AUTHOR NAME : JASMINE

DATE : 18/12/2023

Introduction

The auto shipping industry in India is rapidly growing, with businesses constantly seeking ways to enhance their operations. One critical aspect that often gets overlooked is the payment gateway used for processing auto shipping quotes. In this article, we delve into the intricacies of payment door and their role in the auto shipping quotes process.

Importance of Payment Gateways

Payment gateways are essential for enabling secure, efficient, and convenient online transactions. They protect sensitive customer information through encryption and fraud prevention, ensuring trust and safety. By supporting multiple payment methods, they enhance user experience and help businesses reach a wider audience.

Understanding Auto Shipping Quotes

Process of Obtaining Quotes

Auto shipping quotes are based on various factors like distance, vehicle type, shipping method, and additional services such as insurance or expedited delivery. It’s important to review what is included in the quote to avoid hidden fees. Understanding these details helps customers make well-informed decisions and budget accordingly.

Factors Influencing Quote Calculation

The Role of Payment Gateways

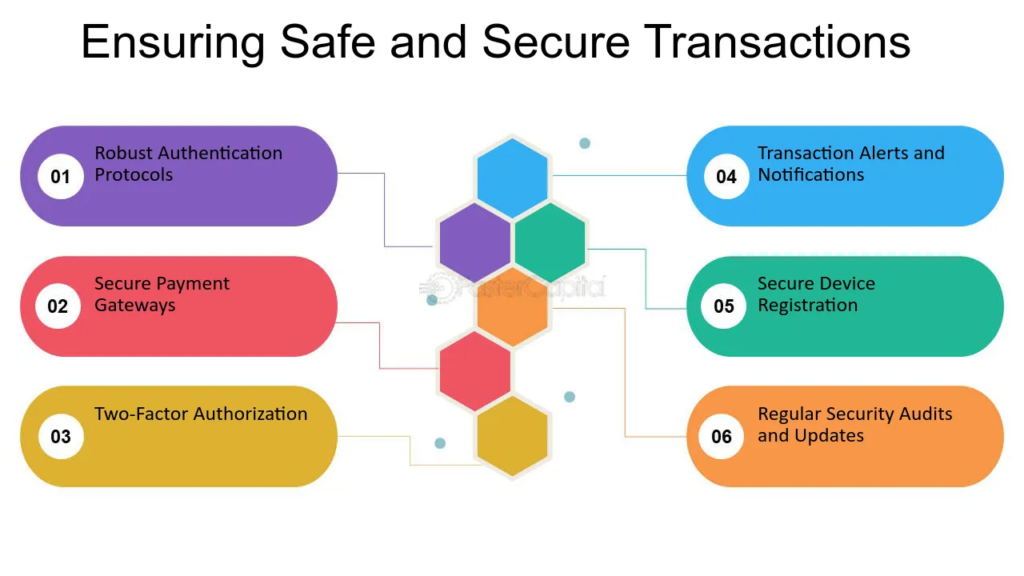

Ensuring Secure Transactions

Payment gateways play a crucial role by facilitating secure and seamless transactions between businesses and customers. They encrypt sensitive data, ensuring safe payment processing, and provide real-time transaction updates. international auto shipping companies[1] By integrating with various payment methods, they enhance user convenience and support efficient payment management.

Streamlining Payment Processes

Streamlining payment processes involves using payment gateways[2] that offer fast, secure, and user-friendly experiences. Automating payment confirmations, integrating with existing systems, and providing real-time tracking can enhance efficiency. Simplified processes reduce transaction times, minimize errors, and improve customer satisfaction.

Popular Payment Gateways in India

Overview of Top Payment Gateways

In India, popular payment gateways include Paytm, Razorpay, CCAvenue, and Instamojo. These platforms are widely used for their secure payment processing, user-friendly interfaces, and support for various payment methods such as UPI, credit/debit cards, Shipping line[3] and digital wallets. They cater to businesses of all sizes, facilitating smooth and efficient transactions.

Features Relevant to Auto Shipping

Key features relevant to auto shipping include real-time tracking, secure payment processing, and flexible payment options. Integration with logistics platforms for seamless coordination, automated notifications for updates, and insurance coverage options are also essential. These features enhance efficiency, transparency, and customer satisfaction throughout the shipping process[4].

