AUTHOR : RIVA BLACKLEY

DATE : 13/12/2023

Introduction

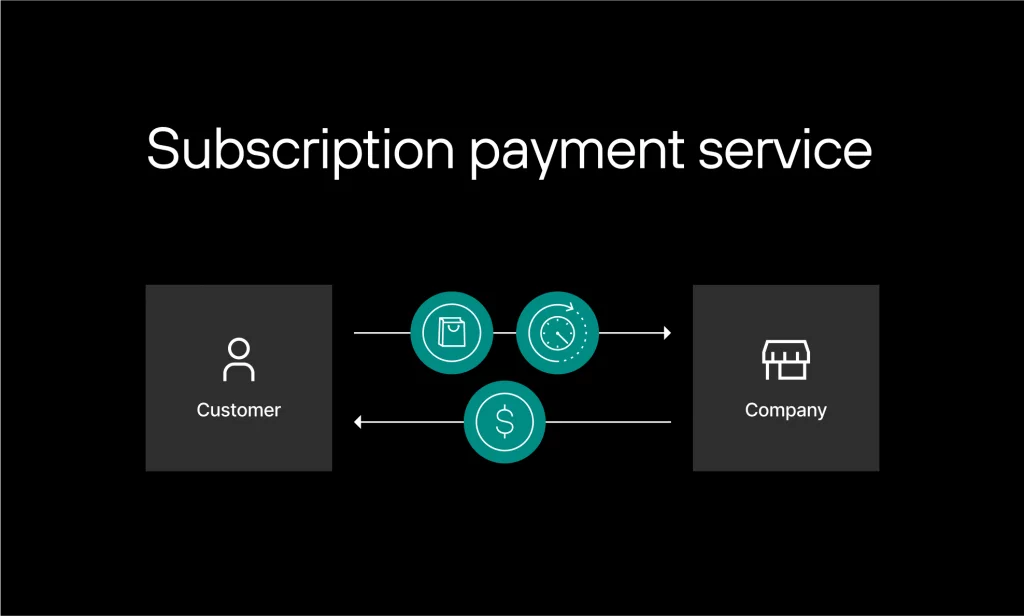

In the vibrant landscape of India’s digital economy[1], Payment Provider Subscription Billing has emerged as a pivotal[2] force, reshaping how businesses manage transactions and consumers access services. This article[3] explores the evolution, key players, benefits, challenges, and future trends of subscription billing in the Indian market.

Evolution of Subscription Billing

Historical Context

Subscription billing has evolved from traditional models[4] to sophisticated systems, adapting to technological advancements. The journey reflects the dynamic nature of India’s economic landscape, where traditional practices meet cutting-edge technology[5].

Technological Advancements

Advancements in payment technologies have played a crucial role in the evolution of subscription billing. From manual processes to seamless online transactions, technology has become the backbone of subscription models, enhancing user experiences.

Key Players in India

India boasts a diverse ecosystem of payment providers. This section provides an overview of leading players and delves into their roles in shaping the landscape of subscription billing.

Benefits of Subscription Billing

Convenience for Consumers

Subscription[1] billing offers consumers a hassle-free experience with automatic payments, eliminating the need for repetitive transactions. The convenience factor has led to widespread adoption among users.

Predictable Revenue for Businesses

For businesses, subscription models ensure a steady and predictable revenue stream, facilitating better financial planning and stability. This section explores how this benefits businesses of all sizes.

Enhanced Customer Relationships

Subscription billing fosters stronger relationships between businesses and consumers. Through personalized offerings and engagement strategies, businesses can build loyalty and trust with their customer base.

Challenges and Solutions

Regulatory Hurdles

Navigating the regulatory landscape can be challenging. We discuss the current regulatory environment and innovative solutions employed by payment[2] providers to overcome hurdles.

Security Concerns

Security[3] is paramount in subscription billing. We explore the concerns surrounding data protection and the security measures implemented to safeguard user information.

Innovative Solutions in the Market

This section highlights how the industry is responding to challenges with innovative solutions, ensuring the continued growth and sustainability of subscription billing[4] in India.

Case Studies

Successful Implementations

Examining real-world[5] cases of successful subscription billing implementations provides insights into best practices and strategies for businesses looking to adopt this model.

Lessons Learned

Through the lens of case studies, we uncover valuable lessons learned by businesses, shedding light on pitfalls to avoid and strategies for success.

Future Trends

Technological Innovations

The article explores emerging technologies set to reshape subscription billing, offering a glimpse into the future of seamless transactions and enhanced user experiences.

Market Predictions

Experts weigh in on the future of subscription billing in India, predicting trends and developments that will shape the industry in the coming years.

Tips for Businesses

Selecting the Right Payment Provider

Choosing the right payment provider is crucial for the success of subscription billing. This section offers tips and considerations for businesses looking to partner with a payment provider.

Optimizing Subscription Models

Businesses can maximize the benefits of subscription billing by optimizing their models. Practical tips are provided for businesses to enhance their subscription offerings.

Consumer Perspective

Preferences and Expectations

Understanding the preferences and expectations of consumers is essential for businesses. This section explores what consumers look for in subscription services and how businesses can meet those expectations.

Building Trust

Building trust is a cornerstone of successful subscription models. We discuss strategies for businesses to establish and maintain trust with their customer base.

Conclusion

In conclusion, payment provider subscription billing in India represents a dynamic intersection of technology, consumer preferences, and business strategies. The future promises exciting developments, and businesses that embrace and adapt to this evolving landscape stand to reap substantial rewards.

FAQS

- How can small businesses benefit from subscription billing?Subscription billing offers small businesses a predictable revenue stream, increased customer loyalty, and the ability to compete with larger enterprises.

- What security measures are in place to protect user data in subscription billing?Payment providers implement robust security protocols, including encryption and secure authentication, to safeguard user data and ensure a secure transaction environment.

- How can businesses navigate regulatory challenges in subscription billing?Businesses can navigate regulatory challenges by staying informed about local regulations, partnering with compliant payment providers, and implementing transparent communication with customers.

- What role does consumer trust play in the success of subscription models?Consumer trust is pivotal. Businesses need to prioritize transparency, deliver value consistently, and address customer concerns promptly to build and maintain trust.

- Is subscription billing suitable for all types of e-commerce businesses?Yes, subscription billing is adaptable to various e-commerce models. Businesses can tailor subscription offerings to match their products and customer preferences.