AUTHOR : ANGEL ROY

DATE : 28-12-2024

For jewelry businesses in India[1], adopting efficient payment methods is crucial, especially when dealing with high-value transactions. One such payment solution that has revolutionized the way businesses accept payments is UPI (Unified Payments Interface). UPI is a fast, secure, and widely accepted digital payment system, and UPI payment providers for jewelry businesses[2] have made it easier for jewelers to manage transactions efficiently. This article will explore the benefits, features, and considerations when selecting UPI payment providers[3] for jewelry businesses.

What is UPI and Why is it Important for Jewelry Businesses?

UPI is a real-time payment system developed[4] by the National Payments Corporation of India (NPCI). It enables users to transfer funds between bank accounts instantly using their smartphones or other digital devices. This system has become the backbone of digital payments in India, offering features like low transaction fees, instant processing, and robust security measures.

For jewelry businesses, UPI payment solutions provide[5] a way to manage both small and high-ticket transactions effectively. With the growing preference for cashless payments, UPI has emerged as a game-changer, especially in the jewelry sector where high-value sales are frequent.

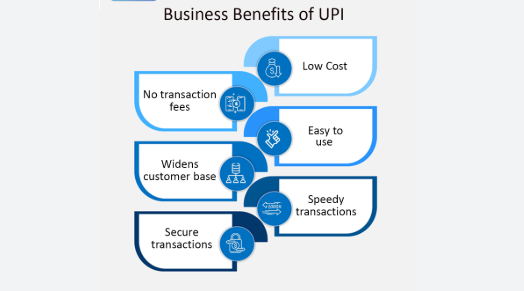

Why Jewelry Businesses Should Choose UPI Payment Providers

1. Convenience for Customers and Businesses

One of the biggest advantages of UPI payment providers for jewelry businesses is the convenience it offers both to the customers and the business owners. Customers can make payments instantly using their smartphones, and there is no need to carry physical cash. For jewelry businesses, UPI reduces the need for handling large sums of cash, which can be cumbersome and risky.

2. Security

In an industry dealing with valuable assets like jewelry, security is a top priority. UPI ensures secure transactions through advanced encryption and two-factor authentication. With features like UPI PIN, businesses and customers can rest assured that their payments are protected from fraud and unauthorized access.

3. Low Transaction Fees

Traditional payment methods like credit cards and debit cards often come with high transaction fees, which can eat into the profits of a jewelry business. UPI payment providers for jewelry businesses offer lower transaction fees compared to other payment systems, making it a cost-effective option for jewelers, especially those handling large transactions.

4. Faster Settlements

UPI payments are processed in real-time, which means that jewelry businesses receive the funds almost instantly. This is particularly advantageous for cash flow management, as businesses do not need to wait for long processing times. Unlike other methods, UPI ensures that the money reaches the business’s account almost immediately after a transaction is completed.

5. Wider Customer Reach

UPI is widely used in India, making it an attractive payment option for jewelry businesses. As of recent years, millions of people are using UPI-enabled apps such as Google Pay, PhonePe, Paytm, and others for daily transactions. By adopting UPI as a payment method, jewelry businesses can tap into this large customer base and cater to tech-savvy buyers who prefer digital transactions.

6. Seamless Integration with Existing Systems

Another major benefit of UPI payment providers for jewelry businesses is their ease of integration with existing point-of-sale (POS) systems or e-commerce platforms. Whether you run an online store or a brick-and-mortar jewelry shop, UPI can be easily integrated into your payment system, providing a seamless experience for both the business and the customer.

Key Features of UPI Payment Providers for Jewelry Businesses

1. Multiple Payment Options

UPI payment providers offer various ways for customers to make payments. Whether it’s through UPI ID, QR code scanning, or linking their bank accounts, customers have multiple options to pay for jewelry purchases. This flexibility makes UPI a convenient option for businesses that cater to a diverse clientele.

2. Real-Time Tracking and Reporting

UPI payment providers offer real-time transaction tracking, which helps jewelry businesses monitor sales and inventory in real time. Businesses can generate transaction reports, helping them stay on top of their finances and make informed decisions regarding cash flow, inventory, and sales trends.

3. Customizable Payment Solutions

Jewelry businesses have unique needs when it comes to payments. Some providers offer customizable UPI solutions tailored specifically to the jewelry industry. These solutions can include features like automated invoicing, integration with loyalty programs, and even support for installment-based payments, making it easier for businesses to cater to the high-value nature of their sales.