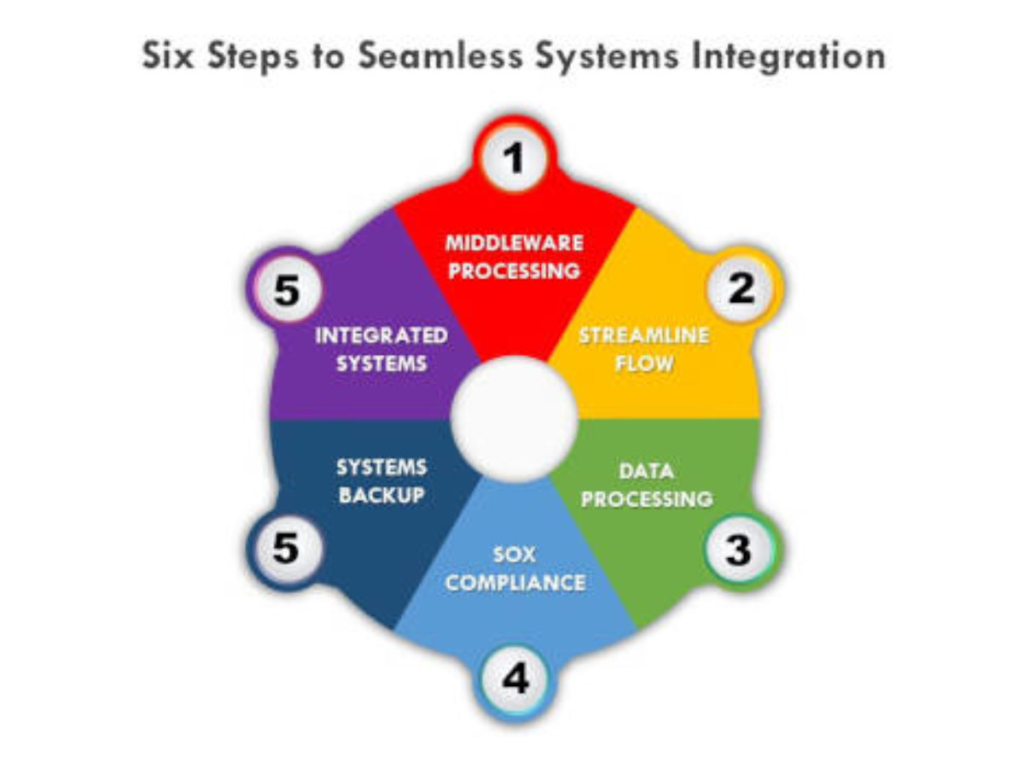

Integration of Payment Gateways

Importance for Auto Shipping Businesses

The integration of payment gateways into the auto Freight Shipping Quotes[5] process enhances the overall customer experience. It’s a strategic move for businesses aiming to stay competitive in the digital era.

Steps for Seamless Integration

To achieve seamless integration of a payment gateway, start by selecting a gateway that aligns with your business needs and technical requirements. Next, ensure compatibility with your existing system and follow the provider’s integration guidelines. Test the integration thoroughly to identify and resolve any issues. Finally, launch the integration and monitor performance for ongoing optimization.

Security Measures in Payment Transactions

SSL Encryption

Security in payment transactions is maintained through robust measures such as encryption, secure socket layer (SSL) protocols, and tokenization to protect sensitive data. Multi-factor authentication (MFA) adds an additional layer of protection, reducing the risk of unauthorized access. Fraud detection systems continuously monitor transactions for suspicious activity, ensuring safe and secure payment processing.

Two-Factor Authentication

Two-factor authentication (2FA) enhances security by requiring users to verify their identity through two separate steps, such as a password and a one-time code sent to their phone or email. This extra layer of protection significantly reduces the risk of unauthorized access and fraud in digital transactions.

Benefits of Using Payment Gateways for Auto Shipping

Enhanced Efficiency in Transactions

Improved Customer Trust

Payment gateways streamline the payment process for auto shipping by offering secure, quick, and hassle-free transactions. They enable real-time payment tracking, ensuring transparency for both businesses and customers. Additionally, features like multi-currency support and automated invoicing make international and domestic transactions seamless. These benefits enhance customer trust and improve overall operational efficiency.

