AUTHOR:HAZEL DSOUZA

DATE:28/12/2023

Introduction

In the dynamic landscape of virtual assets in India, payment providers play a pivotal role in facilitating seamless transactions and financial interactions. As the digital economy continues to surge, understanding the evolution, challenges, and opportunities[1] in the payment provider sector becomes imperative[2].

Evolution of Payment Providers in India

India’s journey in adopting[3] virtual assets is marked by significant[4] milestones. From the initial scepticism to widespread[5] acceptance, payment providers have evolved to become integral to the digital financial ecosystem. The surge in online transactions and the rise of e-commerce platforms have been catalysts for this evolution.

Key Players in the Virtual Asset Payment Sector

In the realm of virtual assets, several key players dominate the payment sector. Giants like Paytm, Google Pay, and PhonePe have established themselves as frontrunners, continually innovating to capture market share. An analysis of their strategies provides valuable insights into the competitive landscape.

Regulatory Landscape

While the digital revolution has brought about convenience, it has also prompted regulatory scrutiny. Understanding the current regulatory environment[1] is crucial for payment providers to navigate compliance challenges and contribute to a secure financial ecosystem.

Challenges and Opportunities

Payment providers face a myriad of challenges, from cybersecurity threats to the ever-evolving consumer expectations. Adapting to the changing landscape ensures sustained relevance in the virtual asset market.

Security Measures in Payment Transactions

In a world driven by digital transactions, ensuring the security of financial interactions is paramount. Payment providers employ robust technologies and protocols[2] to safeguard user data and provide a secure environment for transactions.

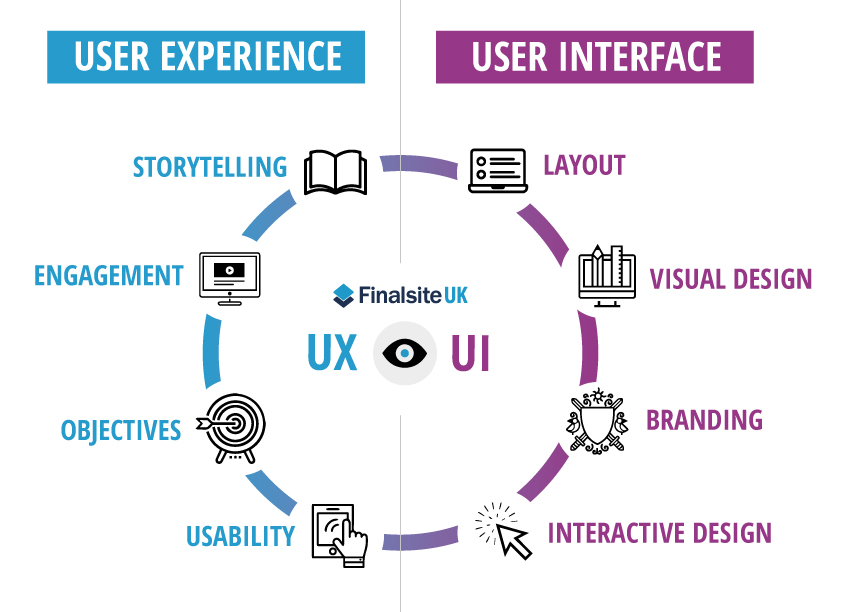

User Experience and Interface

User experience is a critical factor in the success of payment providers. A user-friendly interface enhances customer satisfaction and fosters trust, driving increased usage of virtual assets in day-to-day transactions.

Integration of Virtual Assets in Daily Life

The integration[3] of virtual assets into daily life is evident in various spheres, from utility bill payments to online shopping. Examining real-life examples helps understand the impact of payment providers on the convenience and efficiency of financial transactions.

Innovations and Technological Advancements

Advancements in payment technology continue to reshape the landscape. From contactless payments to blockchain-based solutions, exploring these innovations provides a glimpse into the future of virtual asset transactions.

Case Studies

Examining the success stories of payment providers offers valuable insights into effective strategies. Case studies shed light on how these companies have navigated challenges, adapted to consumer needs, and emerged as industry leaders.

Consumer Behaviour and Trends

Understanding consumer behaviour is essential for payment providers to tailor their services effectively. Analysing[4] current trends helps predict future preferences, enabling providers to stay ahead in a rapidly evolving market.

Social and Economic Impact

The widespread adoption of virtual assets has implications beyond the financial realm. The societal and economic impact of payment providers is multifaceted, influencing how people manage their finances and engage in commerce.

Global Comparisons

Comparing India’s virtual asset landscape with other countries provides a broader perspective[5]. Lessons learned from global practices can inform strategies to enhance the efficiency and inclusivity of India’s payment provider ecosystem.

Role of Payment Providers in Financial Inclusion

Payment providers contribute significantly to financial inclusion by reaching the unbanked population. Initiatives focused on making financial services accessible to all play a crucial role in shaping a more inclusive economy.

Conclusion

the role of payment providers in India’s virtual asset landscape is dynamic and central to the ongoing digital revolution. Navigating challenges, embracing innovations, and prioritizing user experience are key factors that will shape the future of payment providers in the country.

FAQs

- Are virtual assets and cryptocurrencies the same?

- No, virtual assets encompass a broader range, including digital representations of real-world assets, while cryptocurrencies are a specific type of virtual asset.

- How secure are virtual transactions with payment providers?

- Payment providers employ advanced encryption and security measures to ensure the confidentiality and integrity of transactions, making them highly secure.

- What regulatory challenges do payment providers face in India?

- Payment providers grapple with evolving regulatory frameworks, including data protection and anti-money laundering measures.

- How do payment providers contribute to financial inclusion?

- Payment providers offer services that reach the unbanked population, providing them with access to financial tools and services.

- What is the future outlook for payment providers in India?

- The future looks promising, with continued innovation, increased adoption, and a pivotal role in shaping the digital economy.