AUTHOR:HAZEL DOSUZA

DATE:27/12/2023

In the fast-paced world of online commerce, the need for reliable payment providers has become paramount. The landscape of online transactions[1] is evolving, with India emerging[2] as a key player in this digital revolution.

Introduction

The Landscape of Online Transactions

The advent of e-commerce[3] has reshaped how individuals and businesses[4] engage in transactions. With the convenience of online shopping, the role of payment providers has become central to the smooth functioning of digital economies[5].

Importance of Reliable Payment Providers

Security Concerns

Security is a top priority for online transactions. Reliable payment providers employ state-of-the-art encryption technologies to ensure the safety of sensitive information, instilling trust among users.

Ease of Transactions

In addition to security, the ease of transactions is crucial. Payment providers streamline the payment process, offering a seamless experience for both businesses and consumers.

Top Payment Providers in India

Payment Solutions

One of the leading payment solutions in India, XYZ Payment Solutions, has gained prominence for its robust security measures and efficient[1] transaction processing.

ABC Digital Payments

ABC Digital Payments stands out for its user-friendly interfaces and diverse payment options, catering to the evolving needs of the Indian market.

Advantages of Using Online Payment Products

Time Efficiency

Online payment products save time for both businesses and consumers. Quick transactions[2] contribute to the overall efficiency of the digital economy.

Cost-Effective Solutions

Compared to traditional payment methods, online payment products offer cost-effective solutions, reducing the financial burden on businesses.

Challenges in the Payment Provider Industry

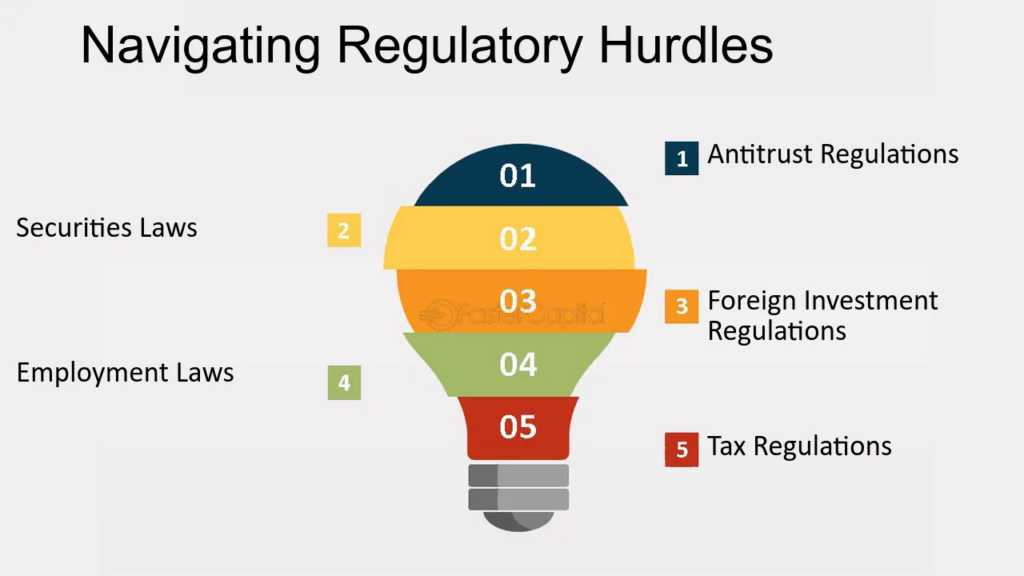

Regulatory Hurdles

Navigating the regulatory landscape poses challenges for payment providers, requiring them to stay abreast of changing regulations.

Technological Advancements

Rapid technological advancements[3] demand continuous innovation from payment providers to stay competitive and meet evolving consumer expectations.

Future Trends in Online Payment Products

Contactless Payments

Contactless payments are on the rise, with the convenience of tap-and-go transactions gaining popularity among consumers.

Blockchain Technology Integration

The integration of blockchain technology is anticipated[4] to enhance security and transparency in online transactions.

How Payment Providers Impact E-Commerce

Streamlining Customer Experience

Payment providers play a pivotal role in enhancing the overall customer experience by providing efficient and secure payment options.

