AUTHOR : RIVA BLACKLEY

DATE : 21/12/2023

Introduction

Navigating the complex world of professional partnerships in India requires a keen understanding of the challenges and opportunities that come with it. At the forefront of these considerations is the choice of a payment provider. This article explores the landscape of professional collaborations in India and sheds light on the pivotal role payment providers play in ensuring the success.

The Landscape of Professional Partnerships in India

India’s business ecosystem is witnessing a surge in professional collaborations[1] across various sectors. From startups to established enterprises, professionals are recognizing the benefits of joining forces to achieve common goals. This collaborative spirit has led to a dynamic landscape where innovation and creativity thrive. Payment Provider For Professional Partnerships In India.

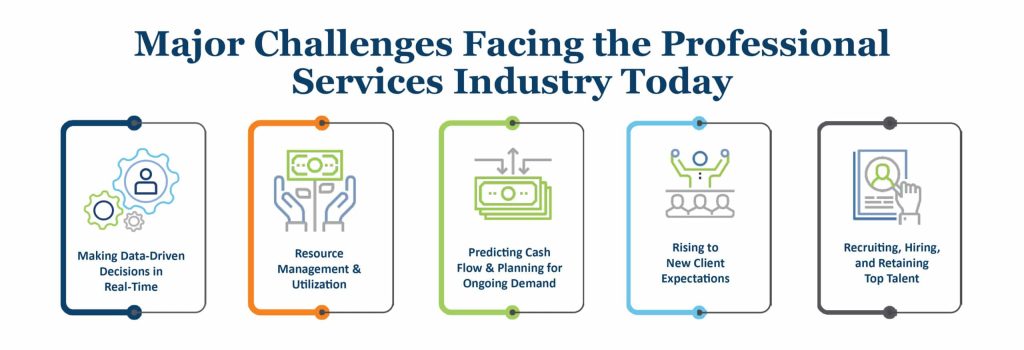

Challenges Faced by Professionals in India

However, this surge in partnerships comes with its set of challenges. One of the significant concerns faced by professionals is the uncertainty surrounding payment transactions[2]. Delays in payments can strain relationships and hinder the smooth functioning of partnerships, emphasizing the need for a reliable and efficient payment provider. Payment Provider For Professional Partnerships In India.

Role of Payment Providers

Payment providers[3] play a crucial role in facilitating seamless financial transactions between professionals. Beyond the basic function of transferring funds, they contribute to building trust in partnerships by ensuring that payments are processed securely and in a timely manner.

Key Features of an Ideal Payment Provider

What makes an ideal Speed, efficiency, and also transparent fee structures are among the key features that professionals should consider. Additionally, integration capabilities with existing business systems can streamline financial processes[4].

Popular Payment Providers in India

Several payment providers cater specifically to the Indian market. Understanding the offerings of these platforms is essential for professionals looking to make informed decisions. Let’s delve into a comparative analysis of some leading payment providers in India[5].

Security Measures in Payment Transactions

Security is a paramount concern in financial transactions. Reliable payment providers implement robust encryption and also authentication processes to safeguard sensitive information, providing users with the assurance that their transactions are secure.

Navigating Regulatory Challenges

Operating within the legal framework is crucial for professionals and payment providers alike. Compliance with Indian regulations ensures that financial transactions are not only secure but also ethical and legal.

User-Friendly Interfaces for Professionals

Apart from security, user experience is another critical aspect. Professionals should opt for payment providers that offer user-friendly interfaces, ensuring accessibility and ease of navigation for users with varying levels of technical expertise.

Case Studies: Success Stories

To illustrate the impact of reliable payment providers, let’s explore a few case studies. These real-world examples highlight how professionals have benefited from seamless financial transactions, ultimately contributing to the success of their partnerships.

Tips for Choosing the Right Payment Provider

Choosing the right payment provider requires careful consideration of business needs and preferences. Reading user reviews and also testimonials can provide valuable insights into the experiences of other professionals, aiding in the decision-making process.

Future Trends in Payment Solutions for Professional Partnerships

As technology continues to advance, the future of solutions for looks promising. Predictions include the integration of innovative technologies that will further streamline financial processes, making transactions even more efficient and secure.

Conclusion

In a landscape where collaboration is key, the role of payment providers cannot be overstated. Professionals engaging in partnerships in India face a myriad of challenges, and a reliable payment system acts as the backbone that sustains these collaborations.

FAQS

- What are the common challenges faced by professionals in payment transactions?

- Professionals often encounter challenges such as payment delays and uncertainties, which can strain business relationships.

- How do payment providers contribute to building trust in partnerships?

- Payment providers play a crucial role in building trust by ensuring that payments are processed securely and in a timely manner, fostering confidence among partners.

- Can businesses customize payment solutions based on their needs?

- Yes, many payment providers offer customizable solutions to cater to the specific needs of businesses, allowing for flexibility in financial transactions.

- Are there any legal considerations when choosing a payment provider in India?

- Yes, it is essential for professionals to choose payment providers that comply with Indian regulations to ensure legal and ethical financial transactions.

- How can professionals stay updated on the latest trends in payment solutions?

- Professionals can stay informed by regularly monitoring industry updates, attending relevant events, and engaging with reputable sources in the financial technology sector.