4. Cross-Platform Support

With UPI payment providers for jewelry businesses, transactions can be processed across different platforms. Whether it’s an in-store purchase via POS terminals, an online transaction through a website, or a mobile app purchase, UPI enables businesses to handle payments across multiple channels, offering convenience to customers and flexibility for the business.

5. Instant Refunds

In case of cancellations or returns, UPI payment providers for jewelry businesses offer the advantage of instant refunds. This feature enhances the customer experience and builds trust, as customers do not have to wait for days to receive their money back after a transaction is reversed.

Choosing the Right UPI Payment Provider for Your Jewelry Business

1. Transaction Limits

Different UPI payment providers for jewelry businesses have varying transaction limits. Jewelry businesses often deal with high-value transactions, and it’s important to choose a provider that can handle large payments seamlessly. Be sure to check the maximum transaction limits and ensure that they align with the typical size of your jewelry sales.

2. Ease of Integration

Look for a UPI payment provider that offers easy integration with your existing POS systems, website, or mobile app. The integration process should be straightforward and should not cause disruptions to your daily operations. Many providers offer plugins and APIs that make integration hassle-free.

3. Customer Support

Good customer support is essential, especially when dealing with high-value transactions. A reliable UPI payment provider for jewelry businesses should offer prompt customer support to resolve any issues related to payments, security, or integration. Check for 24/7 support availability and choose a provider with a strong reputation for customer service.

4. Compatibility with Digital Wallets

Many customers use digital wallets like Google Pay, PhonePe, and Paytm for UPI payments. Ensure that the UPI payment provider you choose is compatible with these widely used wallets to offer a wider range of payment options for your customers.

5. Security Features

Security is non-negotiable when dealing with expensive jewelry transactions. Choose a UPI payment provider that employs advanced security protocols such as encryption, two-factor authentication (2FA), and fraud detection tools to ensure that every transaction is secure.

Advantages of Using UPI Payment Providers for Jewelry Businesses

1. Boost Customer Trust

When customers see that a jewelry business accepts UPI payments, it builds trust and confidence. UPI is a government-backed payment system known for its reliability and security, which encourages customers to make high-value purchases.

2. Improved Cash Flow

Instant payments help improve cash flow, especially for businesses that deal with expensive products like jewelry. With UPI payment providers for jewelry businesses, you can receive payments in real-time and avoid delays associated with other payment methods.

3. Competitive Advantage

Offering UPI as a payment method gives your jewelry business a competitive edge. Many customers now prefer UPI over traditional payment methods due to its speed, security, and convenience. By adopting UPI, jewelry businesses can cater to this growing demand for digital payments.

Conclusion

In conclusion, UPI payment providers for jewelry businesses offer a wide range of benefits, including enhanced security, low transaction fees, and fast payment processing. By integrating UPI into your payment system, jewelry businesses can streamline operations, improve customer satisfaction, and ensure a competitive edge in the growing digital economy. With the right UPI provider, your jewelry business can thrive in the digital age while offering a seamless, secure, and efficient payment experience for your customers.

(FAQs)

1. What are UPI Payment Providers for Jewelry Businesses?

UPI payment providers for jewelry businesses are platforms that facilitate UPI-based transactions for jewelry shops. They enable businesses to accept payments from customers via UPI apps, allowing for seamless and secure transactions.

2. How Do UPI Payments Benefit Jewelry Businesses?

UPI payments benefit jewelry businesses by providing a fast, secure, and cost-effective way to process payments. They help businesses reduce cash handling, speed up transactions, and ensure customer satisfaction with real-time payments.

3. Is UPI Secure for Jewelry Transactions?

Yes, UPI is a highly secure payment system that uses encryption, two-factor authentication, and fraud detection measures to ensure that jewelry transactions are safe and protected from unauthorized access.

4. Can UPI Handle High-Value Jewelry Transactions?

Yes, UPI payment providers for jewelry businesses can handle high-value transactions, although it’s important to check the specific transaction limits of your chosen provider.

5. How Fast are UPI Payments?

UPI payments are processed in real-time, meaning that the funds are transferred almost instantly after the transaction is completed. This ensures faster settlements for jewelry businesses.