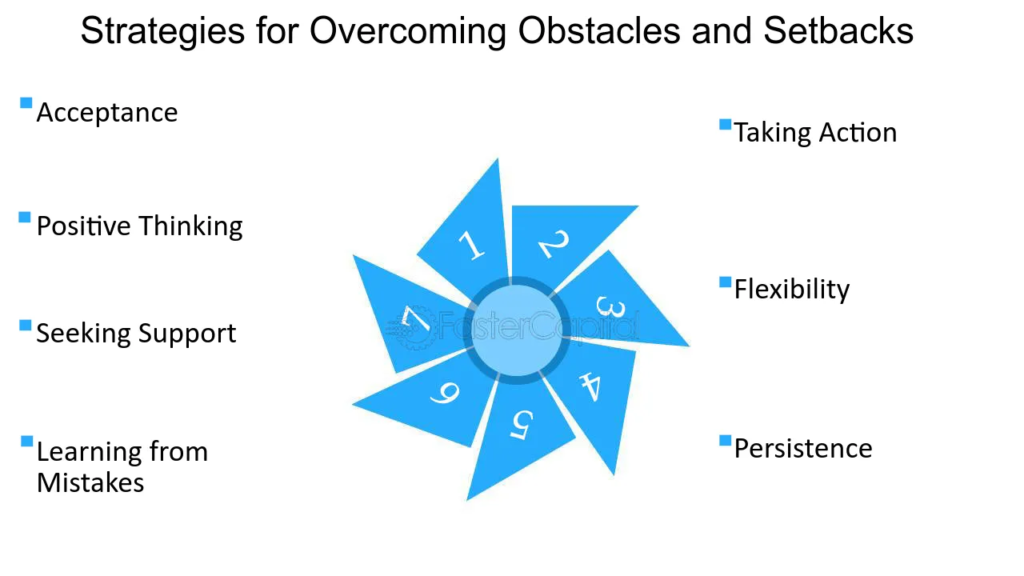

Challenges and Solutions

Addressing Payment Gateway Challenges

To overcome payment gateway challenges, businesses must invest in robust security measures like encryption and fraud detection systems. Regular updates and testing ensure seamless functionality and minimize technical glitches. Providing transparent fee structures and offering reliable customer support helps address user apprehension and build trust. Additionally, selecting gateways with high uptime and compatibility ensures smoother transactions and improved user satisfaction.

Strategies for Overcoming Obstacles

In overcoming challenges, businesses can thrive. We discuss practical strategies for auto shipping companies to navigate payment gateway obstacles and maintain a seamless operation payment gateway for Auto shipping quotes In India.

Future Trends in Auto Shipping Payments

Technological Advancements

The future of auto shipping payments will be shaped by advancements like blockchain technology for enhanced security and transparency. AI-powered systems will offer personalized payment solutions and predictive analytics to optimize transactions. Contactless payments and mobile wallets will become more prevalent, providing convenience and speed. Additionally, increased integration with logistics platforms will streamline the entire payment and shipping process, improving efficiency and user experience.

Evolving Customer Preferences

Customer preferences are shifting towards more convenient, secure, and flexible payment options. Users now expect seamless, mobile-friendly experiences and real-time transaction updates. Additionally, transparency in pricing and data security are top priorities, with customers valuing platforms that offer ease of use and robust protection for their financial information.

Tips for Choosing the Right Payment Gateway

Assessing Business Needs

When selecting a payment gateway, prioritize security features like encryption and fraud detection. Ensure compatibility with your business platform and look for options with transparent fees and excellent customer support. Additionally, consider features like multi-currency support and ease of integration to meet your specific needs.

Consideration of Costs and Features

When evaluating payment gateways, it’s essential to balance costs and features. Compare transaction fees, setup charges, and monthly costs while assessing features like security, scalability, and ease of integration. Choosing a gateway that aligns with your budget and operational needs ensures long-term value.

Comparison of Payment Gateway Options

Side-by-Side Evaluation

Comparing payment gateway options involves evaluating factors like transaction fees, ease of integration, security features, and customer support. It’s important to assess scalability, supported payment methods, and compatibility with your platform. This helps identify the best option that aligns with your business needs and budget, ensuring efficient and secure transactions.

Decision-Making Criteria

When choosing a payment gateway, consider key criteria such as security measures, transaction fees, ease of integration, and reliability. Evaluate the gateway’s compatibility with your existing systems, customer support quality, and available payment options. Ensuring these factors align with your business goals will lead to a well-informed and effective decision.

Conclusion

In conclusion, the integration of secure payment gateways is pivotal for the success of auto sending businesses. We recap key points discussed throughout the article. Looking ahead, the future of auto sending payments holds exciting possibilities. Embracing technological progressand customer-centric strategies will be essential for sustained growth payment gateway for Auto sending quotes In India.

FAQs

- Are all payment gateways suitable for auto sending businesses?

While many payment gateways are versatile, it’s crucial to choose one that aligns with the specific needs and operational requirements of auto sending businesses. - How can businesses ensure the security of payment transactions in the auto sending industry?Implementing SSL encryption and two-factor authentication are key measures to ensure the security of payment transactions in the auto shipping industry.

- What are the common challenges faced by businesses in integrating payment gateways for auto sending quotes?

Challenges may include technical issues, compatibility concerns, and customer trust .Dealing with these problems needs a thoughtful and forward-thinking strategy. - What trends are shaping the future of auto shipping payments in India?

Technological advancements, evolving customer preferences, and a shift towards digital transactions are among the trends shaping the future of auto shipping payments in India. - How can businesses enhance the overall user experience in payment transactions for auto shipping quotes?

Simplifying the customer journey, minimizing friction in transactions, and prioritizing user-friendly interfaces are essential strategies for enhancing the overall user experience in payment transactions for auto shipping quotes.