AUTHOR:AYAKA SHAIKH

DATE:22/12/2023

Introduction

So, you’ve heard about the booming business of payment solutions in India, right? But did you know you could be a part of it through a franchise opportunity? Yes, you read that correctly! Payment provider franchising is rapidly gaining traction, and India presents a goldmine of opportunities for aspiring entrepreneurs.

The Indian Market Potential

Current Payment Landscape in India

Ever waited in a queue to pay a bill or purchase something? Well, with the digital revolution, those days are becoming history. India is witnessing a surge in online transactions, mobile payments, and digital wallets, making it one of the fastest-growing markets globally. payment provider Franchise opportunities in india.

Growth Factors in Payment Services.

Why is India becoming the epicenter of payment solutions? A combination of factors like government initiatives, increased smartphone penetration, and a young tech-savvy population fuels this growth. As businesses pivot towards digital, the demand for reliable payment system skyrockets.

Benefits of Owning a Payment Provider Franchise

Lucrative Returns

Let’s cut to the chase. Why should you consider a payment provider franchise? Simple. The potential for high returns. As more businesses and individuals embrace digital transactions, your franchise stands to benefit from this massive customer base.

Brand Recognition and Trust

Imagine starting a business without having to build a brand from scratch. Sounds dreamy, right? Owning a Customer franchise[1] offers just that. You leverage an established brand, ensuring customers recognize and trust your services from day one.

Top Payment Provider Franchises in India

Features and Offerings

Curious about the frontrunners in this domain? Names like XYZ Payment Solutions and ABC Digital are making waves. They offer a range of services from POS solutions to online payment gateways[2], catering to diverse customer needs.

Investment Requirements

But what’s the catch? Like any business venture, franchising requires an initial investment. Depending on the brand and services offered, costs can vary. However, the potential ROI often outweighs the initial outlay, making it a worthy investment.

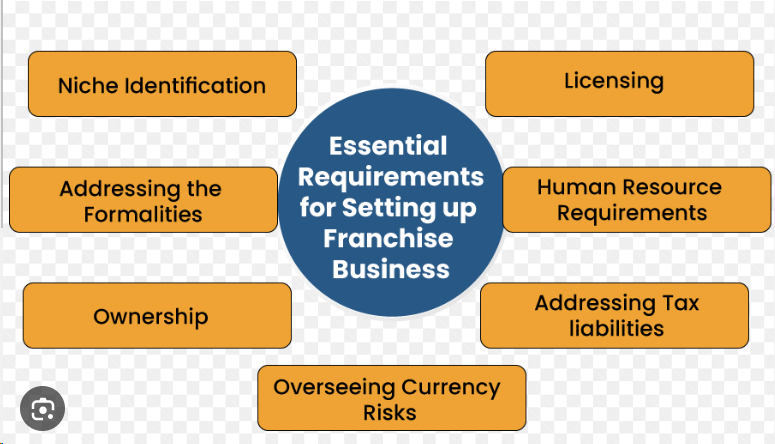

Steps to Acquiring a Franchise

Research and Selection

Before diving in, research is your best friend. Evaluate Category franchises[3], understand their offerings, and align them with your business goals. Once you’ve narrowed down options, reach out for detailed information and start the application process.

Application and Approval Process

Once you’ve found your perfect match, it’s time to apply! The franchisor will guide you through the application, evaluation, and approval stages. Remember, transparency is key. Payment service provider[4] all required documentation, undergo training, and voila! You’re ready to launch your franchise.

Challenges and Considerations

Market Competition

While the prospects are promising, challenges lurk around the corner. Market saturation, intense competition, and evolving customer preferences require adaptability and innovation. Stay updated, offer value-added services, Profitable Franchise Business[5] and differentiate yourself from the crowd.

Regulatory and Compliance Factors

Navigating India’s regulatory landscape can be daunting. From licensing requirements to compliance with financial regulations, ensure your franchise adheres to all legal obligations. Partner with experts, seek guidance, and maintain transparency to avoid pitfalls.

Marketing Strategies for Franchise Success

Understanding the Target Audience

Ever heard the saying, “Know your audience?” Well, in franchising, this mantra holds true. Identify your target market, understand their preferences, pain points, and behaviors. Tailor your marketing strategies to resonate with potential customers, ensuring maximum engagement and conversion rates.

Digital Marketing Initiatives

In today’s digital era, online presence is paramount. Invest in digital marketing strategies like SEO, PPC, social media marketing, and email campaigns. Enhance brand visibility, drive traffic, and generate leads, positioning your franchise as a go-to solution in the payment services landscape.

Customer Service Excellence

Building Trust and Credibility

Why do customers choose one brand over another? Often, it boils down to trust and credibility. Focus on delivering exceptional customer service, addressing queries promptly, resolving issues effectively, and building long-term relationships. Remember, a satisfied customer is your best brand ambassador.

Feedback and Continuous Improvement

Feedback is a goldmine! Encourage customers to share their experiences, suggestions, and concerns. Analyze feedback, identify areas for improvement, and implement necessary changes. By prioritizing customer satisfaction, you foster loyalty, retention, and positive word-of-mouth referrals.

Scaling and Expansion Opportunities

Exploring New Markets

Once you’ve established a foothold in your target market, explore opportunities for expansion. Conduct market research, identify emerging markets, and evaluate growth potential. Whether it’s expanding regionally or diversifying service offerings, strategic expansion can propel your franchise to new heights.

Collaborations and Partnerships

Collaborations can be a game-changer! Partner with complementary businesses, fintech startups, or industry leaders to expand your reach, offerings, and customer base. By forging strategic partnerships, you unlock new opportunities, resources, and avenues for growth.

Risk Management and Compliance

Understanding Regulatory Landscape

Navigating India’s regulatory landscape requires diligence, expertise, and compliance. Stay abreast of evolving regulations, licensing requirements, and industry standards. Establish robust internal controls, processes, and protocols to ensure adherence and mitigate risks.

Insurance and Contingency Planning

Unforeseen challenges are part and parcel of business. Invest in comprehensive insurance coverage, risk assessment, and contingency planning. By proactively identifying potential risks, developing mitigation strategies, and securing adequate insurance, you safeguard your franchise’s assets, reputation, and stakeholders’ interests.

Conclusion

In a nutshell, payment provider franchising in India offers a lucrative yet challenging opportunity for budding entrepreneurs. By understanding the market dynamics, leveraging established brands, and addressing challenges head-on, success is within reach. So, are you ready to embark on this exciting journey?

FAQs

- What is payment provider franchising?

- Payment provider franchising involves partnering with established brands to offer payment solutions, leveraging their brand, expertise, and support.

- How profitable is owning a payment provider franchise in India?

- While profitability varies, the growing digital landscape in India presents significant revenue opportunities for franchises.

- What are the key factors to consider before acquiring a franchise?

- Factors include market research, investment requirements, brand reputation, support provided, and regulatory compliance.

- How do I ensure compliance with India’s regulatory landscape?

- Partner with legal experts, understand local regulations, maintain transparency, and adhere to licensing requirements.

- Is training provided by franchisors?

- Yes, most franchisors offer comprehensive training programs to equip franchisees with the necessary skills and knowledge.