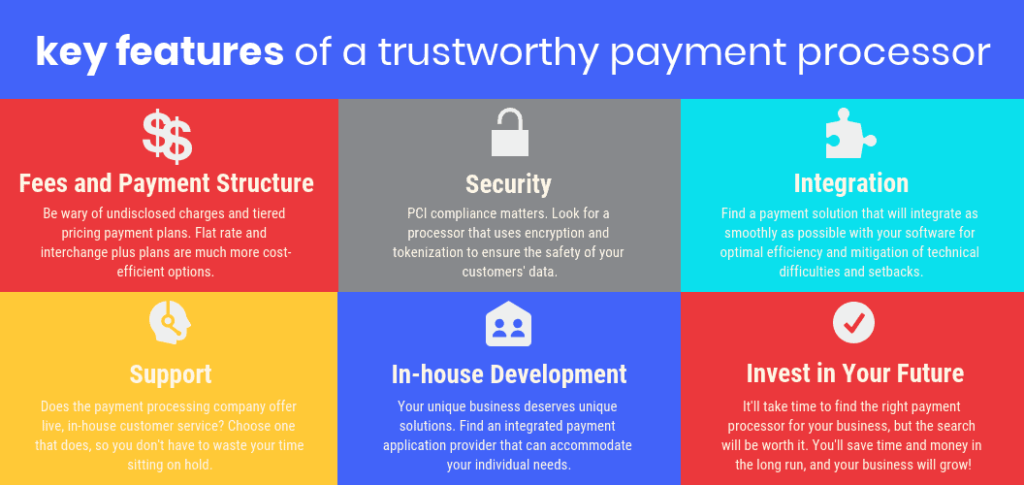

Key Features to Look for in a Payment Provider

Security Measures

User-Friendly Interface

Security is paramount when it comes to financial transactions. Here, we outline the key security features that users should prioritize when selecting a payment provider for auto transport. Navigating payment processes should be seamless. Door to Door[1] We explore the importance of a user-friendly interface in ensuring a positive user experience.

Transaction Speed and Reliability

Top Payment Providers for Door-to-Door Auto Transport in India

In the fast-paced world of auto transport, delays in transactions can be detrimental. This section discusses the significance of transaction speed and reliability. Payment service provider[2] in this section, we delve into the offerings of the first top-tier payment provider, highlighting unique features and user benefits.

Unique Offerings

How Payment Providers Facilitate Smooth Transactions

Provider 2 brings its own set of advantages to the table. We explore the distinctive offerings that set it apart in the competitive landscape[3]. Door-to-Door auto transport To demystify the process, we provide a step-by-step guide on how users can seamlessly utilize payment providers for their auto transport needs.

Future Trends in Payment Solutions for Auto Transport

Anticipated Advancements in Payment Processing

As technology advances, so do payment solutions[4]. We explore the cutting-edge technologies shaping the future of auto transport payments. Looking ahead, we discuss the expected advancements in payment processing that will further revolutionize the auto Transport in India[5] payment landscape.

Conclusion

In conclusion, the payment provider landscape for door-to-door auto transport in India is a pivotal aspect of the industry’s growth. From addressing existing challenges to paving the way for future innovations, these providers play a vital role in ensuring a seamless and secure payment experience for users. As the industry continues to evolve, choosing the right payment provider becomes increasingly important for individuals and businesses alike.

FAQs

1 How do payment providers ensure the security of transactions?

Payment providers implement robust security measures, including encryption protocols and multi-factor authentication, to safeguard transactions from potential threats. These measures ensure that user data and financial information remain confidential and secure.

2 Can I trust online payment methods for auto transport?

Yes, reputable online payment methods for auto transport are secure and trustworthy. It’s essential to choose well-established payment providers with a proven track record to ensure a safe and reliable transaction experience.

3 Are there any hidden fees associated with payment providers?

Transparent communication is key for reputable payment providers. Before engaging their services, users should carefully review the terms and conditions to ensure there are no hidden fees. Legitimate providers are upfront about their pricing structures.

4 What happens in case of payment disputes?

Payment providers typically have dispute resolution mechanisms in place. Users can contact customer support to initiate the resolution process, providing evidence and details of the dispute. Prompt communication is crucial for a timely resolution.

5 How do I know if a payment provider is legitimate?

Legitimate payment providers have proper certifications, secure websites (with “https”), and positive user reviews. Before making any transactions, users should verify the authenticity of the payment provider to ensure a safe and reliable experience.