AUTHOR : PUMPKIN KORE

DATE : 21/12/2023

Introduction

In today’s globalized economy, trade agreements play a crucial role in fostering economic relationships between nations. As businesses engage in international trade, the need for efficient payment providers becomes paramount . This article delves into the landscape of payment providers for trade agreements in India, exploring the current challenges, highlighting top providers, and discussing the role of technology in shaping the future. Payment For Trade Agreements

Provider For Trade Agreements in India have witnessed a significant upswing in recent years, with businesses expanding their reach across borders. However, the efficiency of these agreements is closely tied to the seamless processing of payments. In this dynamic environment, businesses must navigate challenges in payment processing to ensure the success of their international ventures. Payment Provider For Trade Agreements In India

The Current Payment Landscape

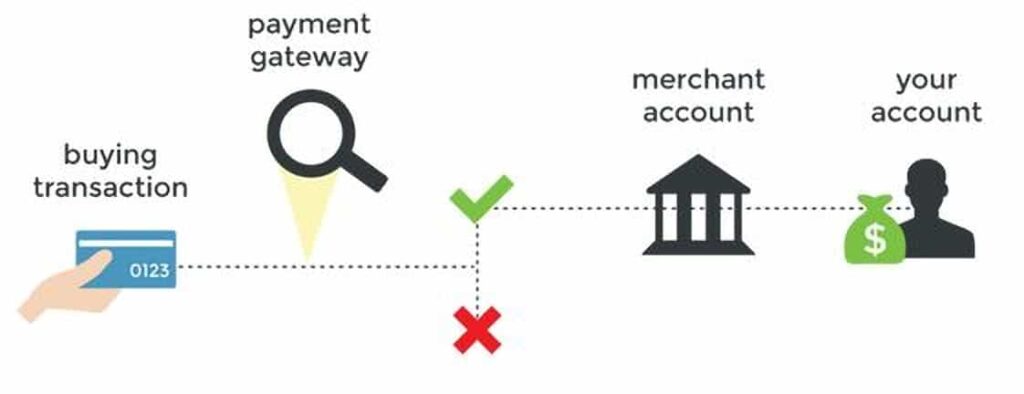

The complexities of international transactions often lead to challenges for businesses, including currency conversions, security concerns, and the need for streamlined processes. The current payment landscape calls for robust solutions that address these challenges and contribute to the smooth execution of Trade Negotiations[4],

Before delving into the world of payment providers, it’s essential to understand the landscape of trade agreements in India. From bilateral agreements to multilateral partnerships, these agreements form the backbone of international commerce, necessitating reliable and efficient payment processing[1] for their success.

Payment Provider Criteria

Choosing the right payment provider is a critical decision for businesses engaged in international trade. Security, currency support, and integration capabilities are key criteria that businesses should consider when selecting a payment provider. Digital Payment Solutions[2] The ability to prevent fraud and support various currencies ensures a seamless payment[3] experience.

Top Payment Providers for Trade Agreements in India

To illustrate the impact of efficient payment providers, Bilateral Agreements[5] let’s explore a few case studies. These success stories showcase how businesses have thrived in international trade by adopting advanced payment solutions, resulting in improved efficiency and profitability.

How Payment Providers Enhance Efficiency

Advanced payment providers go beyond transaction processing. They play a pivotal role in streamlining payment processes, reducing transaction costs, and ensuring a steady cash flow for businesses engaged in trade agreements. The efficiency gained through these providers contributes significantly to the overall success of international ventures.

Innovations in payment technology, such as blockchain and digital wallets, have revolutionized the payment industry. This section explores how these technological advancements are shaping the landscape of payment solutions for trade agreements, leading to faster, more secure transactions.

Challenges and Solutions

While the benefits of efficient payment providers are evident, businesses often face challenges in the implementation process. This section addresses common challenges and provides solutions to ensure a smooth transition to advanced payment solutions.

As technology continues to evolve, so do payment solutions. This section examines emerging trends in payment technology and offers predictions for the future of payment providers in trade agreements. Businesses are encouraged to stay abreast of these trends to remain competitive in the global market.

Choosing the Right Payment Provider

Selecting a payment provider tailored to specific business needs is crucial for success in international trade. Factors such as scalability, customization, and ongoing support should be considered to ensure a seamless payment experience.

Real-world experiences from businesses that have embraced efficient payment providers provide valuable insights. Discover how these businesses have overcome challenges and achieved success through the adoption of advanced payment solutions.

Conclusion

In conclusion, the importance of choosing the right payment provider for trade agreements in India cannot be overstated. As businesses strive for success in international ventures, leveraging advanced payment solutions is a strategic move that enhances efficiency and ensures a competitive edge.

FAQs

- What makes a payment provider suitable for trade agreements?

- A suitable payment provider for trade agreements should offer secure transactions, support various currencies, and seamlessly integrate with business platforms.

- How do payment providers ensure secure transactions?

- Payment providers employ advanced security measures such as encryption and multi-factor authentication to ensure the security of transactions.

- Can businesses integrate payment solutions seamlessly?

- Yes, modern payment providers offer seamless integration capabilities, allowing businesses to integrate payment solutions with their existing systems effortlessly.

- Are there any hidden costs associated with payment providers?

- Businesses should carefully review the terms of payment providers to understand any potential hidden costs, ensuring transparency in the agreement.

- What role does technology play in modern payment solutions?

- Technology plays a pivotal role in modern payment solutions, enabling faster,