AUTHOR : ISTELLA ISSO

DATE : 14/12/2023

Introduction

Evolution of Payment Systems in India

In the dynamic landscape of digital transactions, the security of payment systems in India has become a paramount concern. As the country embraces the digital revolution, ensuring the safety of financial transactions has become crucial to maintaining trust among users. india’s payment systems have witnessed a remarkable transformation over the years. From traditional cash transactions to the introduction of digital payment methods, the evolution has been rapid. With the surge in online transactions, the need for robust security measures has become more pressing than ever.

Rising Concerns in Payment Security

The increasing frequency of cyber threats and data breaches has heightened concerns about payment security. Users are wary of the potential risks associated with online transactions, making it imperative for payment providers to address these concerns effectively.

Regulatory Framework

Encryption Technologies

To address these concerns, regulatory bodies in India have laid down comprehensive security guidelines. Compliance with these regulations is not just a legal requirement but a commitment to safeguarding user data and financial information. One of the cornerstones of Payment Security Strategies[1] security is encryption. This technology ensures that sensitive information is transformed into unreadable code, thwarting any attempts at unauthorized access. Leading payment providers deploy state-of-the-art encryption technologies to fortify their platforms.

Two-Factor Authentication

Ensuring the identity of users is a critical aspect of Online Payment Security Methods[2] security Two-factor authentication adds an extra layer of protection by requiring users to provide two forms of identification before completing a transaction. From SMS-based codes to biometric verifications, 2FA has become a standard practice.

Biometric Authentication

Tokenization

The use of biometric data, such as fingerprints or facial recognition, is on the rise for securing payment transactions. While this adds a high level of security, challenges like false positives and user privacy concerns need careful consideration. Tokenization involves replacing sensitive data with unique identifiers, or tokens, rendering the information useless even if intercepted. This method significantly reduces the risk of data breaches and is widely adopted by Payment service provider[3].

Fraud Detection and Prevention

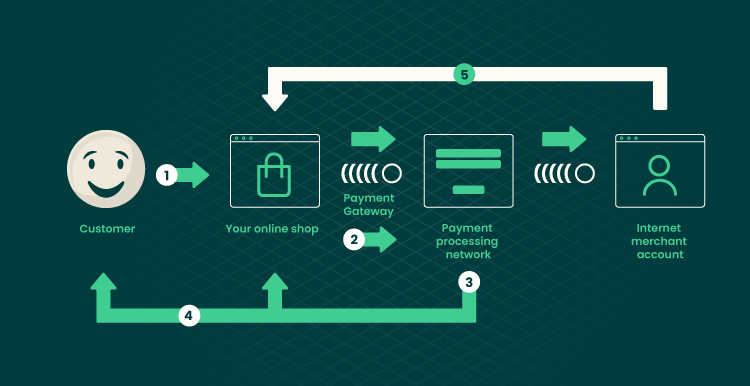

Collaboration with Financial Institutions

Artificial intelligence and machine learning play a pivotal role in fraud detection. Real-time monitoring of transactions, anomaly detection, and swift response mechanisms are essential components in preventing fraudulent activities. Payment Gateway[4] collaborate closely with banks and financial institutions to fortify security measures. Shared responsibility ensures a holistic approach to tackling threats and mitigating risks effectively.

Customer Education on Security

Empowering users with knowledge about secure practices is crucial. Educating customers about password hygiene, Security Measures[5] recognizing phishing attempts, and using secure networks contributes to an overall safer online payment environment.

Challenges in Implementing Security Measures

While enhancing security is a priority, finding the right balance between robust measures and user convenience poses challenges. Additionally, the costs and resources involved in implementing top-notch security can be significant. Several instances showcase the successful implementation of security measures, resulting in a substantial reduction in fraud. These cases underscore the positive impact of prioritizing security in payment systems.

Future Trends in Payment Security

Looking ahead, emerging technologies such as blockchain and advanced biometrics are poised to redefine payment security. The landscape will continue to evolve, necessitating a proactive approach to staying ahead of potential threats.

Conclusion

In conclusion, the security of payment systems in India is an ever-evolving process that demands continuous adaptation to new challenges. By implementing robust measures, staying abreast of technological advancements, and fostering user education, payment providers can contribute significantly to a secure digital ecosystem.

FAQs

- How often should I update my passwords for online transactions?

- It’s advisable to update your passwords regularly, at least every three to six months, to enhance security.

- Is biometric authentication completely secure?

- While biometric authentication adds a high level of security, it’s not immune to challenges such as false positives. However, advancements are continually improving accuracy.

- Do all payment providers use encryption technologies?

- Leading payment providers prioritize encryption technologies, but it’s essential to verify the security measures of any platform you use.

- Can I rely on AI for fraud detection in online transactions?

- AI plays a crucial role, but it should be complemented with human oversight to ensure a comprehensive approach to fraud detection.

- How can I safeguard myself from falling victim to phishing attacks?