AUTHOR : ZOYA SHAH

DATE : 28-12-2023

Introduction

In the dynamic landscape of e-commerce[1] in India, the role of payment providers cannot be overstated. As the digital revolution continues, seamless and secure payment[1] options have become integral to the success of online businesses. This article explores[2] the evolution, challenges, and impact of payment providers on the web goods market in India.

Evolution of Payment Providers in India

The journey of payment providers in India has been marked by significant milestones. From the early days of online transactions to the present era of digital wallets[3] and UPI, the industry has witnessed rapid growth and innovation. The adoption of new technologies has played a crucial role in shaping the payment landscape.[4]

Top Payment Providers in India

Several payment service providers dominate the Indian market,[5] each offering unique features and services. From traditional banking methods to modern mobile wallets, users have a plethora of options to choose from. Popular names like Paytm, PhonePe, and Google Pay have become synonymous with convenient and secure transactions.

Challenges in the Indian Payment Landscape

Despite the advancements, the payment industry in India faces its fair share of challenges. Regulatory hurdles, cybersecurity concerns, and the need for interoperability pose significant obstacles. This section delves into the challenges faced by payment providers and potential solutions to overcome them.Payment Provider Web Goods In India.

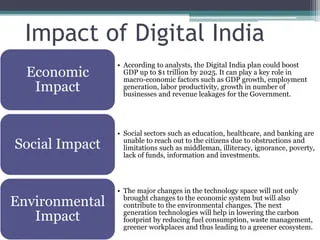

Impact of Digital India Initiatives

The government’s Digital India initiatives have played a pivotal role in driving the growth of digital transactions. With a focus on financial inclusion, these initiatives have encouraged the adoption of online payment methods, contributing to the overall development of the payment ecosystem.

Role of Payment Providers in E-commerce

The symbiotic relationship between payment providers and e-commerce is undeniable. The article explores how the integration of seamless payment options has fueled the growth of online businesses. From one-click transactions to innovative payment gateways, the user experience has been significantly enhanced.

Technological Advancements in Payment Systems

As technology continues to evolve, payment systems are not far behind. This section discusses emerging technologies such as blockchain, artificial intelligence, and biometrics that are shaping the future of payments. The article also explores potential trends and advancements on the horizon.Payment Provider Web Goods In India.

Security Measures Adopted by Payment Providers

In a digital era, security is paramount. Payment providers invest heavily in implementing robust security measures to protect users’ sensitive information. This section provides an overview of the security features employed by payment providers to ensure safe and secure transactions.

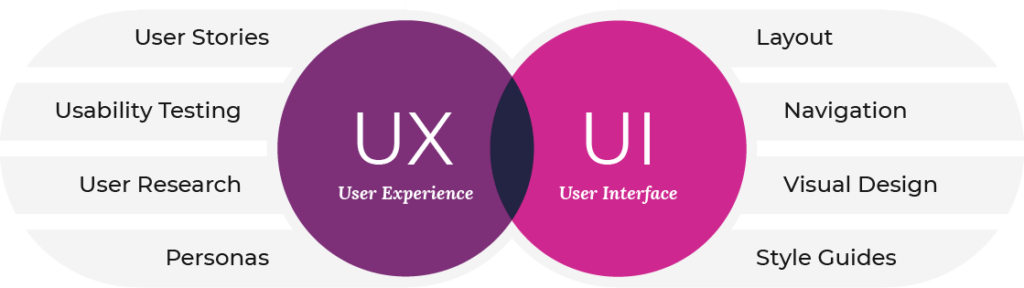

User Experience and Interface Design

User-friendly interfaces play a crucial role in the success of payment providers. This section examines the significance of a seamless user experience and how interface design contributes to customer satisfaction. The article also highlights some best practices adopted by leading payment service providers.

Mobile Wallets vs. Traditional Banking

The debate between mobile wallets and traditional banking methods is ongoing. This section provides a comparative analysis of the two, outlining the advantages and disadvantages of each. Users can gain insights into which method aligns better with their preferences and needs.

Impact on Small Businesses and Startups

Payment providers are not only essential for established enterprises but also for small businesses and startups. This section showcases case studies and success stories, illustrating how payment services have empowered smaller entities to thrive in the competitive online market.

Consumer Trust and Confidence

Building trust in online transactions[2] is crucial for the sustained growth of payment providers. This section explores the measures taken by payment service providers[3] to instill confidence in users. From secure encryption to transparent policies, maintaining consumer trust is a top priority.

Globalization and Cross-Border Transactions

The globalization of businesses necessitates efficient cross-border payment solutions. Payment providers play a vital role in facilitating international transactions.[4] This section delves into the challenges associated with cross-border payments and the innovative solutions being implemented.

Future of Payment Providers in India

As technology[5] continues to advance, the future of payment providers in India holds exciting possibilities. This section offers predictions and insights into the evolving landscape of payment services. From increased personalization to novel payment methods, the article explores what the future may hold.

Conclusion

In conclusion, the article has examined the multifaceted role of payment providers in the Indian web goods market. From evolution and challenges to the impact on e-commerce and future trends, payment providers are integral to the digital ecosystem. As technology continues to advance, the synergy between payment providers and online businesses will shape the future of transactions in India.

FAQs

- Are mobile wallets safer than traditional banking methods for online transactions?

- Explore the safety features of both and choose based on your comfort level.

- How do payment providers contribute to financial inclusion in India?

- Understand the role of payment providers in bringing financial services to the unbanked.

- What security measures should I look for when using online payment services?

- Learn about the essential security features implemented by reputable payment providers.

- Can small businesses benefit from integrating online payment services?

- Discover success stories and the positive impact of payment services on small enterprises.

- What future trends can we expect in the payment provider industry in India?

- Gain insights into upcoming innovations and trends shaping the future of payment services.