AUTHOR :HAANA TINE

DATE :19/12/2023

Introduction

In the dynamic landscape of India’s oil filter industry, efficient and secure financial transactions are paramount for sustained growth. Payment Providers for Oil Filters in India This article explores the significance of selecting the right payment provider[1] for businesses in this sector, focusing on trust, security, and operational efficiency.

The Current Landscape of Oil Filter Businesses in India

India’s oil filter[2] industry is experiencing robust growth, with several key players dominating the market. As demand increases, businesses face challenges ranging from fierce competition to supply chain complexities, underscoring the need for efficient financial management.

Importance of Choosing the Right Payment Provider

Beyond merely processing payments, a reliable payment provider plays a pivotal role in building trust among customers. Payment Providers for Oil Filters in India In an industry where precision and reliability are crucial, the choice of a payment provider influences the overall customer experience and, consequently, the success of the business.

Criteria for Selecting a Payment Provider

When selecting a payment provider, businesses must consider integration capabilities, security features, cost-effectiveness, and user-friendly interfaces. Payment Providers for Oil Filters in India These criteria ensure a seamless and secure payment process, contributing to the overall efficiency of the business operations.

Case Studies

Examining successful case studies of businesses implementing Payment service provider[3] valuable insights. These stories highlight the positive impact on customer satisfaction, operational efficiency, and overall business growth.

Tips for Implementing Payment Solutions

For a seamless integration process, Digital Payments[4] businesses should focus on ensuring compatibility with existing systems, providing comprehensive employee training, and establishing robust customer support mechanisms. Adapting to evolving technologies is also crucial for long-term success.

Future Trends in Payment Solutions for Oil Filter Businesses

As technology continues to advance, the payment landscape is expected to undergo significant changes. New technologies, evolving customer preferences, and the ability of payment providers to adapt to industry shifts will play a pivotal role in shaping the future of financial transactions in the oil filter business.

The Evolution of Payment Ecosystems

The payment ecosystem is evolving rapidly, with innovations such as contactless payments, mobile wallets, and blockchain technology reshaping how transactions occur. Oil filter businesses should stay abreast of these changes to remain competitive and provide convenient payment options to their customers.

Enhancing User Experience with Mobile Payments

As smartphones become ubiquitous, integrating mobile payment options can significantly enhance the user experience. Mobile payments offer convenience and speed, allowing customers to complete transactions with a simple tap or scan, reducing friction in the payment process.

Blockchain and Cryptocurrency Integration

The adoption of blockchain technology and cryptocurrencies presents a unique opportunity for oil filter businesses[5]. Blockchain ensures secure and transparent transactions, while accepting cryptocurrencies broadens the customer base, especially among tech-savvy consumers.

The Green Revolution: Sustainable Payment Practices

With growing environmental concerns, businesses are shifting towards sustainable practices. Adopting eco-friendly payment options, such as digital invoices and electronic receipts, not only reduces paper waste but also aligns with the global push for sustainability.

Collaboration with Fintech Companies

Collaborating with fintech companies can open new avenues for payment solutions. Fintech innovations, such as peer-to-peer payments, instant fund transfers, and data analytics, can streamline financial processes and provide valuable insights for business growth.

Educating Customers on Secure Payment Practices

In the digital age, cybersecurity is paramount. Oil filter businesses should invest in educating their customers on secure payment practices, including the importance of using strong passwords, avoiding public Wi-Fi for transactions, and being cautious of phishing attempts.

The Role of Data Analytics in Payment Processing

Harnessing the power of data analytics can revolutionize payment processing. By analyzing customer spending patterns, businesses can tailor promotions, improve inventory management, and enhance overall business efficiency.

Global Expansion through Cross-Border Payment Solutions

For oil filter businesses eyeing international markets, integrating cross-border payment solutions is essential. This enables seamless transactions across different currencies, reducing currency exchange complexities and attracting a broader customer base.