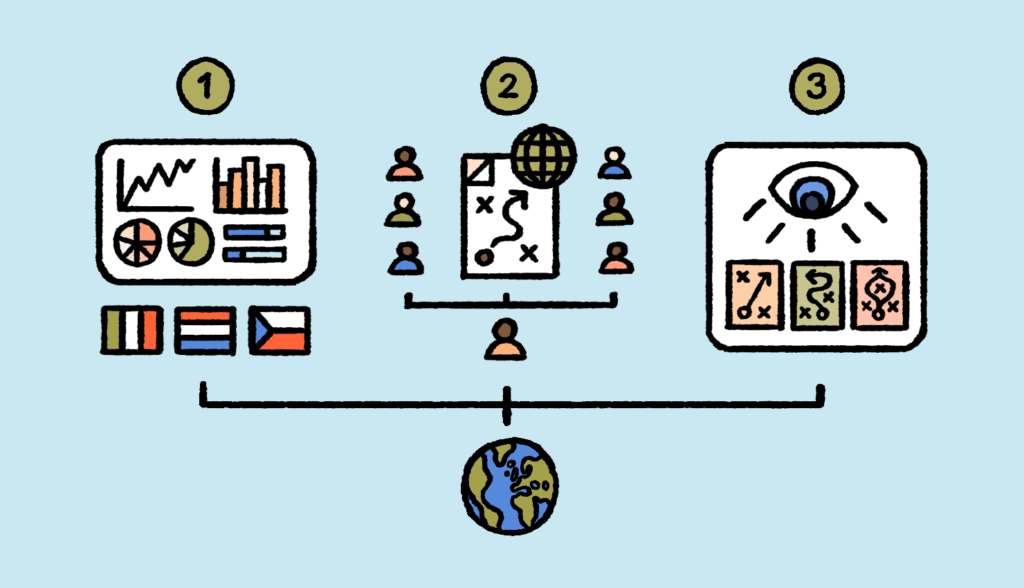

Expanding Market Reach

Enabling diverse payment options facilitates businesses in reaching a broader audience, both locally and globally.

Success Stories in Indian E-Commerce

From Local to Global with Seamless Payments

Highlighting success stories of businesses that expanded globally by leveraging seamless payment solutions.

Empowering Small Businesses through Online Transactions

Showcasing how small businesses have flourished through the adoption of online payment products.

User Experience: Navigating Payment Portals

User-Friendly Interfaces

The importance of user-friendly interfaces in ensuring a positive and hassle-free experience for users navigating payment portals.

Mobile App Accessibility

The increasing reliance on mobile devices emphasizes the importance of mobile app accessibility for payment providers.

Tips for Businesses Choosing Payment Providers

Scalability

Businesses must consider the scalability of payment providers to accommodate[5] growth and evolving transaction volumes.

Integration Capabilities

The seamless integration of payment solutions with existing business systems is crucial for a smooth operation.

The Role of SEO in Boosting Payment Providers

Keywords That Matter

Identifying and incorporating relevant keywords in the content to boost the online visibility of payment providers.

Building Credible Backlinks

Establishing credible backlinks contributes to the authority and trustworthiness of payment providers in the digital space.

Impact of Digital Marketing on Payment Providers

Social Media Presence

Leveraging social media platforms to create a strong online presence and engage with the target audience.

Influencer Collaborations

Strategic collaborations with influencers can amplify the reach and credibility of payment providers in the digital landscape.

Addressing Common Concerns: Is Online Payment Safe?

Encryption Technologies

Explaining the encryption technologies used by payment providers to ensure the safety of online transactions.

Two-Factor Authentication

Highlighting the additional layer of security provided by two-factor authentication in online payment processes.

The Evolution of Payment Gateway Systems

Past, Present, and Future

Tracing the evolution of payment gateway systems from their inception to current innovations and future prospects.

Integrating Artificial Intelligence

Exploring the role of artificial intelligence in enhancing the efficiency and security of payment gateway systems.

Conclusion

As online transactions continue to reshape the business landscape in India, embracing reliable payment providers is crucial. The evolution of payment gateway systems, coupled with advancements in technology, propels us toward a future where transactions are not only secure but also seamlessly integrated into our daily lives.

FAQs

- Are online payment products safe to use?

- Online payment products employ advanced encryption technologies, ensuring the safety and security of transactions.

- How do payment providers impact e-commerce businesses?

- Payment providers streamline transactions, enhance customer experience, and enable businesses to expand their market reach.

- What are the future trends in online payment products?

- Future trends include the rise of contactless payments and the integration of blockchain technology for enhanced security.

- How can businesses choose the right payment provider?

- Businesses should consider scalability, integration capabilities, and the overall user experience when choosing payment providers.

- What is the role of SEO in boosting payment providers?

- SEO plays a crucial role in enhancing the online visibility of payment providers by incorporating relevant keywords and building credible backlinks.