AUTHOR : PUMPKIN KORE

DATE : 16/12/2023

Introduction

In the dynamic landscape of the Indian financial sector, payment providers and their gateway services have become integral components of the digital economy. As more businesses and consumers embrace online transactions, the need for secure, efficient, and reliable payment gateways has skyrocketed. This article delves into the evolution, features, challenges, and future outlook of payment gateway services in India.

Evolution of Payment Gateway Services in India

The journey of payment gateway services in India began with various challenges, including low digital literacy and infrastructure limitations. However, with rapid technological advancements, the sector witnessed substantial growth, transforming the way transactions are conducted in the country.

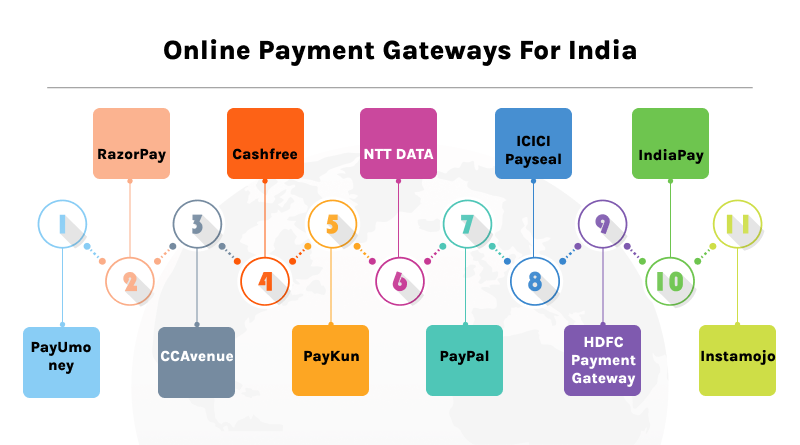

Key Players in the Indian Payment Gateway Scene

In a competitive market, several key players dominate the payment gateway Market[1] in India. Companies like Razorpay, PayU, and CCAvenue have established themselves, each offering unique features and competing for market share. Understanding the landscape is crucial for businesses looking to integrate payment gateways seamlessly.

Features and Benefits of Payment Gateway Services

Payment gateways businesses[2] offer a plethora of features, ensuring secure and convenient transactions for both businesses and consumers. From encryption to user-friendly interfaces, these services play a pivotal role in fostering trust and reliability in digital transactions.

Trends in Payment Gateway Services

The industry is witnessing transformative trends, including the rise of contactless payments and the widespread adoption of digital wallets and mobile apps. These innovations are not only convenient but also align with the changing preferences of the tech-savvy Indian consumer.

Challenges Faced by Payment Gateway Providers

Despite the growth, payment gateway providers face challenges, including security concerns and regulatory hurdles. Payment service provider[3] Addressing these challenges is crucial for sustaining the momentum and ensuring the long-term success of the industry.

Comparison of Popular Payment Gateways

Choosing the right payment gateway involves considering factors like transaction fees and user experience. A detailed comparison helps businesses make informed decisions based on their specific requirements and budget constraints.

Role of Payment Gateway in E-Commerce

In the e-commerce payment gateways[4] play a pivotal role in facilitating seamless online transactions. Their contribution goes beyond processing payments, extending to building trust among consumers, which is paramount for the success of online businesses.

Impact of Digital India Initiatives on Payment Gateways

Government initiatives promoting digital transactions, coupled with increased internet penetration, have contributed to the widespread adoption of payment gateways, even in rural areas. The digital India drive has created an environment conducive to the growth of the payment gateway industry.

Future Outlook of Payment Gateway Services in India

The future looks promising, with continuous innovations and advancements in payment gateway technologies. Predictions indicate sustained market growth as businesses and consumers continue to embrace digital transactions.

Examining successful case studies provides insights into how businesses have benefited from implementing payment gateway services. Positive impacts on revenue, customer satisfaction, and overall operational efficiency highlight the transformative power of these services.

Security Measures in Payment Gateways

Security is a paramount concern in the digital payment methods[5] space. Payment gateways employ robust measures such as encryption, tokenization, and advanced fraud detection and prevention mechanisms to ensure the safety of transactions.

Choosing the Right Payment Gateway for Your Business

Businesses must carefully consider various factors, including transaction fees, integration options, and customer support, when choosing a payment gateway. Tailoring the choice to the specific needs of the business ensures a seamless and effective integration.

Customer Feedback and Reviews

The importance of customer feedback cannot be overstated. Positive reviews and experiences shared by users contribute significantly to building trust. Payment gateway providers that prioritize customer satisfaction are more likely to thrive in the competitive market.

Conclusion

In conclusion, payment providers and their gateway services have become indispensable in the Indian digital economy. The evolving landscape, coupled with the increasing reliance on online transactions, positions payment gateways as key players in shaping the future of finance in India.

FAQs

- Are payment gateway services only for large businesses?

- No, payment gateway services cater to businesses of all sizes, from startups to large enterprises.

- How do payment gateways ensure the security of transactions?

- Payment gateways employ encryption, tokenization, and advanced fraud detection mechanisms to secure transactions.

- What role do payment gateways play in e-commerce?

- Payment gateways facilitate secure online transactions, build trust, and enhance the overall customer experience in e-commerce.

- How can businesses choose the right payment gateway for their needs?

- Businesses should consider factors like transaction fees, integration options, and customer support when selecting a payment gateway.

- What are the upcoming trends in payment gateway services in India?

- Trends include the rise of contactless payments, increased adoption of digital wallets, and continuous technological innovations.