The Emergence of Buy Now, Pay Later (BNPL) Services

Buy Now, Pay Later services are gaining popularity globally. Offering flexible payment options can attract more customers and increase sales. However, businesses should carefully assess the financial implications and customer trust associated with BNPL services.

Staying Competitive in the Digital Age

To stay competitive, oil filter businesses must not only adapt to current payment trends but also anticipate future developments. Keeping abreast of emerging technologies and consumer preferences ensures sustained growth and relevance in the ever-evolving digital landscape.

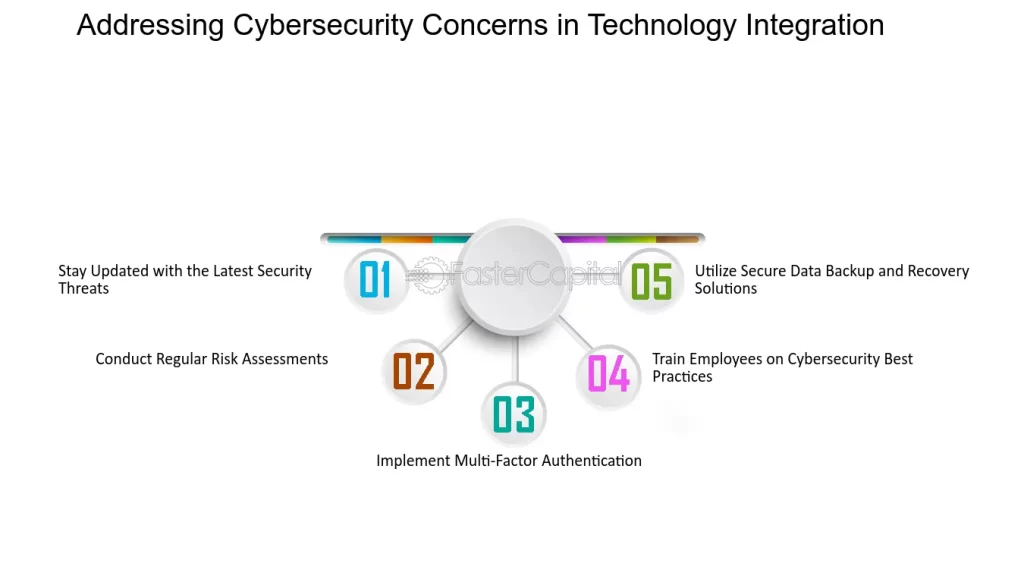

Addressing Cybersecurity Concerns

With the increasing reliance on digital transactions, businesses must prioritize cybersecurity. Implementing robust cybersecurity measures, regularly updating software, and conducting security audits are crucial steps in safeguarding sensitive financial data.

Navigating Economic Fluctuations

Oil filter businesses may face economic fluctuations that impact customer spending habits. Implementing flexible payment solutions and diversifying revenue streams can help businesses navigate challenging economic conditions.

Embracing Contactless Technology

Contactless payments have become increasingly popular due to their convenience and hygiene, especially in the wake of global health concerns. Oil filter businesses should consider adopting contactless payment options to cater to evolving consumer preferences.

Conclusion

In conclusion, the selection of a payment provider is a decision that demands careful consideration from oil filter businesses in India. By prioritizing security, efficiency, and customer trust, businesses can position themselves for sustained success in a competitive market.

FAQs

- How do payment providers contribute to customer trust in the oil filter industry?

- Payment providers ensure secure transactions, building confidence among customers in the reliability of the business.

- What security features should businesses prioritize when selecting a payment provider?

- Businesses should prioritize encryption, real-time tracking, and advanced security protocols.

- How can businesses adapt to changing payment technologies?

- Regularly updating systems, providing ongoing employee training, and staying informed about industry trends are essential.

- What role does customer support play in the success of payment solutions?

- Effective customer support ensures businesses can address issues promptly, enhancing overall customer satisfaction.

- Are there government regulations that businesses need to consider when implementing payment solutions?

- Yes, businesses should stay informed about relevant financial regulations to ensure compliance and avoid legal issues.